5 Important Facts from Bitcoin (BTC) Latest Predictions: US$125,000 Target?

Jakarta, Pintu News – Here are 5 important facts from Bitcoin’s latest prediction regarding short-term pressure vs. US$125,000 target:

1. BTC Drops to Around US$90,400 – Real Short-Term Pressure

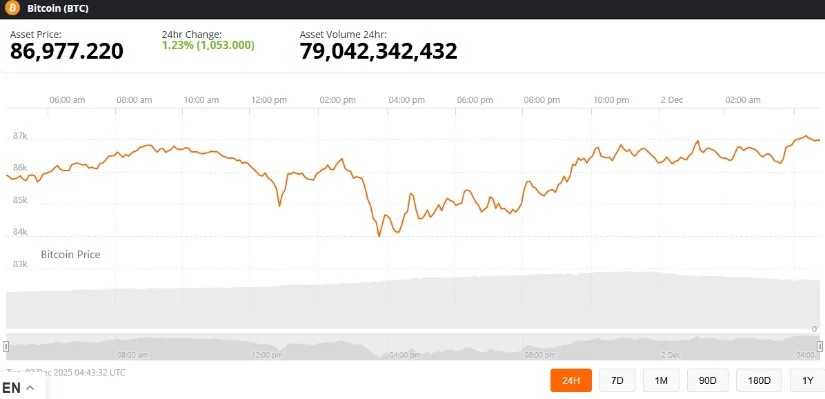

According to the latest reports, the price of BTC had dropped by about 6% to break the US$ 90,400 level on December 1, 2025.

This drop follows a sharp US$18,000 drop in November, indicating that volatility is back on the rise and creating uncertainty. In the short term, many traders view this as a consolidation phase – signaling caution before making any new moves.

Also Read: 5 Signals Ethereum (ETH) Has Hit Bottom After Dropping 28 Percent?

2. Technical Indicators Show Weakness – Opportunity for Deeper Correction

Technical analysis shows that several key indicators on BTC are showing weakness. On the monthly chart, momentum is declining and there is potential for a reversal if there is no quick recovery, reinforcing the narrative that the market needs to consolidate first. Overbought conditions from the previous appreciation could trigger a correction phase, especially if market sentiment or macro factors are unfavorable.

3. Schematic Scenarios for a Drop to Around US$ 55,000 Still Open

Based on several models, analysis shows that if the bearish pressure continues, BTC has a chance to break the medium-term support area towards the US$55,000 range. This medium-term support area is an important zone to monitor in case of further weakness, especially for leveraged positions.

However, this scenario is said to be a possibility in the context of the downside – not a definite prediction – as many external variables affect the price direction.

4. Key Support in US$76,000-$82,000 Range Could Be the Foundation for Recovery

Despite the pressure, analysis shows that an important region of support lies between US$76,000 and US$82,000 – if the price of BTC drops there, it could be a bounce point. If this support holds, the potential for a long-term rebound remains open, so the correction phase could be part of a healthy consolidation cycle.

5. Long Term Target: US$ 125,000 – Provided Fundamentals & Adoption Conditions Support

Despite facing short-term pressure, long-term predictions from technical analysis and institutional adoption still point to a path towards US$125,000. Historical support and a possible rebound from the support zone are expected to deliver BTC to the previous distribution level if the macro market stabilizes.

But analysts caution that this target is conditional – depending on market recovery, institutional sentiment, and external factors such as interest rates and macro turmoil.

Implications for Crypto Ecosystem & Investors

BTC’s correction may offer opportunities for investors who are patient and ready to withstand volatility. Zoning in on important support could form the basis of a long-term strategy. However, medium-term risks remain, especially if support fails to hold – then a scenario down to the US$55,000 area needs to be watched out for.

Overall, the US$125,000 long-term target remains attractive as an optimistic scenario, but requires close monitoring of market conditions and institutional adoption.

Also Read: 5 Facts about Bitcoin Price Drop to US$ 85,000 – Implications for Crypto Market!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What is the cause of BTC’s recent decline?

The decline was due to a combination of a technical correction and weakening market sentiment – including increased selling volume after a large rally and potentially overbought, as well as global macro conditions affecting risk assets.

How likely is it that BTC drops to US$55,000?

The possibility exists if the bearish momentum continues and support in the US$ 76,000-US$ 82,000 range fails to hold, but this scenario is considered an extreme downside, not the ultimate prediction.

Why is the US$125,000 target still considered realistic?

Because long-term analysis shows that the market structure is still bullish – with strong support and potential for a rebound if institutional demand and adoption continue to increase.

Is it a good time to buy or hold BTC?

This is considered a consolidation phase – suitable for long-term investors who are prepared for volatility, while keeping a close eye on support and macro sectors.

What factors could make the US$125,000 target unattainable?

Some of the factors include high volatility due to global economic turmoil, monetary policy (interest rates), regulatory pressure, as well as low institutional interest or liquidity in crypto assets.

Reference

- Ahmed Ishtiaque / Brave New Coin. Bitcoin (BTC) Price Prediction: Short-Term Pressure Builds, Long-Term Path Still Points to $125K. Accessed December 3, 2025.