4 Reasons Why Ethereum Price Could Be Bullish to $3,600: Here’s What Analysts Say!

Jakarta, Pintu News – The price of Ethereum has risen by 11% since falling below the $3,000 level on November 22, and has now managed to reclaim important support levels.

Analysts think that increased demand from institutions, coupled with the end ofquantitative tightening, could lead to a price recovery towards $3,600 in the near future.

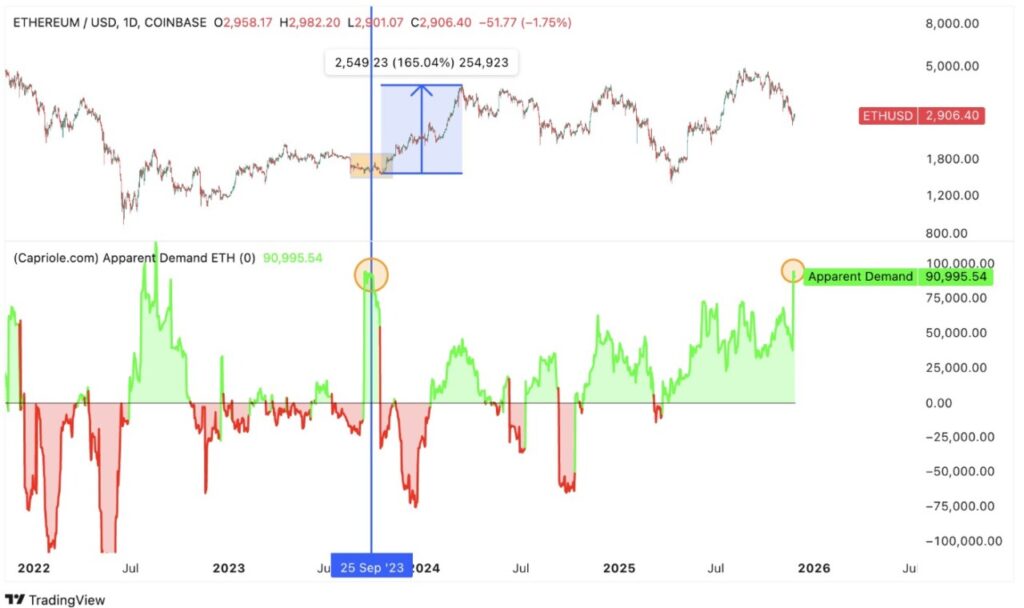

Ethereum Demand Highest in 26 Months

Despite the decline, Ethereum’s Apparent Demand remained in the positive zone and even reached its highest point since September 2024.

Read also: Gold Price Shows Weak Signals, Bitcoin and Ethereum Gain!

Apparent Demand is a metric that measures the market demand for Ether by calculating the difference between the amount of new ETH issued each day and the change in inventory (i.e. ETH that has been inactive for more than a year). A positive value indicates an increase in demand.

Data from Capriole Investment shows that Apparent Demand for ETH jumped sharply to 90,995 ETH on November 26, up from 37,990 ETH on November 22.

This increase in demand for ETH amidst price pressure signals aggressive accumulation by investors during the downturn, which could be an early signal of a price recovery in the near future.

The last time demand was this high was in September 2023, when ETH prices were in the $1,500 to $1,700 range after a 25% correction. After that, ETH recorded a 165% rally, breaking $4,100 in March 2024.

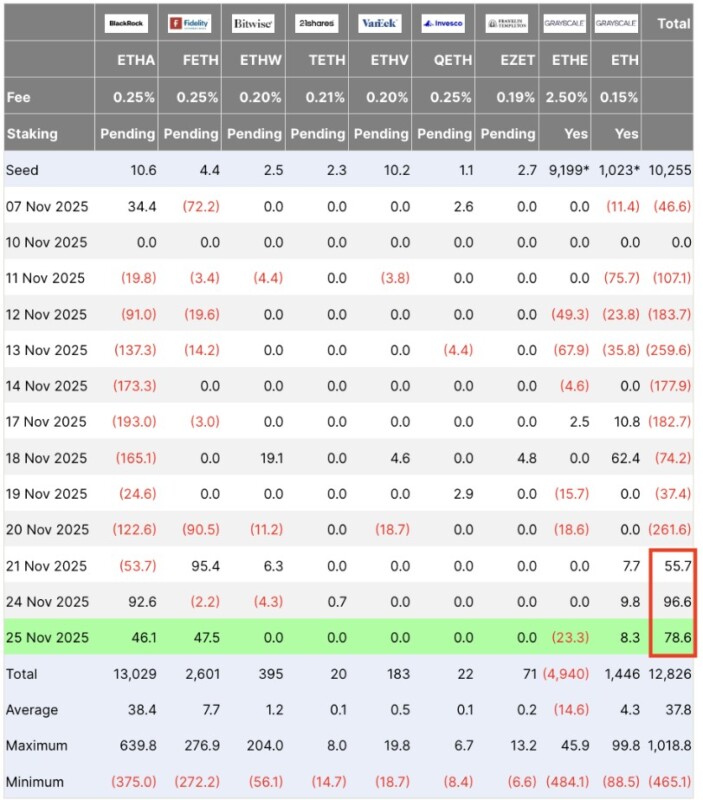

Meanwhile, inflows into spot Ethereum ETFs turned positive by recording three consecutive days of inflows, totaling $230.9 million.

