The Secret Strategy of Crypto Whales that Small Investors Don’t Know About, Do You Know?

Jakarta, Pintu News – An in-depth understanding of the latest cryptocurrency market dynamics shows a significant difference between the actions of large holders, often referred to as ‘whales’, and small holders or micro wallets.

A recent study by Santiment reveals how these different strategies can trigger significant price swings in cryptocurrencies such as Ripple , Bitcoin , and Ethereum . Read the full analysis here!

Opposite Behavior between Whale and Micro Wallets

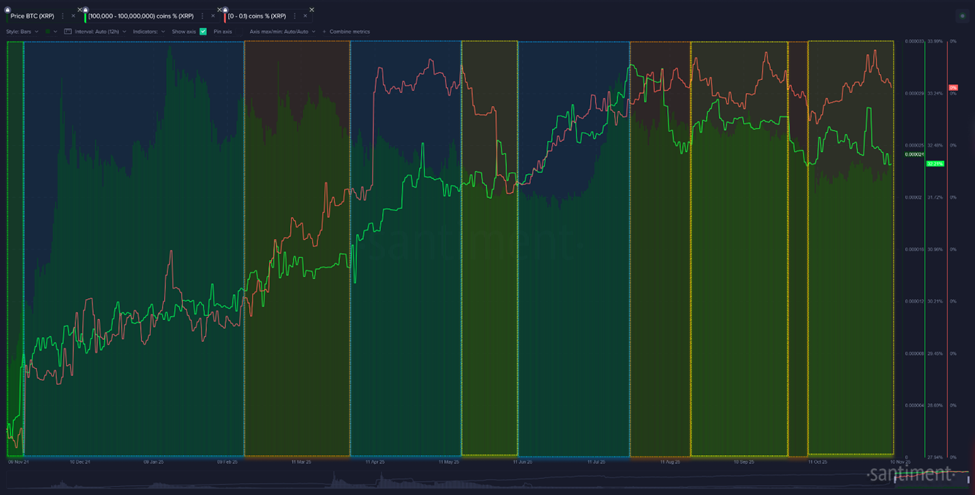

Analysis from Santiment shows that there is a correlation between accumulation by whales and selling by micro wallets which often leads to price spikes. Conversely, when whales reduce their holdings while small wallets continue to buy, prices tend to fall. This phenomenon is evident in Ripple (XRP), where whales are strategically adding to their positions despite the general market underperformance.

In the case of Ripple (XRP), despite the underperformance in the second half of 2025, micro wallets continued to make purchases due to a strong FOMO drive. Meanwhile, large holders engaged in selective accumulation which briefly created upward momentum. However, the most favorable signals occur when whales add to their positions quietly while micro wallets sell their Ripple (XRP).

Also read: Gold Jewelry Price Today, Wednesday, November 12, 2025

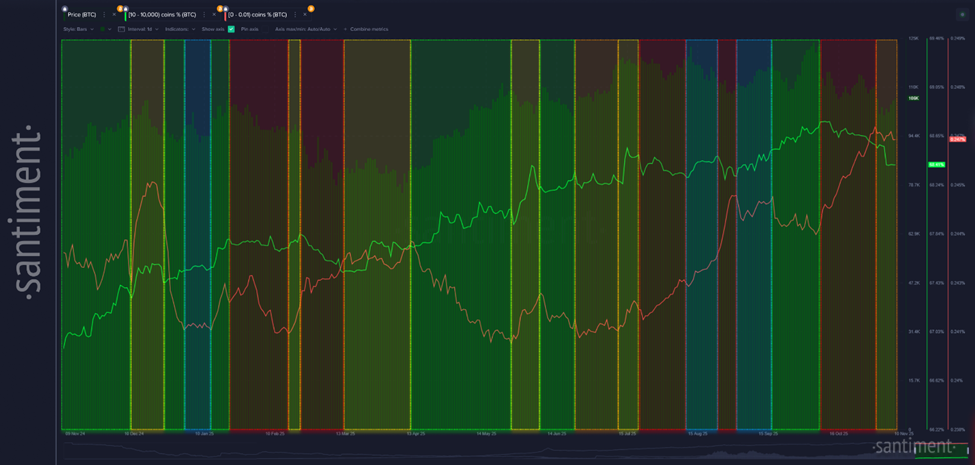

Similar Dynamics in Bitcoin and Ethereum

Bitcoin (BTC) provides a clearer example where large spikes (marked by green bars) occur when whales add to their positions while micro wallets shed their holdings. This created significant upward momentum. On the other hand, when the whales start releasing their Bitcoin (BTC) and retail traders continue buying, the price generally declines. Ethereum (ETH) follows a similar pattern.

Between June and August 2025, strategic accumulation by key holders drove price gains of nearly 87%, despite retail wallets preferring to sell. This shows that opposing movements between large and small holders can often be a more reliable indicator of volatility than conventional indicators.

Also read: Silver Jewelry Price Today, Wednesday November 12, 2025

Daily Insights on the Crypto Market

Monitoring the activity of whale and micro wallets provides valuable insights into understanding broader market dynamics. By identifying these trends, investors can anticipate price movements that may not be visible through traditional analysis. This study emphasizes the importance of paying attention to these two types of holders to maximize opportunities in trading.

The conclusion of this study suggests that a deeper understanding of the behavior of large and small holders can help in making more informed investment decisions. With the right strategy, investors can utilize this information to optimize their portfolios and gain maximum benefit from market fluctuations.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Santiment: Whale Accumulation Crypto Price Rallies. Accessed on November 11, 2025

- Featured Image: Generated by Ai