Bitcoin Outlook 2026: Will it Reach $150,000?

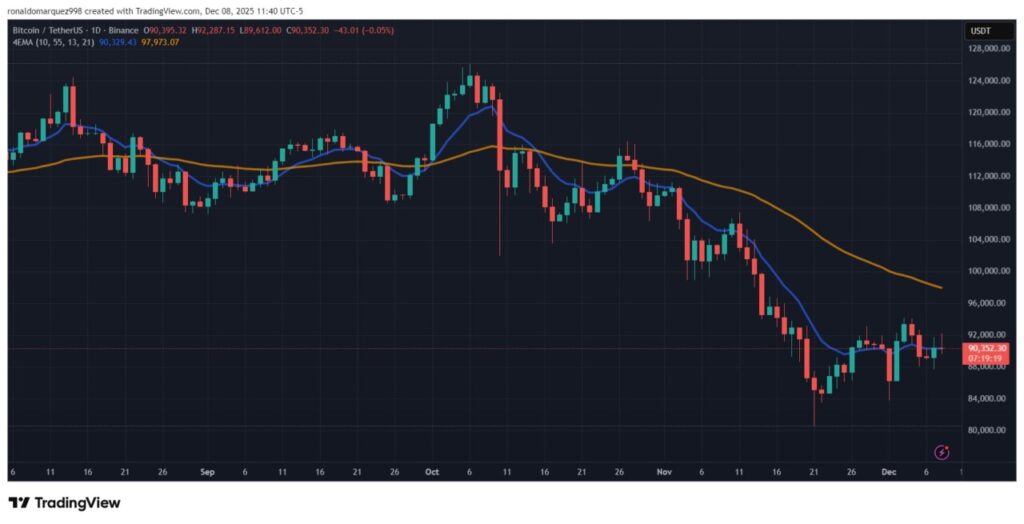

Jakarta, Pintu News – Throughout 2025, Bitcoin experienced significant price fluctuations, reaching new record highs before experiencing a sharp correction of up to 30%. This has sparked debate among the crypto community about the future direction of Bitcoin.

While some analysts fear a potential bear market in 2026, Shanaka Anslem, a market expert, provides a different perspective via social media platform X (formerly Twitter).

Signs of Cycle Change

Anslem highlights key evidence in his analysis. For the first time in history, Bitcoin broke a record high before the Halving event in April this year. According to him, this is not a bullish signal, but rather an indication that the cycle has reversed. This suggests that 2025 may have been a true bear market, albeit masked by nominal highs.

Also Read: Sneak Peek at 3 Crypto Events This Week that Could Affect Prices!

Characteristics of a Bear Market in 2025

Bitcoin’s dominance reached a multi-year peak while altcoins continued to experience quarter-on-quarter declines in value. In addition, there was a $3.5 billion outflow of funds from exchange-traded funds (ETFs) in just one month. The year was also marked by a significant 29% drop from its October peak, with sentiment index readings showing extreme fear.

Bitcoin’s Big Rise Predicted in 2026

Anslem’s “cyclical inversion” theory implies that if a bear market has occurred, the next phase may be a very high peak. His predictions suggest that Bitcoin’s price could jump between $150,000 and $200,000, especially as global liquidity continues to expand and direct capital to hard assets.

However, there is also a dissenting opinion from an analyst known as Mr. Wall Street, who argues that the bottom of the Bitcoin price has not yet been reached and will not be reached in the coming weeks or months.

Conclusion

While there are different views on the future of Bitcoin, one thing that is clear is that the volatility of the crypto market will continue to provide both opportunities and risks. Investors and market watchers should stay alert to the changing dynamics and prepare strategies that suit the evolving market conditions.

Also Read: Leading Investor Ditches Bitcoin in Favor of All-In on Ripple (XRP), Here’s Why!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

Q1: What is Bitcoin (BTC)?

A1: Bitcoin (BTC) is a digital currency or cryptocurrency created in 2009, which uses peer-to-peer technology to facilitate instant payments.

Q2: What is Bitcoin Halving?

A2: Bitcoin Halving is an event that occurs every four years, where the block reward for Bitcoin miners is halved, resulting in a decrease in the supply of new Bitcoin.

Q3: Why is there an outflow of funds from Bitcoin-related ETFs in 2025?

A3: The outflow of funds from Bitcoin-related ETFs in 2025 of $3.5 billion may be due to market uncertainty and the decline in Bitcoin price, which triggered investors to withdraw their funds.

Q4: What does “cycle inversion” mean in the context of Bitcoin?

A4: “Cycle inversion” in the context of Bitcoin refers to the theory that Bitcoin’s traditional market cycle has inverted, with it reaching record highs before the Halving event, which is usually considered a bullish indicator.

Q5: What is the Bitcoin price prediction for 2026?

A5: Bitcoin price predictions for 2026 show the potential for significant price increases, with estimates reaching between $150,000 and $200,000, depending on global liquidity conditions and other economic factors.

Reference

- NewsBTC. Did 2025 Mark a Bear Market for Bitcoin? Predictions Point to a $150,000 Rally in 2026. Accessed on December 10, 2025