Nvidia Stock Builds Short-Term Bullish Momentum Ahead of Earnings Release

Jakarta, Pintu News – As the stock market reverses to a bullish trend after suffering a fall in early November, the technology sector is one of the main drivers in this latest recovery. NVIDIA Corp , the public company with the world’s largest market capitalization, is among the top performers since November 7.

NVDA shares have gained more than 10% in the last five days and nearly 44% so far this year. This rise is in line with the accelerating adoption of artificial intelligence technology in various sectors as more and more real-world applications of the technology emerge.

AI is now forming a new frontier in technological advancement, with AI agents being at the center of its increasing adoption. The development and training of AI agents requires immense computing power, and this is where Nvidia through its graphics processing unit (GPU) business line comes in.

Analysts expect that Nvidia will exceed management’s revenue projections for the third quarter, with GPU sales again being the main driver of revenue growth. Ahead of the latest financial performance report scheduled for November 19, NVDA stock is expected to remain in a positive trend, potentially driving further gains.

Technical Analysis of Nvidia Stock

Technically, Nvidia stock is currently moving in an ascending wedge pattern as seen from trend line 2 (T2) and trend line 3 (T3) on the daily chart. The price of NVDA recently touched both trend lines at $212 and $178, where the touch at $178 was also the starting point of the latest rally.

Read also: Ethereum Foundation Launches “Trustless Manifesto” to Affirm Commitment to Decentralization

This recovery is further reinforced by the confluence of several trend lines, including trend line 1 (T1), which previously served as major upside resistance from June 2024 to July 2025.

Trend line 4 (T4) and trend line 5 (T5), which have served as upside support zones since May 2025 and July 2025 respectively, are also still active as support areas at the $178 level.

With Nvidia stock having bounced off this strong support level, the current upward momentum is one of the strongest in recent months, creating a more positive market sentiment ahead of next week’s earnings report.

This sentiment was also driven by investors’ reaction to the news that SoftBank (SFTBY) sold its entire stake in Nvidia for $5.8 billion. Since the report emerged, SoftBank shares have fallen more than 10%, suggesting that investors disapproved of the decision.

Nvidia Stock Options Open Interest Supports Bullish Signal

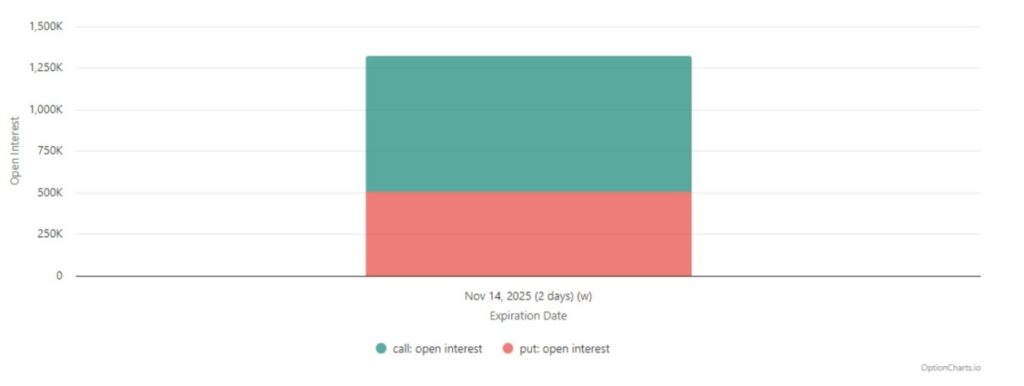

The current upward momentum in NVDA’s share price is also reinforced by open interest data in the options market.

For options maturing at the end of this week, the Put-to-Call open interest ratio was recorded at 0.61 according to data from OptionCharts. This indicates that 61% of the existing contracts are call options, while the remaining 39% are put options.

In total, there are more than 1.3 million NVDA option contracts maturing on November 14, with more than 819,000 being call options and around 503,000 being put options.

Nvidia’s Financial Report Potentially Triggers Further Upside

In its second quarter earnings report, Nvidia provided third quarter revenue guidance of $54 billion, indicating growth of about 16% quarter-on-quarter and about 50% compared to the same period last year.

Read also: Michael Saylor Forecasts Bitcoin to Surpass Gold Market Capitalization by 2035!

This growth will be largely driven by sales in the data center segment, which is expected to surpass $48 billion, along with the expansion of production of their latest GPU architecture, Blackwell, designed for high-performance generative AI and professional workflows.

Nvidia CEO Jensen Huang recently stated that he expects the combined order book for Blackwell and Rubin (next-generation) chips to surpass $500 billion by the end of 2026. This statement reinforces the company’s long-term outlook. If this view is reaffirmed in next week’s earnings conference, the stock’s upward momentum is expected to continue until the end of the year.

As such, the current recovery has the potential to push NVDA stock to retest its all-time high around $212, even breaking to a new record of around $240 post-financial report-higher than the current analyst consensus of around $230.

However, with price projections as high as $350 for 2025, the $240 target is still considered realistic, especially with the support of recent comments from the CEO and expectations of solid revenue growth.

Trading US Stock Tokens on the Door

Imagine being able to buy shares of big companies like Tesla , Apple , and Coinbase in tokenized form for just a few thousand dollars. The good news is that you can now buy/sell tokenized US stocks from xStocks on Pintu.

By leveraging blockchain technology, you can now enjoy a faster settlement process for tokenized US stocks, more affordable start-up capital, and a more global investment experience.

Trade on the Door Now!

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Investing. Nvidia Short-Term Bullish Sentiment Gathers Momentum Ahead of Earnings. Accessed on November 14, 2025