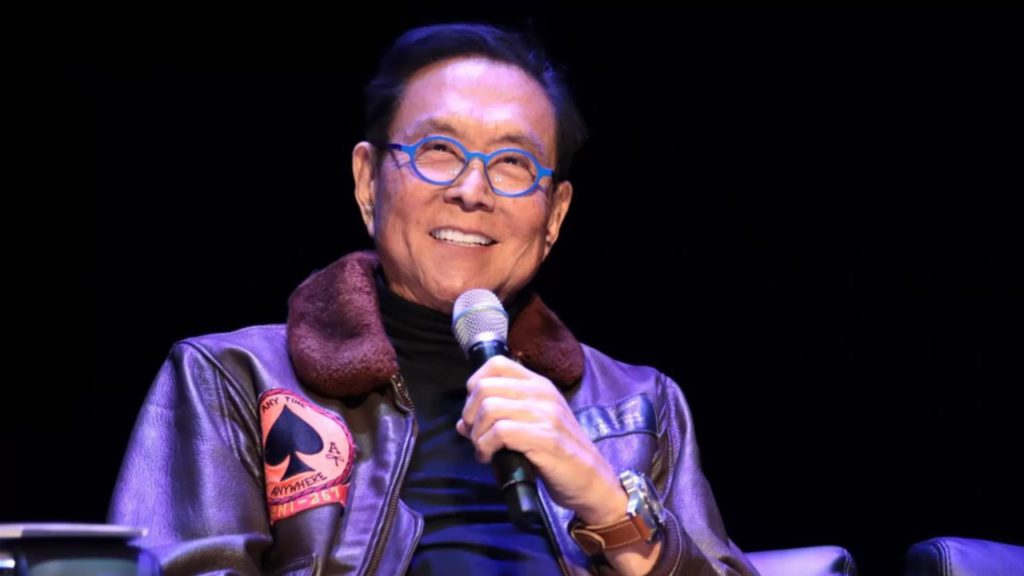

5 Insights from Robert Kiyosaki on the Global Bubble and Bitcoin (BTC)

Jakarta, Pintu News – Kiyosaki’s emphasis on the vulnerability of traditional assets could strengthen the appeal of crypto as an alternative safe haven. If confidence in traditional monetary systems weakens, demand for decentralized assets like Bitcoin could potentially increase.

However, it’s important to remember that crypto remains highly volatile – so diversification and risk mitigation approaches remain relevant.

1. Kiyosaki: The “30-Year Bubble” is Bursting – All Traditional Assets are at Risk

Robert Kiyosaki has warned that the world faces a “massive asset shrinkage” after what he calls a 30-year bubble begins to burst. He says that traditional assets such as stocks, bonds and property are particularly vulnerable in this scenario – and investors need to be aware of the potential for mass losses.

Also Read: 5 Signals Ethereum (ETH) Has Reached the Bottom After Dropping 28 Percent?

2. Kiyosaki’s faith in Bitcoin remains strong – when many are skeptical

Despite the global market shake-up, Kiyosaki states that his faith in Bitcoin has not wavered. In his view, cryptocurrencies – including Bitcoin – represent “real money” or an alternative to traditional “paper money” which he says is prone to inflation and monetary manipulation.

3. Criticisms of Fiat Money, ETFs and “Paper Assets” Grow Louder

Kiyosaki strongly criticizes financial instruments such as ETFs, bonds, and other paper-based assets, calling them “fake money”. According to him, when the monetary system loses credibility – such as when a bubble bursts – real assets and decentralized assets such as cryptocurrencies are more resilient.

4. Exposure to Crypto and Precious Metals as Wealth Protectors

Besides Bitcoin, Kiyosaki also mentions precious metals such as gold and silver as savior assets in a crisis. This approach is consistent with his “hedge against fiat” philosophy – preserving the value of wealth when traditional currencies are expected to depreciate.

5. Momentum: Market Reality Supports Kiyosaki’s Warning Right Now

As Bitcoin and other cryptocurrencies come under pressure from market declines, Kiyosaki’s warning is drawing attention as a reflection of global economic uncertainty. The situation has prompted a reassessment of the value of crypto and precious metals as portfolio alternatives – especially for those concerned about the stability of fiat and traditional markets.

Also Read: 5 Facts about Bitcoin Price Drop to US$ 85,000 – Implications for Crypto Market!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What does Kiyosaki mean by a “30-year bubble”?

The term refers to a long period where traditional assets such as stocks, bonds or property have appreciated significantly – which Kiyosaki says is now beginning to collapse, potentially triggering a global asset value crisis.

Why does Kiyosaki continue to believe in Bitcoin despite the shaky crypto market?

Because according to him, Bitcoin is a form of “real money” that does not rely on the monetary policies of governments or central banks – making it more resistant to inflation and fiat value manipulation.

Does Kiyosaki’s view mean crypto is safer than stocks or bonds right now?

He makes the argument – that in a bubble burst scenario, traditional assets are high risk, while cryptocurrencies and precious metals could be more resilient. However, this depends on future market and regulatory conditions.

What are the risks of relying on crypto as a hedge?

Cryptocurrencies like Bitcoin remain vulnerable to price volatility, regulation, and global market sentiment – so they cannot be considered completely “safe”. Portfolio diversification remains important.

Is it a good time to switch to crypto according to Kiyosaki?

Kiyosaki thinks that the period of collapse of traditional assets is a moment for investors to consider crypto or precious metals – but the final decision should still take into account the risk profile and time horizon of the investment.

Reference:

- Kevin Helms. Robert Kiyosaki Sees 30-Year Bubble Bursting as His Bitcoin Conviction Holds Firm. Accessed December 3, 2025.