7 Important Facts for 2026 Monad (MON) Price Prediction

Jakarta, Pintu News – The launch of the Monad mainnet on November 24, 2025 has made this cryptocurrency a buzzword for its high throughput, fast finality, and full compatibility with EVM.

According to a CCN report, the launch triggered a surge of interest in the MON token, which is now entering a price discovery phase with high volatility. This article summarizes the price predictions, technical analysis, and important on-chain data that the crypto market is monitoring throughout 2026.

1. Mainnet launch gets MON a lot of attention

According to CCN’s report, Monad’s mainnet launch on November 24 brought improved network efficiency, 800ms finality, and the ability to process up to 10,000 transactions per second. Such efficiency makes MON attract attention as an altcoin that supports parallel execution and full compatibility with the Ethereum ecosystem.

Data from the official whitepaper shows that the Monad architecture drives high performance through optimistic parallel execution and the MonadBFT consensus algorithm. With the combination of these factors, MON is considered to have high utility potential that the crypto community is monitoring.

Also Read: 3 Stock Sectors Predicted to be Bought by Investors When the Technology Sector Weakens

2. MON 2026 price prediction based on CCN data

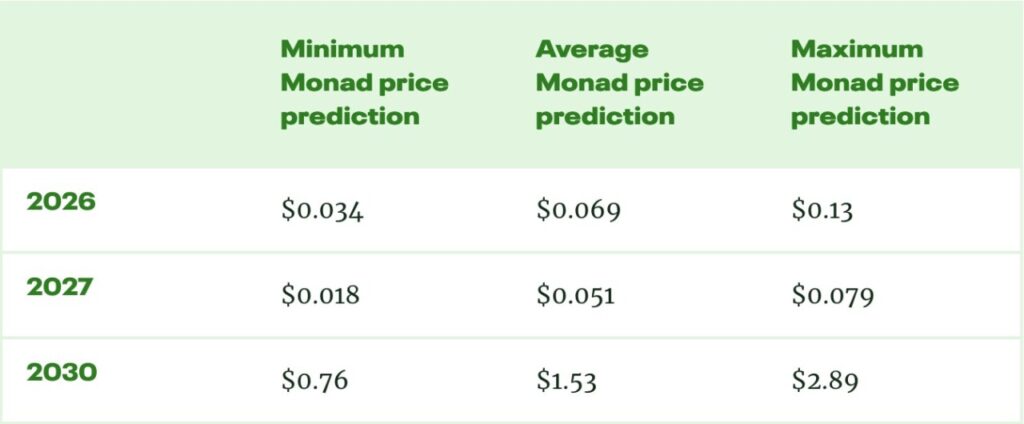

The 2026 price prediction depicts a scenario that is still subject to post-launch volatility. Based on CCN data, the minimum price is expected to be around $0.034 or IDR566,542, while the average is at $0.069 or IDR1,148,747.

In an optimistic scenario, CCN said the maximum price could reach $0.13, equivalent to IDR 2,165, – as a result of a medium-term increase in demand. The analysis still emphasizes the high risk due to the price discovery phase and selling pressure from early adopters.

3. 2027-2030 projections reflect demand dynamics

According to CCN, the 2027 prediction shows potential price pressure due to profit-taking by early investors. The price range is delivered between $0.018-$0.079 or approximately IDR299,934-IDR1,316,377.

For 2030, CCN data notes an aggressive growth scenario with an average price of $1.53 or IDR 25,495, if adoption increases. The maximum value in the prediction is at $2.89, which is IDR48,152, but it is still subject to macro uncertainties and crypto demand dynamics.

4. Technical analysis: MON exits consolidation phase

The daily chart quoted by CCN shows MON has broken out of the resistance area and entered a short-term bullish phase. The Bull Bear Power (BBP) indicator according to TradingView data records positive momentum that could take the price towards $0.050 or IDR833 , 150.

Under extremely bullish market conditions, technical projections suggest a potential move towards $0.071, around Rp1,183,073. CCN emphasizes, however, that the sustainability of this trend depends on steady buying interest and no increased selling pressure.

5. Market Cap to TVL ratio puts MON in the spotlight

DeFiLlama data as of 26 November 2025 records MON’s market capitalization at $499.53 million or IDR 8.3 trillion, with TVL reaching $119.99 million or IDR 1.99 trillion. The market cap-to-TVL ratio stands at 4.16, which according to CCN indicates a high valuation relative to on-chain activity.

This metric is important because it is widely discussed as an indicator of real demand in the MON ecosystem. A high ratio does not necessarily mean a correction, but indicates the presence of speculation that gets investors’ attention.

6. MON performance comparison with other cryptos in similar categories

CCN’s report features a price performance comparison between MON and other L1 cryptocurrencies such as Berachain , Sei , and Hedera . MON recorded a +52.40% gain in the first 24 hours, while BERA fell -58.71%, SEI fell -53.98%, and HBAR fell -40.22% in the last 3-month period.

This data has earned MON attention as one of the new gainers that the crypto market is monitoring after the mainnet launch. Nevertheless, long-term stability remains unverified.

7. Token distribution and potential risks

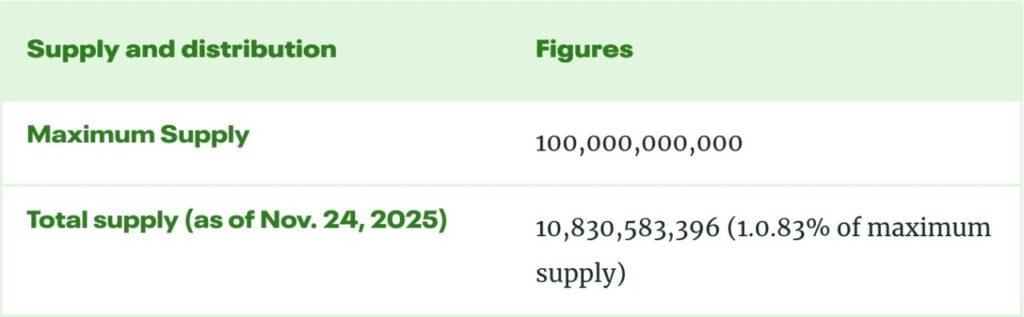

According to CCN, MON’s total maximum supply is 100 billion tokens, with a circulating supply of 10.83 billion or only about 10.83% of the total supply. The token unlock model is a risk factor to watch as it could increase supply and affect price pressure.

The whitepaper documentation explains that optimistic parallel execution, MonadBFT, RaptorCast, and MonadDB work simultaneously to maintain performance without sacrificing decentralization. However, this supply curve risk remains a key variable in price prediction.

Also Read: 4 Key Risks of Cardano (ADA) in December 2025 that Crypto Investors Should Monitor

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What is the Monad (MON) price prediction for 2026?

CCN’s prediction notes a price range of $0.034-$0.13 (IDR566,542-IDR2,165,000) based on volatility and initial demand.

Why is MON considered interesting in the crypto community?

The launch of the mainnet with high performance of up to 10,000 TPS and 800 ms finality is the main reason for the increased interest according to CCN.

Is MON already considered overvalued?

The market cap-to-TVL ratio of 4.16 according to DeFiLlama indicates a relatively higher valuation compared to on-chain activity.

What has been MON’s highest price so far?

CCN data records the all-time-high at $0.040 or IDR666.52.

What are the main risks to MON?

Risks include increased supply (token unlock), crypto volatility, and selling pressure from early adopters.

Reference

- Victor Olanrewaju / CCN. Monad Price Prediction 2026: MON Sets the Stage for Big Gains. Accessed December 2, 2025