3 Crypto Narratives Dominating the End of 2025 – What are the Best Picks in 2026?

Jakarta, Pintu News – Three rapidly evolving narratives are emerging in December’s crypto outlook, which will likely shape the market’s direction for the rest of the year and open a new chapter towards 2026.

Spending on Web3 is at a record high, Washington is shifting its focus to robotics, and the prediction market is picking up steam – all point to potential areas of concern for investors.

Record Month for Crypto Cards

Payments using crypto cards surged quietly in November, marking the strongest confirmation so far that Web3 neobanks are really starting to become a real consumer trend.

Read also: 3 Altcoins that Crypto Whale Accumulated to Millions Ahead of Christmas and New Year 2026!

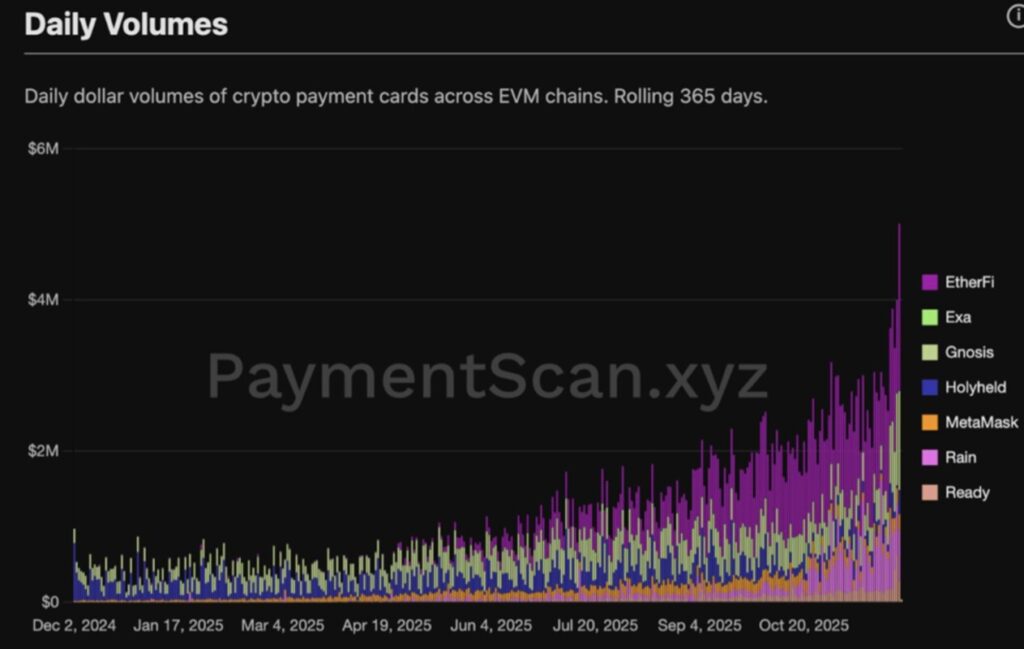

According to independent researcher Stacy Muur, crypto card transaction volume reached $406 million in November-the highest figure ever recorded. The Rain platform led the way with $240 million, followed by RedotPay at $91 million and ether.fi Cash at $36 million.

Some of the players that recorded significant growth include Rain (+22%), Ready (formerly known as Argent) (+58%), and Ether.fi (+9%). Meanwhile, MetaMask saw a 30% decline, indicating a shift in user preference towards newer card products and a focus on real-world usability.

Data dashboard platform Paymentscan confirmed this trend by reporting an all-time high daily volume of $5 million for crypto card transactions, accompanied by increased user activity.

This surge reinforces the narrative that Web3 neobanks are gaining ground and growing rapidly.

This is in line with a recent report from BeInCrypto, which shows that small-cap neobank tokens such as AVICI, CYPR, and MACHINES are starting to attract analysts’ attention due to their combination of features-the ability to be used for real shopping, self-custody, and yield-generating crypto accounts.

These early-stage altcoins are likely still undervalued when compared to their growing use across sectors.

Robotics x Crypto: Washington Turns on the Trigger

The second rapidly evolving narrative this week comes as the Trump administration shifts its technology focus from artificial intelligence to robotics.

According to a Politico report, Commerce Secretary Howard Lutnick expressed full support for expanding the US robotics sector, after a high-level meeting with CEOs of robotics companies.

Market participants immediately picked up on this signal. HK crypto analyst revealed that they are starting to form new positions on robotics-related tokens. He highlighted PEAQ, and mentioned that many such assets are now attractive for dollar-cost averaging (DCA) strategies.

