Circle Ready to Launch New Tokens for Arc Network, Expecting Sharp Revenue Growth

Jakarta, Pintu News – Circle, the company behind USDC stablecoin issuance, recently announced plans to launch a native token for their stablecoin network, Arc. This announcement came alongside the release of their third quarter financial report, which showed an increase in revenue and net profit compared to the previous year.

Circle Considers Launching Native Tokens for Arc

In its latest financial report release, Circle revealed that it is exploring the possibility of launching a native token on the Arc network. This move is expected to increase participation in the network and drive further adoption. According to Circle, this will support the network’s long-term growth and success.

The Arc network, which launched in August this year, initially used USDC as the gas token. However, with the planned launch of native tokens, this structure may change. Currently, the Arc network is still in the testnet phase that started on October 28, with the participation of more than 100 companies from various sectors such as capital markets, banking, asset management, and insurance.

Read also: Visa launches direct payment program with stablecoins, revolutionizing business transactions?

Circle Product Adoption Increases

Circle also highlighted the increasing adoption of its products, including partnerships with major entities such as Brex, Deutsche Börse Group, Finastra, Fireblocks, Hyperliquid, Kraken, Unibanco Itaú, and Visa. For example, Circle recently launched USDC natively on the Hyperliquid platform and also invested in Hyperliquid’s native token HYPE.

Additionally, Circle’s tokenized money market fund, USYC, experienced over 200% growth from June 30 to November 8, reaching nearly $1 billion. Their payment network now supports transaction flows in eight countries with 29 financial institutions involved. The network’s annualized transaction volume based on the last 30 days of activity stands at $3.4 billion.

Read also: Startale Unveils New Super App for Sony’s Soneium Blockchain Ecosystem

Circle’s Financial Results Record Improvement

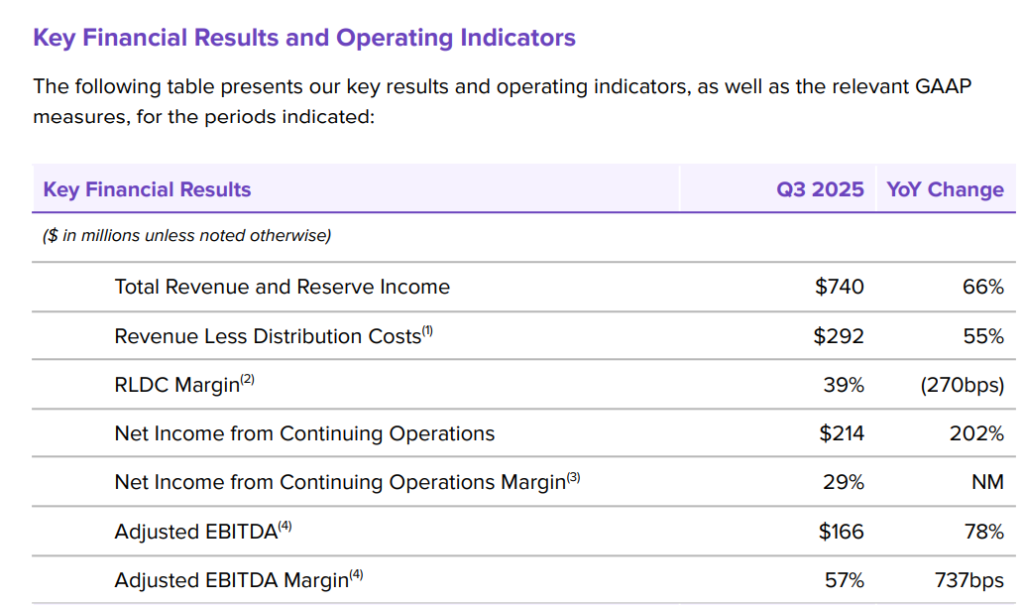

Circle reported total revenue and reserve income of $740 million, a 66% increase over the previous year. This also represents an increase from the $658 million reported in the second quarter of this year. In addition, their net income reached $214 million, an increase of 202% compared to the previous year.

This improvement marks a significant turnaround as Circle previously incurred a net loss of $482 million in the second quarter, which was largely due to non-cash costs related to the IPO. Adjusted EBITDA also increased to $166 million, up 78% compared to the previous year. Meanwhile, USDC outstanding reached $73.7 billion at the end of the third quarter, an increase of 108% year-on-year.

Conclusion

With various developments and improvements made by Circle, including the potential launch of a native token for the Arc network, the company is showing significant growth prospects. Although Circle’s stock has taken a dip in pre-market trading, the strategic moves the company is making promise continued progress in the stablecoin and digital payments industry.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. USDC Issuer Circle Explores Native Tokens for ARC Network. Accessed on November 13, 2025

- Featured Image: The Block