Ethereum Reclaims $3,000 Today, Is a Full Recovery on the Horizon for ETH?

Jakarta, Pintu News – Ethereum price briefly traded around $2,995, still holding slightly above the crucial demand zone between $2,950 and $2,880. Currently, the market is in a clear downward trend, where the downtrend line continues to control the price movement, and the set of EMA indicators reinforces the dominance of bearish sentiment.

Then, how will Ethereum price move today?

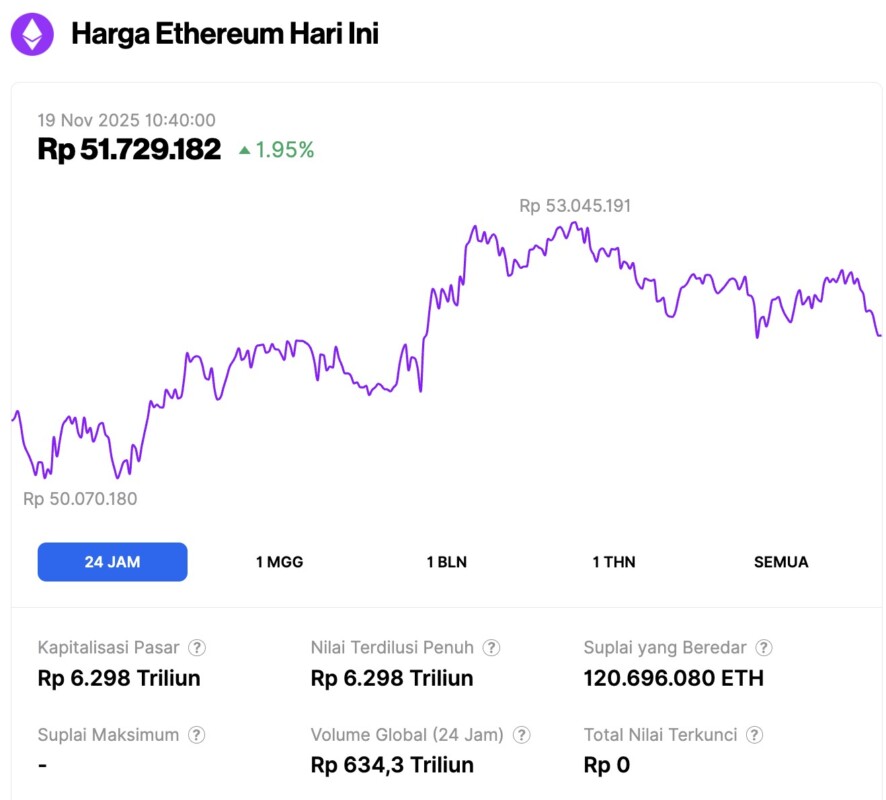

Ethereum Price Up 1.95% in 24 Hours

On November 19, 2025, Ethereum was trading at approximately $3,080, or around IDR 51,729,182 — marking a 1.95% increase over the past 24 hours. During this period, ETH reached a low of IDR 50,070,180 and a high of IDR 53,045,191.

At the time of writing, Ethereum’s market capitalization is estimated at around IDR 6,298 trillion, while its 24-hour trading volume has declined by 18% to IDR 634.3 trillion.

Read also: Bitcoin Turns Green Today as Spot Selling Activity Picks Up

ETH Extends Decline as Sellers Maintain Trendline

Ethereum has again failed to break the downtrend line that has limited any recovery attempts since early October. Every time the price has tried to rise to the $3,350 to $3,450 range, it has been held below this line, reinforcing a downward pattern consistent with a series of lower highs.

Currently, the ETH price is below all major Exponential Moving Averages (EMAs):

- 20 EMA: $3,392

- 50 EMA: $3,703

- 100 EMA: $3,781

- 200 EMA: $3,564

The slopes of all four EMAs indicate consistent downward pressure, while the daily candles have remained trapped below the 200-day average for over two weeks. This signals that buyers have lost control in the medium term, and market movements are more influenced byforced flows than natural riskappetite.

The RSI indicator is currently near the 30 level, which indicates that the market is starting to enter oversold territory. However, there has been no strong divergence so far that could argue against a larger downward trend.

Spot Outflows Increase amid Continued Selling Pressure

Data from Coinglass shows that on November 18, Ethereum recorded a net outflow of $27.56 million, reinforcing the selling bias that has been seen throughout last week.

Most trading sessions in November were dominated by outflows, indicating that investors tend to reduce exposure instead of buying when prices are weak.

This pattern is consistent with the trending outflows(red outflow bars) seen since late October – the first time the price broke below the 200-day EMA, triggering a rotation out of ETH. A rise in outflows during a long-term downtrend is usually a confirmation that spot sellers (rather than simply derivative liquidations) are in control of price movements.

Intraday Momentum Shows Weak Attempt to Stabilize

The short-term chart shows Ethereum trying to stabilize above the $2,980 level, but the recovery is still shallow. On the 30-minute time frame, the Supertrend indicator is above the price, at $3,083, forming an upper boundary that continues to reject any minor price bounces.

Read also: Arthur Hayes Shifts Millions of Dollars: Will Ethereum Price Plummet Below $3,000?

The Parabolic SAR indicator is also above the price, confirming that the downward momentum is still active. Any attempt to reclaim the $3,050 to $3,100 range always fails, as selling pressure remains dominant in the intraday bearish structure.

For buyers to start gaining a foothold, ETH needs to close above $3,083 to reverse the Supertrend signal. This would be the first sign that selling pressure is starting to weaken. But before that happens, any price rally is still classified as corrective, not constructive.

Outlook: Will Ethereum Price Rise?

Ethereum’s trend was still bearish ahead of November 19, and now the proof is in the buyers’ hands.

Bullish Scenario:

- ETH able to stay above $2,950

- Breaks $3,083

- Then continue above $3,392

If this scenario occurs, the short-term momentum reverses and the downtrend line again becomes the target for a breakout attempt.

Bearish Scenario:

- A daily close below $2,950 will open the way towards $2,800

- If the pressure continues, the next support is around $2,600.

As long as ETH stays below the major EMA, the market structure will remain skewed to the downside.

In conclusion, if ETH manages to reclaim the $3,083 level and break the 20 EMA, then buyers start to take over. But if it loses the $2,950 level, the downtrend is sure to continue.

FAQ

What is Ethereum (ETH)?

Ethereum (ETH) is a blockchain platform that allows developers to build and run decentralized applications and smart contracts.

Why is the Ethereum (ETH) price currently on a downward trend?

Ethereum (ETH) price is currently in a downward trend due to sustained selling pressure and failure to break the downtrend line that has been in place since early October.

What was the net outflow of Ethereum (ETH) on November 18?

On November 18, Ethereum (ETH) recorded a net outflow of $27.56 million, indicating increased selling activity.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinEdition. Ethereum Price Prediction: Rising Outflows Push ETH Toward Key Breakdown Zone. Accessed on November 19, 2025