Whales Dumped $4 Billion in XRP This November — The Largest Sell-Off Since March 2023

Jakarta, Pintu News – XRP tried to bounce back this week, fueled by renewed optimism following the launch of the spot XRP ETF. Increased attention to the asset supported a mild recovery, but pressure on the upside momentum remains.

A massive wave of sell-offs by whales throughout November hampered XRP’s ability to regain solid uptrend strength, creating a crucial turning point for the asset.

New Record Whale XRP Sell-off

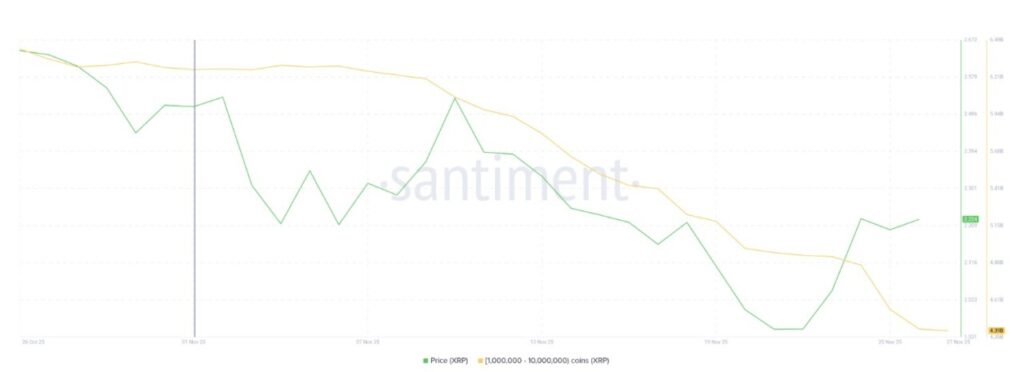

The behavior of XRP whales showed a sharp turn towards bearishness. This month, large holders of XRP recorded the largest sell-off in a single month since March 2023.

Read also: 5 Crypto that Potentially Rebound in December 2025 According to ChatGPT Prediction

Wallet addresses holding between 1 million and 10 million XRP have collectively sold over 2.20 billion XRP, valued at over $4.11 billion. The total holdings of this group have now dropped to 4.39 billion XRP – the lowest figure in the last 32 months.

This aggressive distribution reflects deepening concerns among high-net-worth wallets. Many whales appear to be reducing their exposure to avoid further losses, signaling that market confidence remains fragile despite optimism from ETF launches. The scale of this sell-off suggests that large holders are not yet fully convinced of a sustainable recovery.

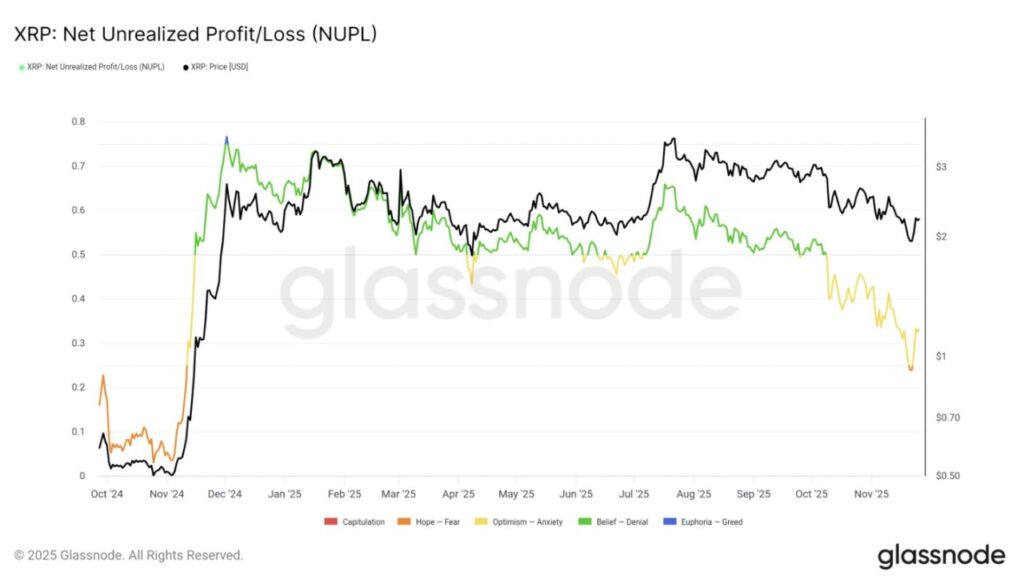

Broader macro indicators also reinforce these concerns. XRP’s Net Unrealized Profit/Loss (NUPL) recently dropped below the 0.25 threshold, entering the “Fear” zone before recovering slightly. Historically, this level produces two distinct possibilities.

If fear subsides and investors do not sell further, prices usually recover gradually as profits are accumulated again. However, if fear increases, there will usually be capitulation triggering a sharp price drop.

Whether XRP stabilizes or weakens further will largely depend on investor behavior in the next few days. A convincing move towards the $2.50 level would signal growing confidence and reduce the risk of capitulation.

Conversely, if the fear sell-off continues, downside pressure could push XRP prices back into the vulnerable zone.

XRP price still far from target

Currently, XRP is trading at around $2.20 and moving flat below the $2.28 resistance level. The launch of the new ETF helped the asset to hold above the important support of $2.14, but the momentum of the move remains weak.

Read also: What is the Estimated Price of 2,000 XRP at the End of 2035 – Fantastic or Realistic?

If XRP fails to continue its rise due to continued whale distribution, it is likely that the price will consolidate between the $2.28 to $2.14 range. A drop below $2.14 could push the price down to $2.00 or even lower, extending the existing bearish trend.

However, if the selling pressure eases and investor confidence begins to recover, XRP could potentially retest the $2.28 resistance level. If it is able to break above that level, the price could be pushed towards $2.36 and eventually to $2.50. This scenario would invalidate the bearish outlook and could encourage renewed accumulation interest among investors.

FAQ

What is Ripple (XRP)?

Ripple (XRP) is a cryptocurrency used in the Ripple payment network to facilitate money transfers between various currencies.

How many sales did XRP whales make in November?

In November, XRP whales sold over 2.20 billion XRP, valued at over $4.11 billion.

What is the impact of the massive sale by XRP whales?

This massive sell-off shows deep concern among large investors and could affect market confidence in Ripple (XRP).

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. XRP Whales Sell-Off Is the Highest Since March 2023. Accessed on November 28, 2025