Bitcoin, Ether, and XRP Decline Increases Towards the End of 2026, Why?

Jakarta, Pintu News – Crypto markets saw weakness alongside global risk assets as investors scaled back investments ahead of key economic data from the US, extending a December slide characterized by thinning liquidity and increased caution across markets.

Global Markets Sluggish, Cryptos Take a Tumble

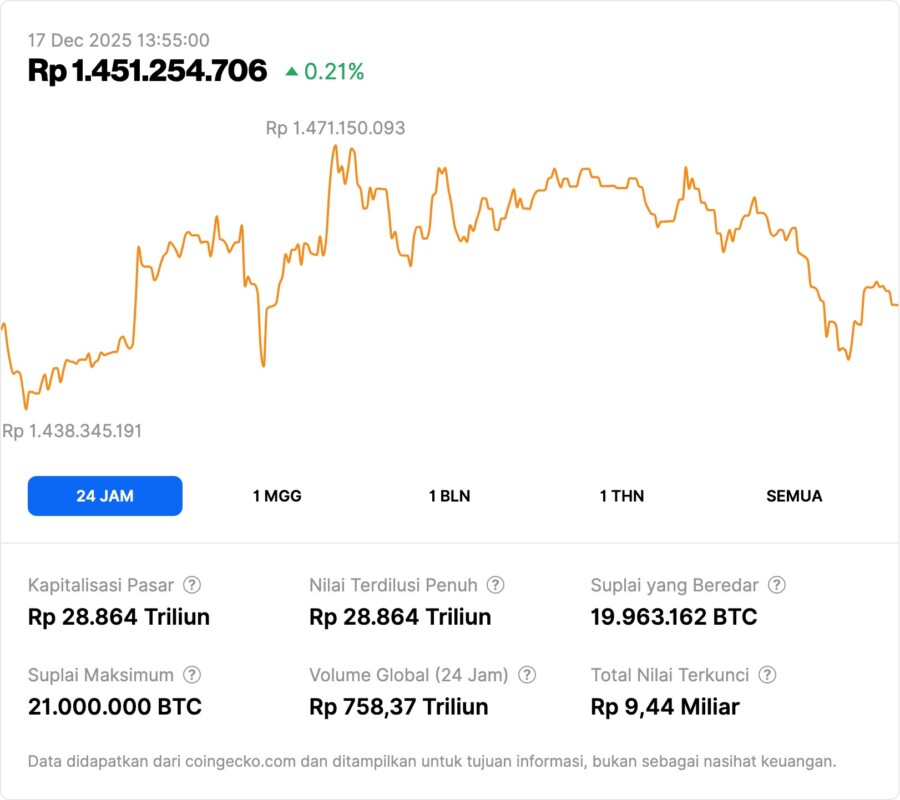

Bitcoin fell close to $85,800 in Asian trading, down more than 4% over the past week. The selling pressure spread to other major tokens. Ethereum dropped to around $2,930, while Solana , Ripple , and Dogecoin all recorded weekly losses of more than 5%, indicating a broad drawdown rather than token-specific pressure.

Concerns in global markets were reflected in a sharp decline in Asian equities, with the MSCI Asia Pacific Index down 1.3%. Meanwhile, US equity futures were lower ahead of the November jobs report scheduled for Tuesday, which is expected to show a labor market that is starting to cool.

Also Read: 7 Reasons Ripple (XRP) Prediction to Break $100 is the Global Crypto Talk

Technical Analysis and Market Predictions

The crypto market capitalization fell to around $3.06 trillion, down 0.2% in 24 hours and more than 2% in a week. Although the market has repeatedly defended the $3 trillion level over the past 10 days, analysts say the shift from an uptrend to horizontal support is a sign of weakening momentum, not renewed strength.

According to Alex Kuptsikevich, principal market analyst at FxPro, the transition from uptrend to horizontal support is not a positive signal for buyers. “The selling pressure since late November has damaged the short-term structure, and the market is now in a consolidation phase with downside risks still in play,” he said in an email.

Market Outlook and Sentiment Indicators

Sentiment indicators show increased caution. The crypto fear and greed index dropped to 16, the lowest level in almost three weeks, reflecting extreme caution.

The long stay in fear territory with no obvious catalyst echoes the period of cyclical weakness seen towards the end of the previous market cycle. Prediction markets also reflect a more cautious outlook. On Kalshi, the majority of users expect Bitcoin (BTC) to finish the year below $100,000, with the probability of a move above that level at just 23%.

Market Consolidation and Correction

December is typically a period of lower liquidity, increasing the risk of sharper price movements as traders adjust exposure towards the end of the year.

FxPro analysts state that a return to the $81,000 area now represents the base scenario, although a period of range-bound consolidation is still possible if selling pressure eases. However, broader indicators suggest that the market is entering a deeper corrective phase. Binance Research estimates that the total crypto market capitalization has fallen by around 15% over the past 30 days.

Also Read: Bitcoin Stuck Below $94,000: When Will Price Recovery Happen?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

Q1: How much has the Bitcoin price fallen in the last week?

A1: The price of Bitcoin (BTC) fell by more than 4% in the last week.

Q2: What caused the recent downturn in the crypto market?

A2: The decline was due to investor withdrawal ahead of important economic data from the US and increased caution in global markets.

Q3: What is the current crypto market capitalization?

A3: The current crypto market capitalization is around $3.06 trillion.

Q4: What are the predictions for Bitcoin price at the end of the year?

A4: The majority of users in the Kalshi prediction market expect Bitcoin (BTC) to finish the year below $100,000.

Q5: What is the percentage probability of Bitcoin exceeding $100,000 according to the prediction market?

A5: The probability of Bitcoin (BTC) exceeding $100,000 currently stands at 23% according to data from Kalshi.

Reference

- Coindesk. Bitcoin, Ether and XRP Extend Losses as Year-End Caution Builds. Accessed on December 17, 2025