Bitcoin Holds at $92,000 — Is This the Start of a Bear Market or Just a Temporary Dip?

Jakarta, Pintu News – Bitcoin’s current price drop is recorded as the deepest correction in this market cycle, according to an on-chain analyst’s observation.

At the same time, market sentiment also declined sharply. Analysts had different views-some expected the market to experience a prolonged decline, while others believed a bottom was about to be formed.

Then, how will the Bitcoin price move today?

Bitcoin Price Up 0.10% in 24 Hours

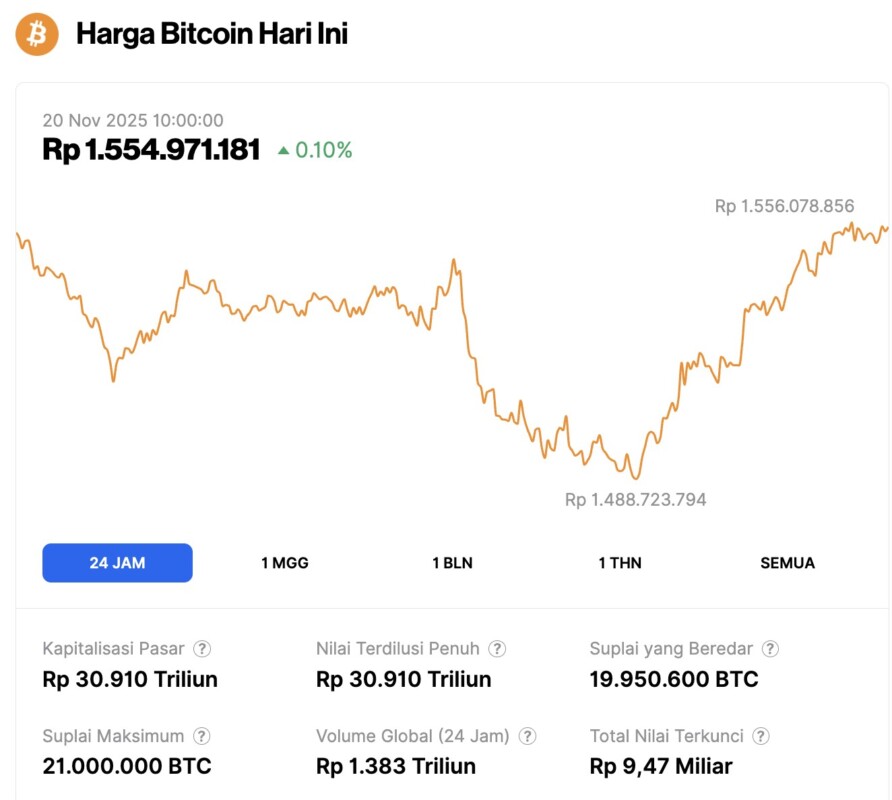

As of November 20, 2025, Bitcoin is trading at $92,567, or approximately IDR 1,554,971,181—marking a modest 0.10% gain over the past 24 hours. During the same period, BTC dipped to a low of IDR 1,488,723,794 and reached a high of IDR 1,556,078,856.

At the time of writing, Bitcoin’s market capitalization is around IDR 30,910 trillion, while its 24-hour trading volume has declined by 13% to IDR 1,383 trillion.

Read also: Crypto Market Plunges, Here are 3 US Stocks that Steal the Show

Bitcoin experiences deepest correction this cycle amid dominance of market fear

Over the past few months, Bitcoin has been steadily declining in value. Yesterday, the price of BTC fell below $90,000, hitting a seven-month low. Even so, a small recovery occurred afterward.

On-chain analyst Maartunn highlighted the magnitude of this decline in a recent post on platform X (formerly Twitter). He noted that this correction is the deepest in the current market cycle.

This price drop has also had a major impact on market sentiment. The Crypto Fear & Greed Index has been in the “Extreme Fear” zone for eight consecutive days until November 19.

The streak that lasted as long as it did shows that traders are still very cautious, with risk appetite at one of its lowest points so far this year.

“This is the longest period in the Extreme Fear zone since the FTX collapse,” Coin Bureau wrote.

Analysts Split: Is Bitcoin Entering a Bear Market or Just Hitting a Temporary Low?

Alphractal states that a strongly negative market sentiment can have two meanings. In a bull market, it can be a sign that a local bottom is near. But in a bear market, such sentiment usually signals a further decline. This is the point where analysts still disagree.

Some believe that a bear market has already begun, in accordance with the four-year cycle pattern. In an in-depth analysis thread, Mister Crypto laid out a number of reasons why he thinks the bull market is over. He highlighted technical signals and cycle time models that show a similar pattern to previous cycle peaks.

On-chain signals and market behavior also support his view. He notes that old Bitcoin whales have started selling their assets, the Wyckoff distribution pattern has finished forming, and Bitcoin’s performance has started to weaken relative to the S&P 500 index – a pattern also seen at the beginning of previous bear markets.

Read also: Bitcoin dominance drops below 60%, Altcoin Season is about to begin?

Investor and trader Philakone even predicts that the price of BTC could drop to $35,000 by the end of next year. This is in stark contrast to the bullish predictions that many analysts have made so far this year.

“It’s crazy that anyone thinks this is impossible. That Bitcoin can’t drop to $35K-$40K before December 2026. All previous bear markets lasted about 365 days from peak to trough in 2014, 2018, and 2022. All saw declines of 78% to 86%. So why is it impossible now?” he wrote.

However, there are analysts who think otherwise. They argue that this is not the typical way a bull market ends, and believe that Bitcoin is forming a bottom.

Institutional figures such as Tom Lee and Matt Hougan have also stated that Bitcoin may be in a bottom phase, and that the bottom could even happen this week.

“I’m not saying prices will immediately shoot to new highs from here. But if history repeats itself, a local low should have formed, and there could be a recovery spike in the near future,” Hougan said.

With views so divided, it’s uncertain whether this Bitcoin price drop is the start of a deeper bearish trend, or just a short-term correction. Time will tell who is right.

FAQ

What caused the recent Bitcoin price drop?

Bitcoin’s price decline is due to global economic uncertainty and changes in monetary policy by central banks, which has raised concerns among investors.

Does this drop signal a bear market for Bitcoin?

Analysts are divided on this; some see the drop as a local bottom in a bullish trend, while others consider it the start of a longer bear market.

How should investors respond to the current market volatility?

Investors are advised to pay attention to market indicators and global economic news, as well as use risk management strategies and portfolio diversification to reduce risk.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Bull Market: Deepest Correction Since Fear & Greed Index Launched. Accessed on November 20, 2025