This change comes after a period of sharp decline from November 11 to 20, when the Ethereum fund experienced outflows of $1.28 billion-one of the most significant periods of decline since the ETF was launched.

ETH’s ability to stay above the $2,800 support level is largely driven by market expectations that increased demand as well as fund inflows from ETFs will be the main drivers of future price gains.

The End of QT: History Supports Potential Ethereum Price Rebound

The United States Federal Reserve is expected to end its Quantitative Tightening (QT) policy on December 1-an event that has historically often been followed by a significant surge in Ethereum (ETH) prices.

As QT ends, liquidity begins to flow back into the market, and riskier assets such as cryptocurrencies generally experience a recovery.

“QT ends on December 1 – it’s a good moment to look back at how the crypto market behaved when something similar happened before,” Front Runners crypto analysts wrote in their latest post on the X platform.

In the post, they also shared a chart showing that altcoins had even outperformed Bitcoin ($BTC) after QT ended in the previous cycle. They added:

“At the time, BTC had been on a 200-day downtrend, and liquidity rotation was flowing more into smaller assets.”

The chart also shows that Bitcoin’s market dominance peaked soon after the QT ended, then continued to decline, forming a double top pattern during the COVID-19 period before finally resuming the downward trend.

Front Runners also noted the difference between the current conditions and the previous cycle:

“The difference this time is that BTC is already below its 50-week moving average (50W SMA), while in previous cycles, that level was only broken after QT ended.”

If the historical pattern repeats itself, then the end of QT this time could trigger a massive liquidity rotation that pushes altcoins – especially ETH – to record stronger performance than Bitcoin in the coming months.

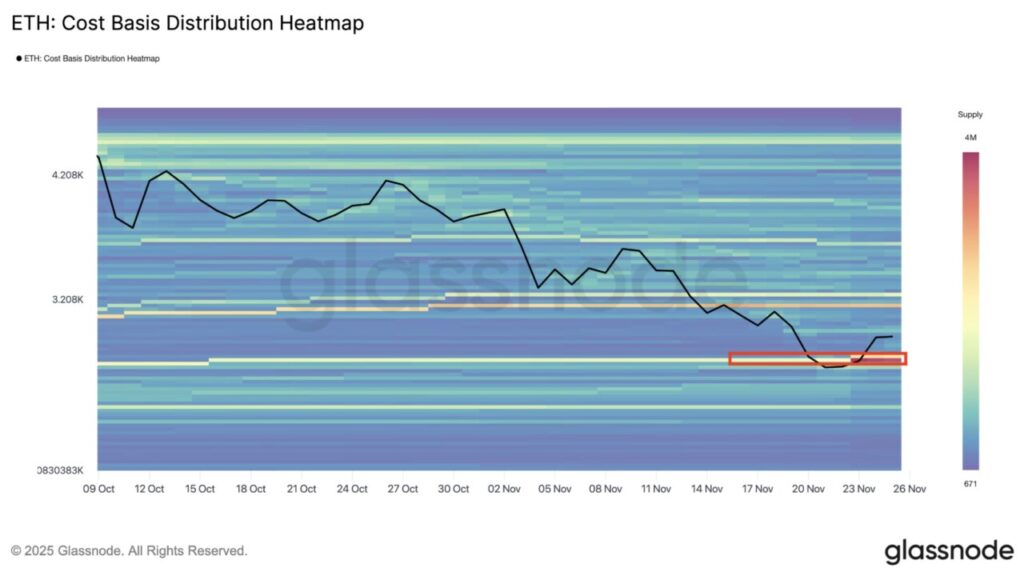

Ethereum’s Main Average Cost Area Is Around $2,800

According to Ethereum’s cost basis distribution data, about 4.95 million ETH were bought by investors at an average price range between $2,800 and $2,830. The concentration of purchases at these levels creates a fairly strong potential support zone.

Read also: Ethereum Price Rebounded to $3,000 Today: Tom Lee Predicts ETH Could Explode to $9K!

The high volume of accumulation at this price range suggests that many investors will most likely look to keep the price around this level, making it a potential foothold to start the next price rally.

Analysts think that ETH must be able to hold above the $2,800 support for bullish momentum to be restored.

“Ethereum is again trading at the big $2,800 level, which during this cycle has been a very important support and resistance,” Daan Crypto Trades analysts said in an X post on Monday, adding:

“It is crucial for the bullish camp to defend this area.”

However, as reported by Cointelegraph, if the ETH price breaks and closes below the $2,800 level, this could signal the beginning of the continuation of the next downward trend towards $2,400, possibly even further down to $2,100.

Ethereum’s V-Shaped Chart Pattern Hints at Target to $3,600

Technically, Ethereum’s price movement since early November shows the potential for the formation of a V-shaped chart pattern on the four-hour chart, as seen in the latest analysis.

Currently, ETH is still trading below the key supply zone between $3,000 to $3,500, where the 100- and 200-periodsimple moving averages(SMA s) are located.

For this V-shaped pattern to be resolved, the bullish camp needs to push the price through the supply zone until it reaches theneckline around $3,650. If successful, this would reflect a price increase of about 26% from the current level.

On the downside, 50 SMA has provided crucial support at $2,891 levels, further emphasizing the importance of this demand zone, as discussed earlier.

In response to the ETH/BTC chart, Michael van de Poppe, founder of MN Capital, stated that ETH is preparing for a strong upward movement in the next few weeks.

“This cycle is far from over,” he said.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Four reasons why Ethereum price remains bullish above $2,800. Accessed on November 27, 2025