XRP price could drop to $2.03 before surging, says CasiTrades trader

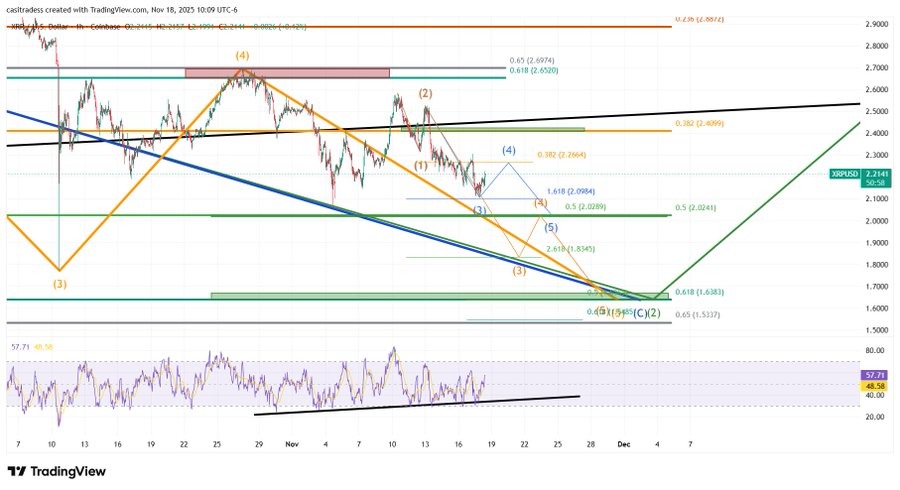

Jakarta, Pintu News – According to the latest analysis from renowned trader CasiTrades, the price of Ripple may see a drop to the $2.03 level before embarking on a stronger rise.

While many were expecting a significant rise post the launch of the XRP ETF, the reality is that the price has shown a decline. Currently, XRP is trading at around $2.10, and many traders are confused about the cryptocurrency’s future prospects.

Important Analysis of the $2.03 Level

CasiTrades emphasizes that the $2.03 level is crucial as it coincides with the 0.5 Fibonacci support area, which is often a turning point for price increases in healthy markets. This analysis shows that XRP is still following the large structure that has formed over the past few months, with prices trending slowly down towards this key support level.

In addition, CasiTrades predicts that the price drop will not happen immediately, but will move in a zigzag pattern with the rise and fall of the price. This is considered normal behavior in this stage of the market cycle. If XRP manages to stay below $2.41, then the scenario of a drop to $2.03 is still very relevant.

Potential Surprise at $1.65

Despite concerns that XRP could fall lower, CasiTrades thinks that the drop to $1.65-which is Fibonacci 0.618-is not a bearish signal, but an opportunity. According to him, this price area is an opportunity for smart traders to quietly accumulate XRP.

Also read: New Hampshire Leads the Way with the First Bitcoin-Based Bond in the US, Here’s How It Works!

The experienced trader adds that the best moment to buy is often before a big spike, not after. Therefore, if the price of XRP drops to $1.65, this should be seen as a golden opportunity to invest, not as a time to panic.

XRP ETF Outlook and Impact

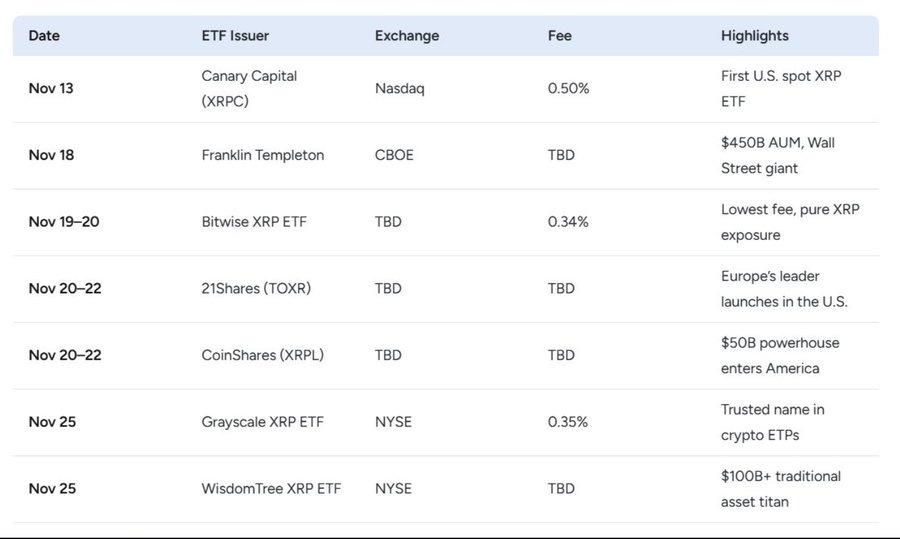

Following the launch of ETFs by Canary Capital and Franklin Templeton, there are five more XRP ETFs awaiting approval in November. The presence of these new ETFs is expected to bring in new buyers and increase demand, which in turn could push XRP prices closer to or even exceed the previous record high of $3.80.

Market experts believe that with continued demand, there is great potential for XRP to reach new price levels. This suggests that despite short-term volatility, the long-term outlook for Ripple (XRP) remains positive.

Conclusion

With all these factors, investors and market watchers should pay close attention to the dynamics happening around Ripple (XRP). Key levels like $2.03 and $1.65 not only signal potential risks, but also opportunities that may not be visible to many. With the right strategy, this could be a favorable moment to get involved in the cryptocurrency market.

FAQ

What is Ripple (XRP)?

Ripple (XRP) is a cryptocurrency used by the Ripple digital payments network to facilitate fast and cheap cross-border money transfers.

Why is the $2.03 level important for the XRP price?

The $2.03 level is considered important because it coincides with the 0.5 Fibonacci support area, which is often a turning point for price increases in healthy markets.

What could happen if the XRP price drops to $1.65?

According to CasiTrades’ analysis, the drop to $1.65 is not a bearish signal, but rather an opportunity to buy XRP at a low price before a possible price spike.

How can ETFs affect the price of XRP?

The launch of the XRP ETF is expected to bring in new buyers and increase demand, which might push the price of XRP up to near or exceed previous record highs.

What is the long-term outlook for Ripple (XRP)?

Despite short-term volatility, the long-term outlook for Ripple (XRP) is considered positive, with the potential to reach new price levels if demand continues to increase.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coinpedia. XRP Price Could Drop to $2.03 Before Bull Run Begins, Says Top Trader. Accessed on November 20, 2025

- Featured Image: Coinfomania