Will the BNB Price Reach $1,000 in December 2025?

Jakarta, Pintu News – This December, the cryptocurrency Binance Coin is showing strong bullish signals, which might lift its price close to $1,000. Various technical indicators such as the double bottom pattern and falling wedge breakout, along with liquidation pressure, promise significant upside potential. This analysis will delve deeper into the factors that support this optimistic prediction.

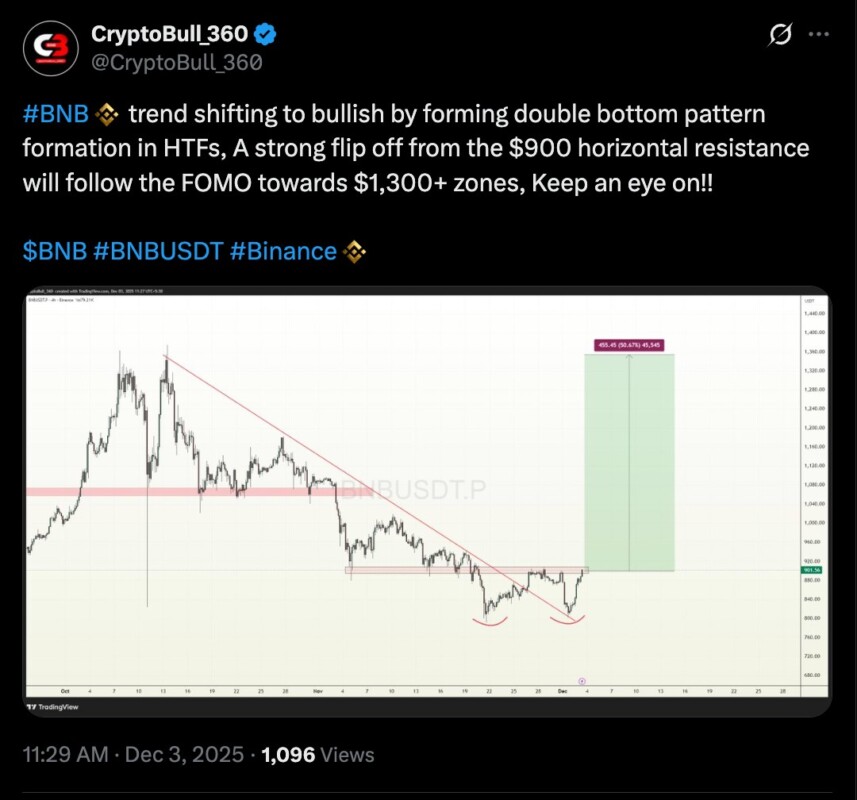

Double Bottom Pattern Promises Upside

The double bottom pattern formed in the $800-$820 demand zone has provided a solid base for BNB to begin its recovery. This pattern, seen on the four-hour chart, signals that BNB has found solid support and is ready to surge.

This rise is not only supported by technical analysis but also by the growing buying interest in that price zone. Given this pattern, investors may see this as an opportunity to enter before the price jumps higher.

Also Read: Ripple CEO’s Shocking Prediction: Bitcoin Will Break $180,000!

