Has Bitcoin Reached Its Lowest Price in November?

Jakarta, Pintu News – Identifying Bitcoin’s bottom has always been a difficult task for analysts. However, based on on-chain indicators and trading data, there are some signs that suggest Bitcoin may have bottomed out this November.

Delta Whale vs. Retail Indicator Shows Bullish Signal

The Delta Whale vs. Retail indicator, which measures the difference in long positions between whale and retail traders, shows an unprecedented bullish signal for Bitcoin.

Joao Wedson, founder and CEO of Alphractal, stated that whales, or large investors holding large amounts of Bitcoin, now dominate long positions, far outpacing retail traders. In February and March, this indicator also saw a sharp spike, which marked Bitcoin’s bottom near the $75,000 level.

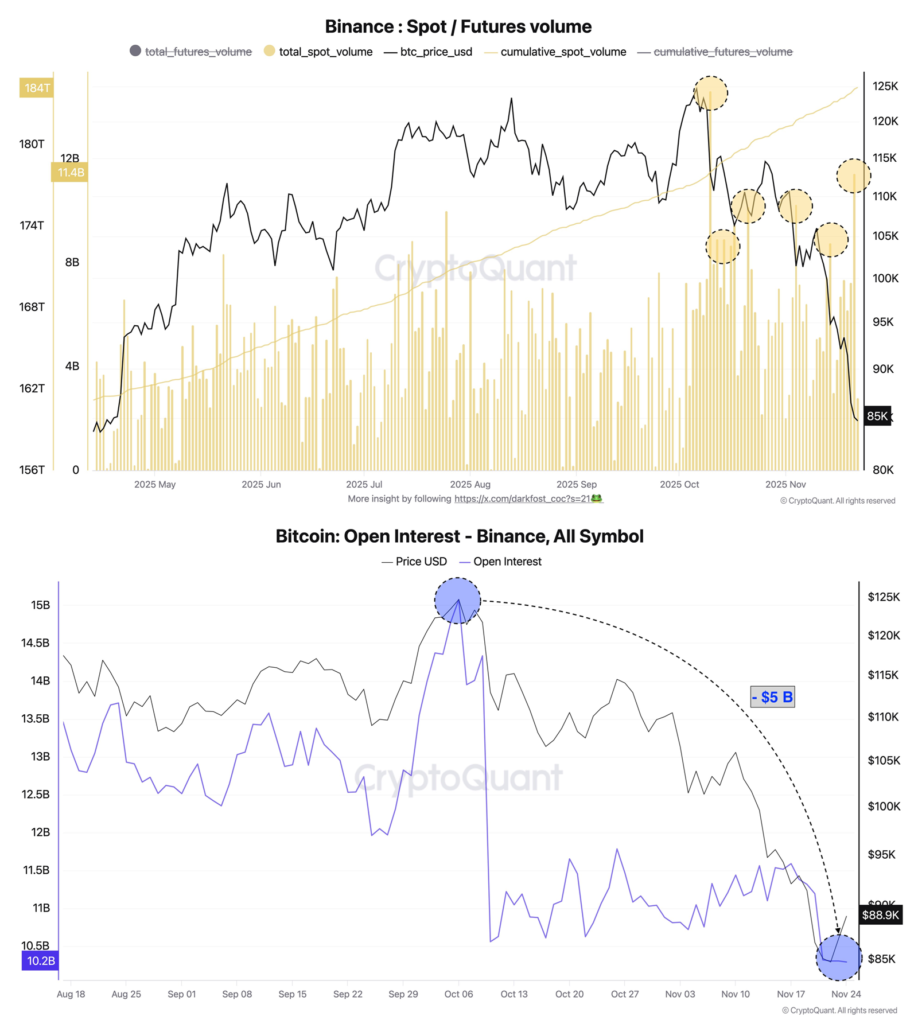

Spot Trading Volume and Declining Open Interest

The daily volume of spot Bitcoin trading on Binance has consistently exceeded $10 billion throughout November, much higher than the average of previous months. Meanwhile, daily open interest on Binance decreased by $5 billion compared to last month.

Also read: Texas becomes the first state to buy bitcoin, what does this mean for crypto?

This trend suggests that speculative positions are being unwound and capital is returning to the spot market, where investors are buying real Bitcoin rather than using high leverage. This transition provides stronger and more sustainable upward momentum for Bitcoin.

Possible Risk of “Dead Cat Bounce”

Despite strong indications that Bitcoin may have hit bottom, some analysts remain skeptical and warn that the current rebound could be just a “dead cat bounce”.

This term refers to a temporary price recovery that occurs after a sharp decline, before the downward trend returns. This risk might encourage traders to reduce leverage and trim positions if the market suddenly turns negative.

Conclusion

Based on recent data and indicators, there is a strong possibility that Bitcoin has bottomed this November. However, it is still important for investors to be aware of potential risks and unexpected market changes.

FAQ

What is the Delta Whale vs. Retail Indicator?

The Delta Whale vs. Retail indicator is a tool that measures the difference between the long positions held by whales (large investors) and retail traders in the Bitcoin derivatives market.

What was Bitcoin’s daily spot trading volume on Binance during November?

Bitcoin’s daily spot trading volume on Binance has consistently exceeded $10 billion throughout November.

What is a “dead cat bounce”?

A “dead cat bounce” is a market term that refers to a temporary price recovery that occurs after a sharp price drop, before the downward price trend resumes.

How did open interest position on Binance in November compare to the previous month?

Daily open interest on Binance decreased by $5 billion compared to the previous month.

Why is it important to monitor indicators like Whale vs. Retail Delta?

Monitoring indicators such as the Whale vs. Retail Delta is important as it can provide insights into the expectations and behavior of large investors compared to retail traders, which can influence market dynamics.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Bitcoin May Have Formed a Bottom in November. Accessed on November 27, 2025

- Featured Image: Generated by AI