“Starting to get into Robotics x Crypto positions… Many have gone down since the late October spike… Might be time for DCA… Add PEAQ,” HK wrote in a post.

Read also: Is Meme Coin Ready to Explode in December? Here are 3 Signs

If robotics truly becomes a policy priority in 2025, blockchain projects related to automation, machine-to-machine coordination, and machine identity could potentially get a new spotlight.

This narrative mirrors the AI token boom in 2023-2024, but with a more industry-oriented and hardware-based approach.

Market Prediction: Volume War Begins

December’s most noticeable breakthrough may have come from the prediction market. The latest report from BeInCrypto shows that Opinion.Trade recorded a weekly volume of $1.5 billion, averaging $132.5 million per day. With this achievement, the platform briefly surpassed its competitors-Kalshi and Polymarket-with a market share of 40.4%.

There are two main factors driving this surge:

- AI-based prediction model

- Low-fee infrastructure on BNB Chain, strengthened by the integration of Polymarket in October and the launch of Opinion Labs mainnet

At the same time, CZ jumped back into the sector by launching a new prediction platform powered by YZiLabs on BNB Chain. Shortly after, Trust Wallet made its move by integrating prediction tools for its 220 million users through partnerships with Kalshi, Polymarket and Myriad.

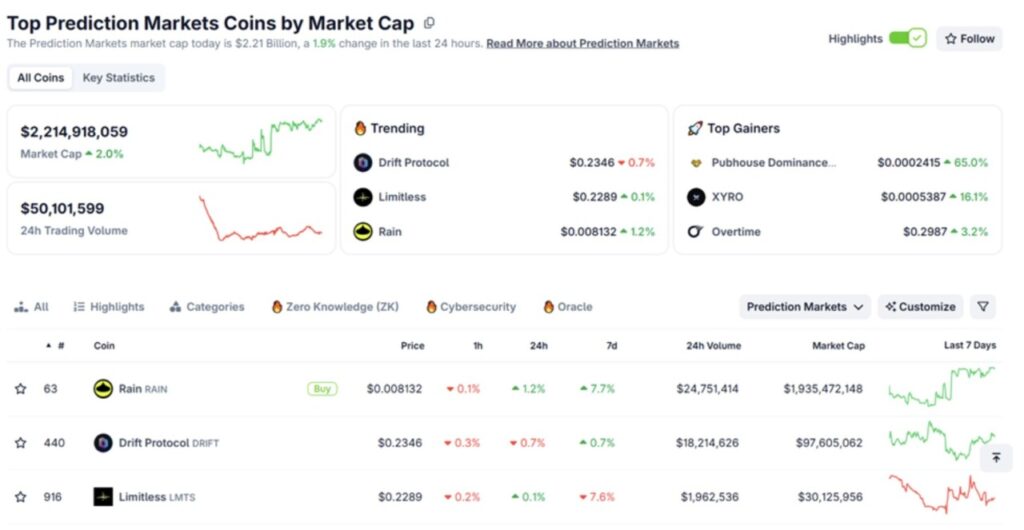

According to data from CoinGecko, the prediction market category now has a market capitalization of $2.23 billion, with daily trading volumes reaching $49.2 million. Up-and-coming assets include Limitless, Drift Protocol , and Rain, among others.

Many projects within the sector are still largely unknown, creating a discovery ecosystem similar to the initial DeFi cycle in 2021.

With crypto cards setting records, Washington’s renewed focus on robotics opening up fresh narratives, and prediction markets heating up with surging volumes, December looks to be an important turning point.

Investors are now setting their sights on the first quarter of 2026, looking forward to regulatory updates, new card integrations, and a list of major projects in the predictive market-these three narratives have the potential to drive early-year momentum in the crypto market.

FAQ

What are the three big narratives emerging in the crypto world in December 2025?

The three big narratives that emerged were the increasing use of crypto cards, the integration of crypto with robotics under the Trump administration, and the surge in volume in the prediction market.

How will crypto card usage change by November 2025?

In November 2025, crypto card usage saw a significant increase, indicating wider adoption among consumers and integration in everyday payment habits.

What will be the impact of the Trump administration’s new focus on robotics and crypto?

This new focus sparks innovation and collaboration between robotics developers and crypto platforms, which is expected to improve the automation and operational efficiency and security of robotic systems.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Crypto Narratives December 2025: Web3, Neobanking, BNB. Accessed on December 5, 2025