Zcash (ZEC) Plunges 21% — Is It on the Verge of Losing Its Last Line of Bullish Support?

Jakarta, Pintu News – Zcash fell about 21% on December 1 and has now extended its seven-day loss to nearly 33%. The monthly trend has also turned negative.

Nevertheless, Zcash’s price increase over the past three months is still above 780%, which shows how strong the previous rally was.

Currently, Zcash is trading in a bullish pattern that has formed every major move since September. The price has just touched the lower trend line of this channel. This is the last strong support level keeping the long-term uptrend intact.

Two internal indicators suggest that the selling pressure may be starting to ease, but ZEC needs to hold that important line to recover.

Momentum Weakens, but Pressure May Begin to Ease

The first clue came from the Relative Strength Index (RSI), which measures the strength of momentum on a scale of 0-100. Between September 27 and December 1, prices formed higher lows, while the RSI formed lower lows. This is known as a hidden bullish divergence, which often appears when the market is approaching a downward saturation point.

Read also: First Chainlink ETF in the US Launched by Grayscale, Will LINK Rise?

Currently, the RSI is nearing the oversold zone. The last time the RSI was at this low level – around August 19 – ZEC started to experience a new upswing shortly after.

The second clue comes from the Chaikin Money Flow (CMF) indicator, which tracks the flow of large funds either into or out of the market.

Since November 6, the CMF has continued to decline, coinciding with a sharp correction in prices. The CMF fell below zero on November 24, for the first time since late October, and this decline was in line with the increasing selling pressure. But now the CMF has started to curve upwards and is moving back closer to the zero line.

This is important because the CMF also shows a small divergence. Between November 27 and December 1, the price recorded lower highs, while the CMF recorded higher highs. When the CMF starts rising while the price is falling, it indicates that large buyers may be preparing to re-enter the market.

If the CMF is able to break above the zero line and cross the downtrend line drawn from the previous peaks, then ZEC could potentially experience a positive shift in momentum.

However, these two signals are only relevant if thelower channel support holds.

Correlation Changes and Key Zcash Price Levels that Determine Trend Direction

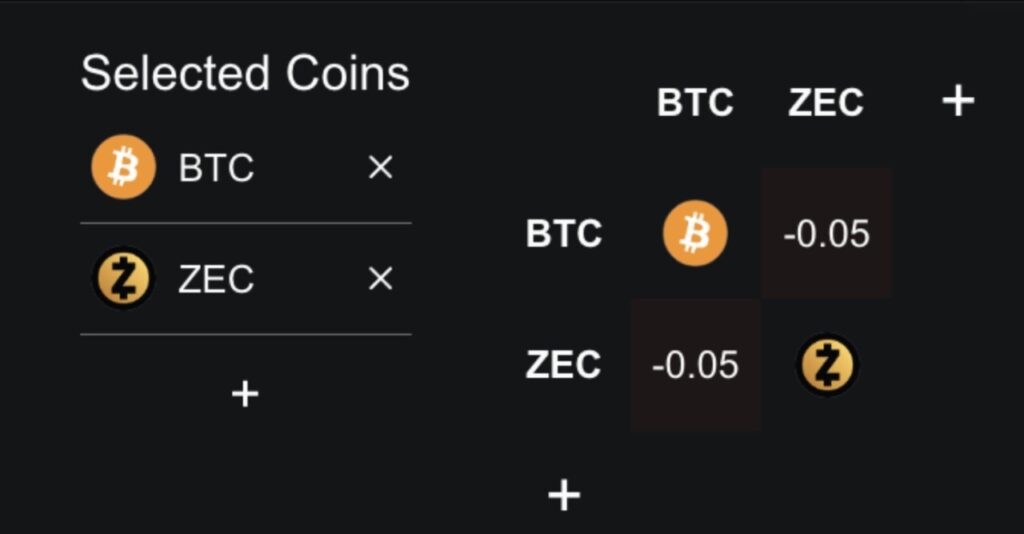

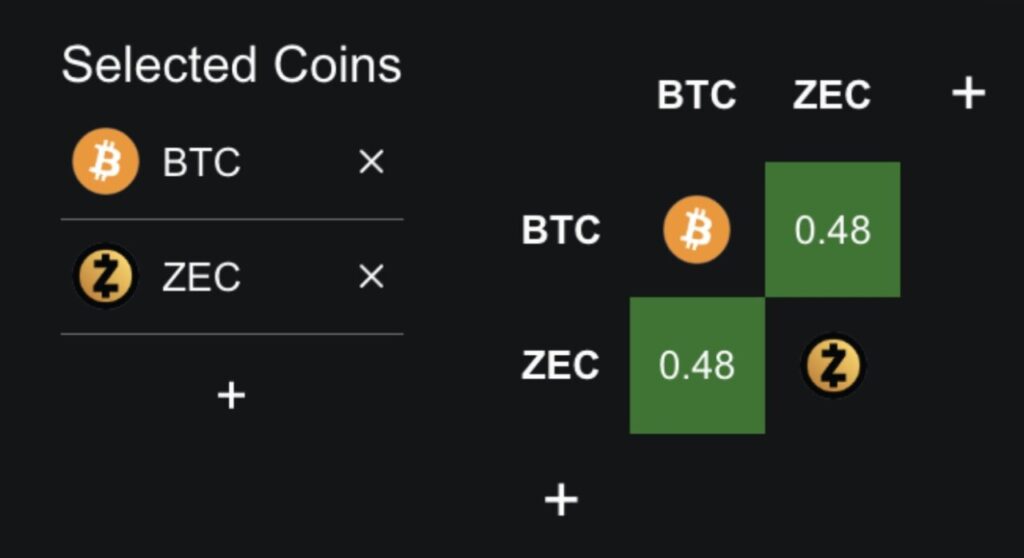

Zcash’s rise was previously driven by a weak or even slightly negative correlation to Bitcoin. In the past year, the correlation between BTC and ZEC was around -0.05. This allows ZEC to perform better when Bitcoin is weak.

However, in the last seven days, that correlation has turned slightly positive at 0.48. While this is still weaker than other major coins – meaning ZEC can still move differently – it also means that Bitcoin’s decline could drag ZEC down further in the short term.

Because of this change, price levels are becoming increasingly crucial:

Currently, ZEC is slightly above $348, which is the lower limit of theascending channel. If the daily price closes below $348, the long-term trend line will be broken and open up a potential drop towards $309. If the $309 level fails to hold, the next major support is at $230 – the point where buyers previously entered strongly.

Read also: Silver Hits All-Time High, Leaves Gold Behind — What’s the Outlook Ahead?

A drop below $230 could trigger a new low, which even crypto luminary Max Keiser has predicted.

For the Zcash price to rally again, ZEC needs to break and hold the $592 level – which is the 0.618 point in the Fibonacci retracement. This would require a rise of about 63.9% from current levels – large, but not unheard of for ZEC, given the previous volatility.

If the CMF indicator continues to point upwards and the long-term negative correlation to BTC comes back into play, Zcash still has a chance of maintaining the upward channel and continuing the upward trend. But if the $348 level is lost, the overall technical structure changes, and the bullish scenario will fall – at least temporarily.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Zcash Price at Critical Level: Rebound or Breakdown. Accessed on December 2, 2025