Price of 1 Pi Network (PI) in Indonesia Today (12/01/25)

Jakarta, Pintu News – The price of 1 Pi Network (PI) in Indonesia on December 01, 2025 recorded new volatility that caught investors’ attention. Amid the discussion about the prospects for Pi Network ETFs, two key issues are determining market direction: the criteria that must be met to qualify for an ETF and the regulatory and asset custody challenges. These two factors are increasingly relevant for Indonesian investors who want to understand how global policies may affect the value and prospects of Pi Network in the local market.

How much is 1 PI in Indonesia today?

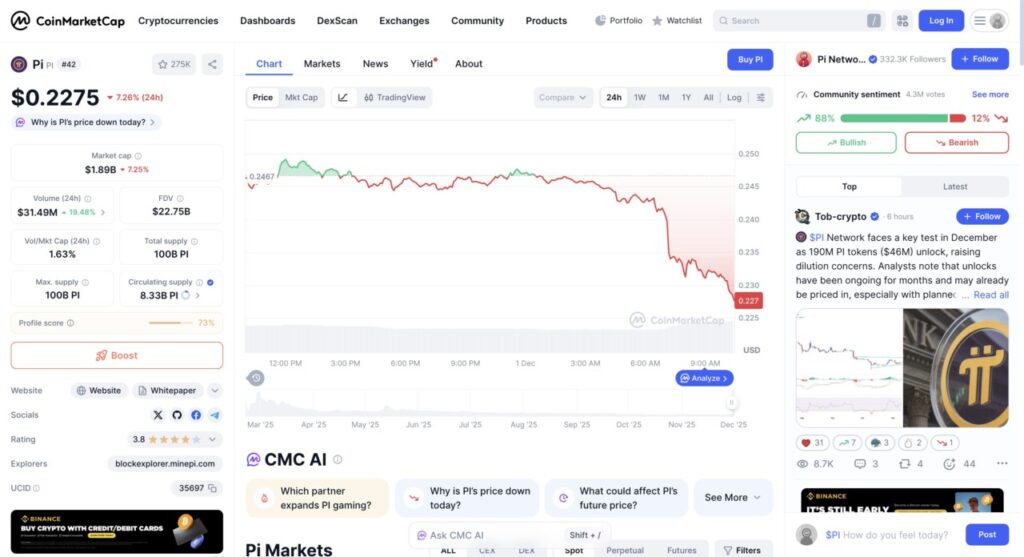

The Pi (PI) price chart over a 24-hour span shows a consistent downward trend throughout the day. At the beginning of the period, the price was still moving steadily in the range of around $0.246-$0.247, characterized by relatively flat small fluctuations. However, as we entered the night and into the early hours of the morning, selling pressure began to increase and the price slowly moved downwards.

A sharper drop occurred towards the morning, when the price dropped from the $0.235 range towards levels around $0.227. This phase is visible as a steep decline at the end of the chart, indicating a sell-off or increased selling pressure in a short period of time. The 24-hour trading volume increased by around 19% indicating higher market activity, possibly accelerating the downward price movement.

Overall, the chart reflects a short-term bearish sentiment for Pi, with the price declining by 7.26% in a day and moving towards the daily low at the time of data capture.

Read also: Ethereum (ETH) is Predicted to Reach $4,200 by the End of 2025

Key Criteria for Pi Network ETFs

Before a Pi Network ETF can be realized, several important criteria must be met. First, Pi Network must have a stable and widely accepted market price. Although Pi prices are already visible on some platforms, the fluctuations that occur demand the establishment of a more stable and transparent market.

This is a crucial first step to building investor confidence. In addition, strong liquidity is another important requirement. The current trading volume of Pi is still much lower compared to other major cryptocurrencies. For an ETF, sufficient volume is needed to buy and sell large amounts of assets without disrupting the market price.

Regulatory and Storage Challenges

From a regulatory perspective, the Pi Network must be able to demonstrate that its assets can be verified, tracked, and protected from manipulation. Although Pi is moving towards greater transparency and compliance, further proof of maturity is still required for institutional adoption. Regulators need assurance that all activity within the network complies with strict security standards.

Furthermore, the existence of a regulated depositor is an absolute requirement. Currently, there is no traditional financial institution that can store Pi tokens in a regulated environment. Regulated depositor approval and full network accessibility are important steps before the ETF can be launched.

FAQ

How much will 1 Pi Network (PI) cost in Indonesia on December 01, 2025?

The PI price is hovering around $0.227 after experiencing a significant drop in the last 24 hours.

Why has the price of PI decreased today?

Increasing selling pressure from the evening into the morning triggered the price drop, reinforced by rising trading volumes.

What are the main requirements for Pi Network ETFs to be approved?

Pi requires a more stable market price, high liquidity and sufficient transparency to meet the ETF criteria.

Why is regulation a challenge for Pi Network?

Regulators require proof that assets can be verified, tracked, and protected from manipulation before granting approval.

Is Pi Network’s liquidity sufficient for ETFs?

Not yet. Pi’s trading volume is still low compared to major cryptocurrencies, so it needs a significant increase to meet ETF standards.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coinpedia. Is Pi Network ETF Possible? Analysts Weigh In. Accessed on December 1, 2025

- Featured Image: Bitcoin news