El Salvador Adds to Wealth with $100 Million Bitcoin Purchase

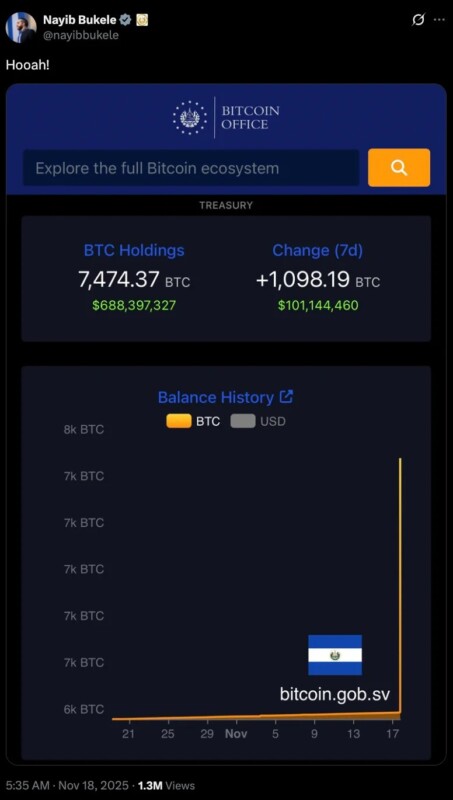

Jakarta, Pintu News – El Salvador recently added to its Bitcoin holdings with a large purchase during the currency’s price drop. The country purchased an additional 1,090 BTC when the price of Bitcoin briefly dropped below $90,000, which is the lowest price since April. This purchase increased the country’s total Bitcoin holdings to 7,474 BTC, valued at approximately $676 million.

The long-term accumulation strategy employed by El Salvador has prompted them to buy Bitcoin when the price drops, in the hope that the value will increase in the future. President Nayib Bukele even shared a screenshot of the latest purchase on his official X account, reaffirming the country’s commitment to Bitcoin.

Global Reaction to Bitcoin Price Fluctuations

Despite Bitcoin experiencing sharp market turbulence with a drop from $125,000 to $91,286.39, many countries are not shying away from the cryptocurrency. The Czech National Bank (CNB) recently made its first crypto investment, allocating $1 million into Bitcoin, US dollar-backed stablecoins and tokenized deposits.

This move shows that global interest in Bitcoin is still high despite price volatility. On the other hand, France through its conservative UDR party, has proposed the creation of a national Bitcoin reserve that would be managed by a specialized public institution.

If approved, France will hold 420,000 BTC, making it one of the largest sovereign Bitcoin holders in the world. This shows that major countries are starting to seriously consider Bitcoin as a strategic asset.

Also Read: Gold Outperforming Bitcoin? Asset Performance Analysis in 2025

Interesting Developments in Japan and China

Japan and China, previously known for their harsh policies against Bitcoin mining, are now showing surprising developments. Japan has started a mining project powered by renewable energy linked to the government, showing that Bitcoin mining can support a modern energy grid.

Meanwhile, China has returned to hosting 14% of the total global hashrate, signaling that mining activity in the country never really stopped, but rather adapted and operated clandestinely.

Bitcoin Remains Attractive in the Eyes of the World

Despite the market cooling down, Bitcoin is still showing strong traction among global governments. With countries like El Salvador continuing to strengthen their position in the cryptocurrency, as well as other major countries beginning to adopt similar strategies, the future of Bitcoin still seems very bright. This engagement signals a new era in cryptocurrency adoption by governments around the world.

Also Read: 5 Reasons Solana (SOL) Was Scooped Up by Institutions Despite Falling 30%: Whale’s Stealth Strategy?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

Q1: How much Bitcoin does El Salvador currently have?

A1: El Salvador currently holds a total of 7,474 Bitcoin (BTC), with a value of approximately $676 million.

Q2: Why does El Salvador buy Bitcoin when the price drops?

A2: El Salvador follows a long-term accumulation strategy and often buys Bitcoin when the price drops to maximize future value.

Q3: What is the Czech National Bank (CNB) doing regarding crypto investments?

A3: CNB recently allocated $1 million for investments in Bitcoin, US dollar-backed stablecoins, and tokenized deposits, marking their first crypto investment.

Q4: What are the proposals of the UDR party in France regarding Bitcoin?

A4: The UDR party in France has proposed the creation of a national Bitcoin reserve that would be managed by a specialized public institution, with plans to store 420,000 BTC.

Q5: How is Bitcoin mining developing in Japan and China?

A5: Japan has initiated the latest energy-backed and government-linked mining projects, while China is showing an increase in clandestinely operated mining activity with 14% of the total global hashrate.

Reference

- AMB Crypto. El Salvador buys $100M in Bitcoin, global governments quietly join the crypto race. Accessed on November 19, 2025