Bitcoin is Poised for a Surge: Latest Analysis Reveals December’s Upside Potential!

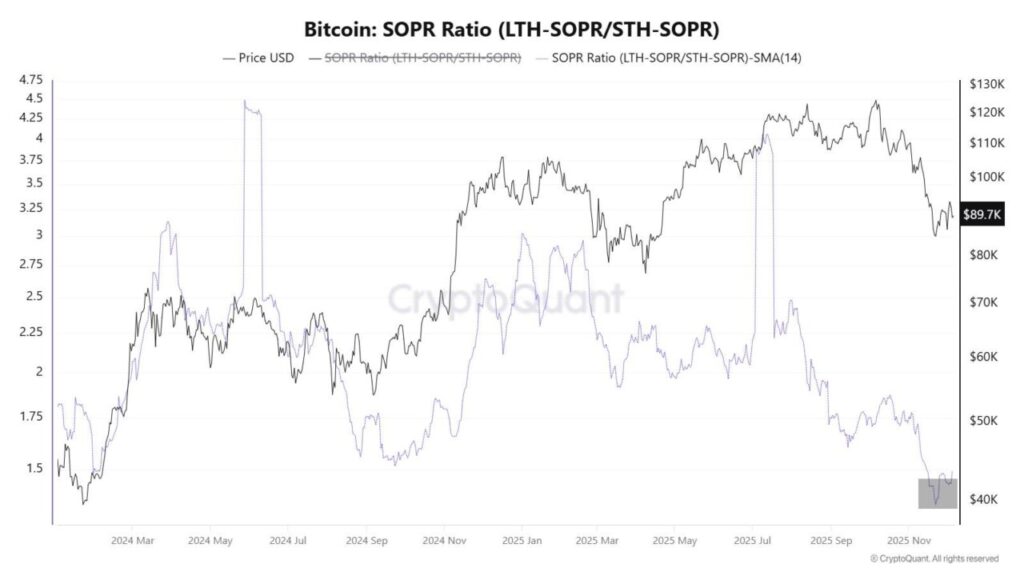

Jakarta, Pintu News – In the weekend just gone, Bitcoin experienced mounting selling pressure, with prices struggling below the psychological $90,000 level. However, the latest on-chain data suggests that the cryptocurrency may be gearing up for another healthy run-up. This analysis is based on the decline in the Spent Output Profit Ratio (SOPR), which reached its lowest point since early 2024.

SOPR Shows Recovery Potential

According to a December 6 post by CryptoOnchain on the X platform, there are indications that Bitcoin (BTC) may have hit a local bottom. The SOPR, which measures the ratio of profit to spent output, has dropped to 1.35, the lowest value since early 2024. This suggests that many long-term investors have started to stop selling their assets.

When SOPR is more than 1, it signifies that investors are selling at a profit. Conversely, values below 1 indicate that they are selling at a loss. This decrease in SOPR signals that the profit-taking phase by long-term holders may have reached a saturation point, which could be a positive signal for Bitcoin (BTC) prices going forward.

Also Read: 5 Important Facts from Bitcoin’s (BTC) Latest Prediction: US$125,000 Target?

Current Market Dynamics

At the time of writing, Bitcoin (BTC) price is hovering around $89,500, with no significant change in the last 24 hours. Data from CoinGecko shows that Bitcoin (BTC) is down almost 2% in the last seven days. Nonetheless, the drop in SOPR could be an indicator that the selling pressure is starting to ease.

Further analysis suggests that fatigue among the bears, or sellers, is increasing, which could trigger a price rebound. History has shown that SOPR declines are often followed by price recoveries, giving hope to investors looking for potential entry points.

Future Prospects of Bitcoin

CryptoOnchain suggests that the current price rebound could be the basis for the next healthy upside rally for Bitcoin (BTC). If the selling pressure continues to ease and the SOPR remains stable or increases, this could be the start of a new bullish phase.

From a historical perspective, whenever SOPR hits a similar low, this is often followed by a period of significant price increases. Investors and market watchers may want to pay attention to this indicator and other market dynamics to make informed investment decisions.

Conclusion

With SOPR hitting a new low and selling pressure easing, the Bitcoin (BTC) market may be gearing up for a recovery phase. Although there is still uncertainty, the current on-chain data gives some reason for optimism among investors and crypto enthusiasts.

Also Read: 10 Ways to Learn Crypto from Zero: Basic Guide to Start Investing Safely

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

Q1: What is Spent Output Profit Ratio (SOPR)?

A1: Spent Output Profit Ratio (SOPR) is an on-chain metric that measures the profit ratio of the output spent by Bitcoin (BTC) holders, indicating whether they are selling at a profit or loss.

Q2: Why is a low SOPR value important for Bitcoin price?

A2: A low SOPR value indicates that many investors are selling at a loss, which often signals a market bottom and the potential for a price rebound.

Q3: What is the current price of Bitcoin?

A3: Currently, the price of Bitcoin (BTC) hovers around $89,500, showing stability in the last 24 hours but down almost 2% in the last seven days.

Q4: What can be expected from the Bitcoin market in the near future?

A4: If selling pressure diminishes and SOPR stabilizes or increases, the Bitcoin (BTC) market may experience a bullish phase, signaling a good time for investors to consider their positions.

Q5: How should investors interpret the changes in the SOPR?

A5: Investors should look at SOPR as one indicator to judge when to sell or buy. A low SOPR could signal a good time to buy if the market is expected to recover.

Reference

- NewsBTC. Bitcoin Market Profitability Hits Complete Reset. Accessed on December 8, 2025