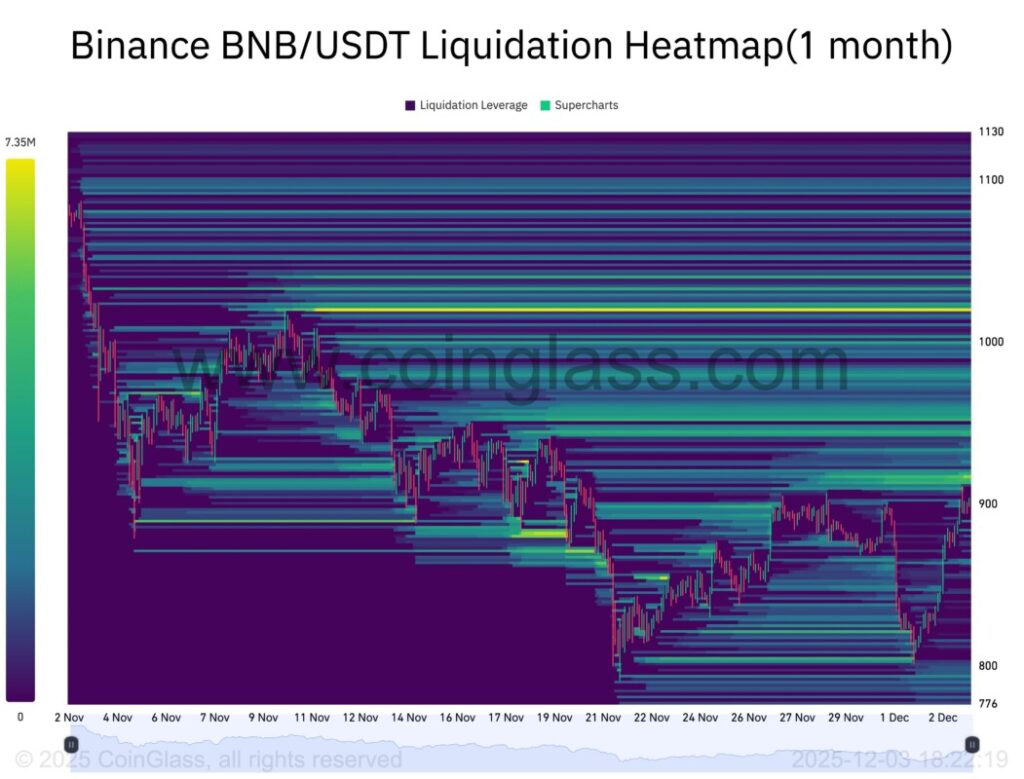

Liquidation Pressure Points to $1,020 Price

The liquidation heatmap from CoinGlass shows that there is a short liquidation leverage of around $112.28 million near the price of $1,020. This suggests that there is potential for strong price momentum if BNB reaches that level.

This liquidation pressure can trigger further price spikes as traders who go short are forced to buy back BNB to cover their positions. This phenomenon often accelerates the price movement upwards, providing an opportunity for BNB to reach higher price targets.

Falling Wedge Breakout Supports BNB Recovery

BNB recently managed to break out of a falling wedge pattern that had been forming for several weeks. This pattern is generally considered a bullish signal, especially after a long period of selling. A breakout from this pattern not only indicates a change in market sentiment but also the potential for a rapid price recovery. With BNB breaking out of the falling wedge, the opportunity to reach and even surpass $1,000 is becoming more and more real.

Conclusion

With various technical factors in favor, BNB’s prospects of reaching $1,000 in December seem very likely. Investors and traders should pay close attention to these indicators and the changing market dynamics to make informed investment decisions. BNB’s rise to this price level would not only be an important milestone but could also mark the beginning of a broader bullish trend in the crypto market.

Also Read: Decisive Week: XRP Braces for a Huge December 2025 Surge!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

Q1: What is a double bottom pattern?

A1: A double bottom pattern is a chart formation that shows a price drop, followed by a rebound, a drop back to a similar level, and finally a stronger rebound. It is often considered a bullish signal in technical analysis.

Q2: How can a falling wedge breakout affect the price of BNB?

A2: A breakout from a falling wedge pattern is usually considered a bullish signal. It indicates that the price has successfully broken out of a downward trend and is ready to start an upward trend, which may lead to further price increases.

Q3: What impact does short liquidation have on the BNB price?

A3: Short liquidation occurs when traders who bet on falling prices are forced to buy back assets to close out their positions, often as prices rise. This can lead to further price spikes due to a sudden increase in demand.

Q4: What is BNB’s predicted price target for December?

A4: Based on technical analysis and liquidation pressure, BNB prices are targeted to reach between $1,020 to $1,115 in December.

Q5: Why is the $800-$820 price zone important for BNB?

A5: The $800-$820 price zone is considered a strong demand zone, where investors tend to buy BNB, believing that the price will rise. This is also the area where a double bottom pattern formed, providing additional support.

Reference

- Cointelegraph. Can BNB price retake $1K this week. Accessed on December 4, 2025