3 Important signals MicroStrategy could sell Bitcoin: mNAV drops, liquidity drags, new risks emerge

Jakarta, Pintu News – For the first time since embarking on a massive Bitcoin accumulation strategy, MicroStrategy has publicly acknowledged the possibility of selling some of their 649,870 BTC.

CEO Phong Le cited certain emergencies that could trigger the decision, which is a major shift from the “never sell” philosophy of Chairman Michael Saylor.

Here are 3 crucial points that crypto investors and market participants should pay attention to, based on the BeInCrypto report on November 30, 2025.

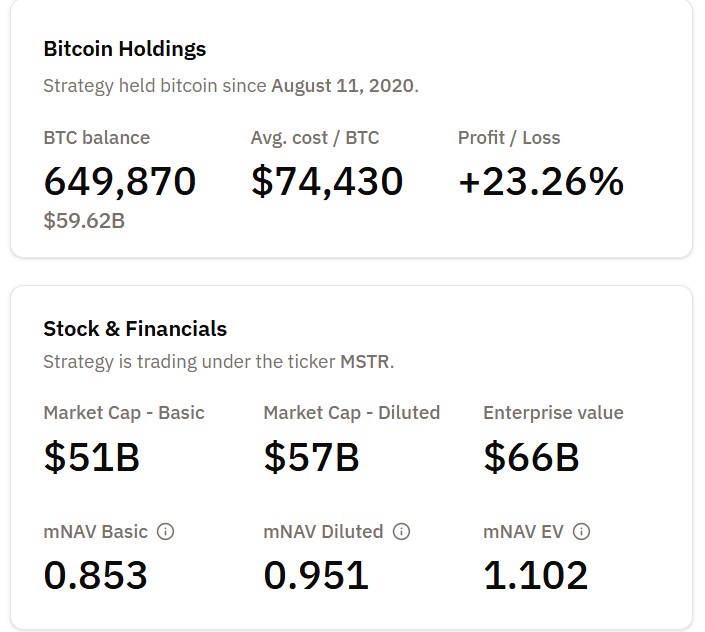

1. Sale will occur if the share price is < 1x mNAV and cannot increase capital

In his interview on the What Bitcoin Did podcast, CEO Phong Le explained that MicroStrategy will only sell BTC if two conditions are met: the company’s shares fall below 1x modified Net Asset Value (mNAV) and the company can no longer raise funds through debt or equity issuance.

Currently, the company’s mNAV hovers around 0.95x – quite close to the 0.9x risk zone. If this figure continues to fall, and capital markets are inaccessible, then selling BTC would be considered “mathematically justified” to maintain the company’s financial stability.

Also Read: 7 Proper Ways to Save Money to Make Your Finances Safer

2. Pressure Comes from Dividend Obligation of IDR13 Trillion per Year

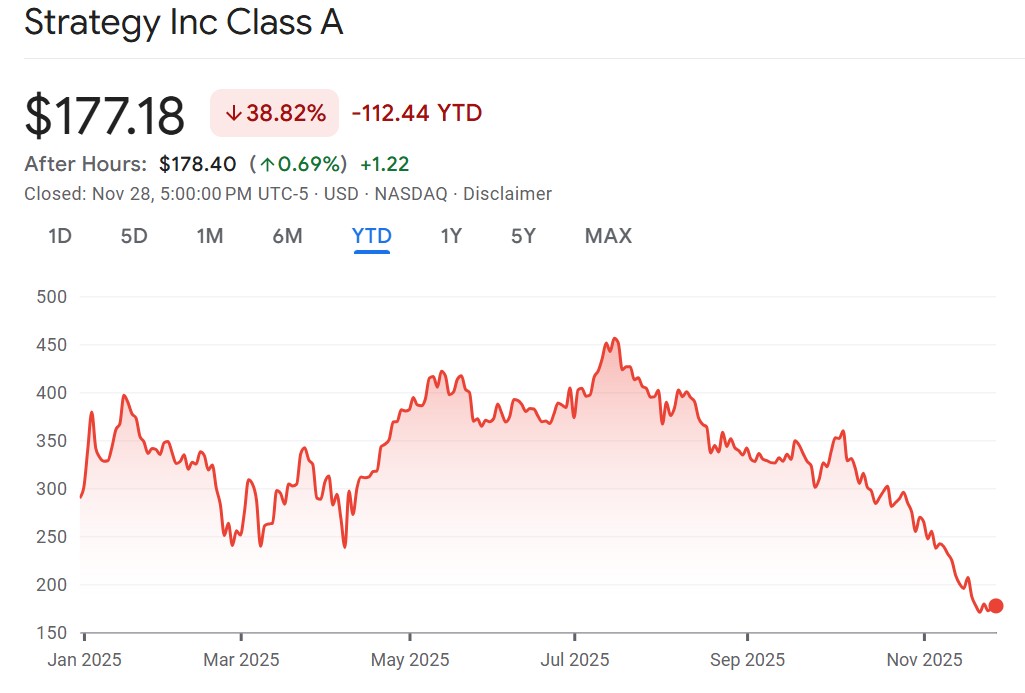

MicroStrategy has a dividend obligation on preferred shares of $750-$800 million (approximately Rp12.5 trillion-Rp13.3 trillion) per year. Previously, these funds were covered from the issuance of new shares. However, with the stock price (MSTR) plummeting more than 60% from its highest peak, the ability to issue new equity has drastically decreased.

If the company’s mNAV falls below the value of the BTC held, and investors are no longer willing to buy new shares, the company could be forced to sell BTC just to fulfill dividend obligations.

3. MicroStrategy is now like a leveraged Bitcoin ETF: Profitable in Bullish, Precarious in Bearish

According to research from Astryx Research, MicroStrategy’s financial structure makes it similar to a leveraged Bitcoin ETF – based on BTC assets but wrapped in a software company. This strategy works very well when BTC prices are rising, but it increases risk when the market enters a downward phase or when liquidity is thin.

Although MicroStrategy insists it does not face the risk of forced liquidation, the acknowledgment of a “kill switch” in their BTC strategy makes the “hodl forever” narrative now more realistic.

Also Read: When will the Gold Price Drop Drastically? This is the Full Explanation

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing.

FAQ

When will MicroStrategy sell their Bitcoin?

According to CEO Phong Le, the sale will only happen if MSTR shares fall below their Bitcoin asset value (mNAV < 1x) and the company cannot raise new capital.

What is mNAV and why is it important?

mNAV (modified Net Asset Value) compares a company’s market capitalization to the value of its BTC holdings. If it falls below 1x, it means the company’s market value is less than its BTC assets – a danger signal.

What is the main reason MicroStrategy’s BTC selling risk is increasing now?

As the share price fell dramatically and the capital market was tight, new funding options were limited. Meanwhile, dividend obligations continued to run.

Has MicroStrategy sold BTC so far?

Not yet. But for the first time, the company explicitly stated that a sale is an open option if financial conditions worsen.

Reference:

- Lockridge Okoth/BeInCrypto. MicroStrategy Admits a Bitcoin Sale Is Possible-Here’s When. Accessed December 1, 2025.