Could These 3 Made in USA Cryptos Deliver a Holiday Surprise by Christmas 2025?

Jakarta, Pintu News – The entire Made in USA crypto coin category has been rather flat over the past week, despite a general increase in crypto market volatility. This lack of movement is highlighted in the run-up to the Christmas holidays, when dwindling liquidity often reveals projects that have quietly begun to show pressure.

Some US-based tokens are now at a crucial technical juncture, where small movements can determine the direction of the short-term trend.

Here is a review of three Made in USA coins worth monitoring before Christmas 2025, with a focus on improving price structures, increasing downside risks, and movement patterns that could change drastically in either direction, based on BeInCrypto’s report.

Cardano (ADA)

Cardano is one of the Made in USA coins that traders should keep an eye on ahead of Christmas 2025. On December 14, its price fell by about 3.5%, extending the monthly loss to more than 27%.

Read also: Spot XRP ETF Raises Nearly $1 Billion as Bitcoin and Ethereum ETFs Bleed!

The latest update called the Midnight upgrade failed to change market sentiment, and selling pressure returned as the overall crypto market weakened.

On the daily chart, Cardano has broken out of a downtrend continuation structure – a bearish pole-and-flag pattern. The previous consolidation ended in a decline, confirming that sellers still dominate.

The medium-term downside projection remains active as well, with a potential drop of almost 39% from the previous breakdown zone.

The important level is currently at $0.370. This area was previously a strong support zone in recent weeks, but the price is starting to approach it. If the daily price closes below $0.370, the downside risk will increase and $0.259 could be the next target, as per the full downside projection of the technical pattern.

For Cardano’s price to stabilize, the selling pressure must subside around $0.370. To invalidate the bearish scenario and restore upside momentum, Cardano needs to break the $0.489 level again, then $0.517. These two levels are important Fibonacci resistances that signal a potential return of buying interest.

Until that happens, Cardano remains in a vulnerable state ahead of Christmas, especially if the weakness in the Made in USA coin category continues.

Stellar (XLM)

Stellar is at a crucial point among Made in USA coins ahead of Christmas, as price movements begin to test whether long-term adoption is still capable of sustaining value in the short-term.

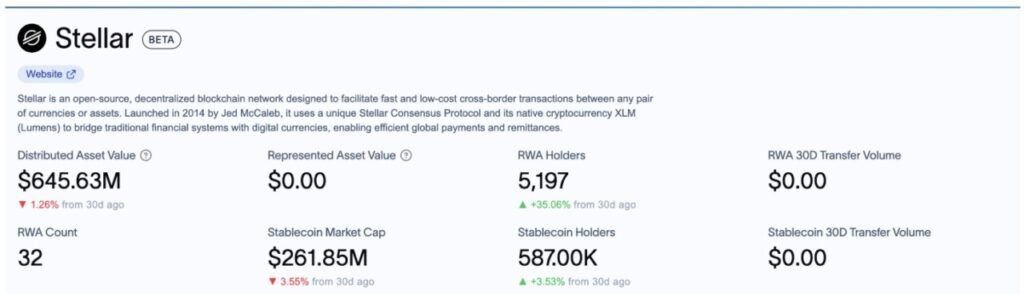

XLM dropped about 2.5% on December 14, 2025, extending its monthly decline to close to 18%. This caution is even more apparent when looking at the latest adoption data.

Although the number ofreal-world asset( RWA) holders on the Stellar network increased sharply in the past month, the total value of assets circulating on the network actually decreased.

The price chart supports the signal. Between December 3 and 9, Stellar formed a hidden bearish divergence – the price printed lower highs, while the RSI indicator printed higher highs. The RSI (Relative Strength Index) is a momentum indicator, and since the divergence appeared, the XLM price has continued to weaken, confirming that the general downtrend is still ongoing.

The current key level is $0.231. This zone has been short-term support over the past few dips. Holding above this level indicates selling pressure is starting to ease, especially ahead of the typically quiet Christmas trading period.

However, if XLM closes daily below $0.231, then the next target is $0.216 – opening up the potential for further downside if market weakness continues.

To invalidate this bearish structure, Stellar needs to break the $0.262 level again. This level has been the upper limit of every attempted rally since mid-November.

Read also: HBAR Has Only One Bullish Opportunity – Can HBAR Avoid a 13% Drop?

It would take a rise of around 10% to reach that level, which would be a signal that buyers are starting to be willing to sustain higher prices. Hope in that direction still exists, as some analysts on the X platform indicate that XLM is giving buy signals.

But until there is further confirmation, Stellar remains one of the Made in USA coins that is still trending down, making the current support test particularly important in the run-up to Christmas.

Litecoin (LTC)

Litecoin was one of the Made in USA coins that showed relative stability in the run-up to Christmas. Over the past week, the price of LTC rose by around 1.5%, making it an exception among Made in USA coins.

However, on a monthly basis, LTC still recorded a decline of around 19%. This mixed performance is in line with recent fundamental developments. Reports show that institutions and large funds have quietly accumulated around 3.7 million LTC, although interest from retail investors remains low.

This accumulation hasn’t prompted a price spike in the short term, but it could explain why Litecoin has managed to avoid the sharp declines that similar projects have experienced. For US-made crypto projects, steady demand like this often means more than fleeting hype, especially towards the end of the year.

On the price chart, Litecoin is forming an inverse head-and-shoulders pattern, which is technically considered a bullish pattern. This pattern reflects the gradual weakening of selling pressure, followed by the resumption of buyers’ control. An attempted breakout occurred on December 9, but it failed to hold, so the price went back into a consolidation phase instead of confirming a trend reversal.

This structure is still valid as long as the LTC price stays above $79.63. If it drops below this level, the pattern will weaken and the potential upside will be delayed. A further drop below $74.72 will invalidate the pattern completely and return the outlook towards the downtrend.

To confirm the reversal, Litecoin needs to register a clean daily close above the neckline around $87.08. If successful, the pattern reactivates and paves the way towards the initial target at $97.95, with the full target at $101.69.

Until that happens, Litecoin remains a US-made crypto project at a critical decision point – where steady institutional interest still contrasts with cautious price action ahead of Christmas 2025.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bullish Made in USA Coins to Watch Before Christmas 2025. Accessed on December 19, 2025