Gold and Silver Return to Dominate the Market Amid Global Uncertainty, Here’s the Data!

Jakarta, Pintu News – At the start of an uncertain year, gold and silver have once again shown their dominance as the two assets with the largest market capitalization. The two precious metals, known as safe “stores of value”, managed to outperform other assets including Bitcoin , which came in eighth place. The rise was driven by global concerns that prompted investors to seek safety in traditional investments.

Gold Stands Firm at the Top of Market Capitalization, Silver and Nvidia Closely Compete

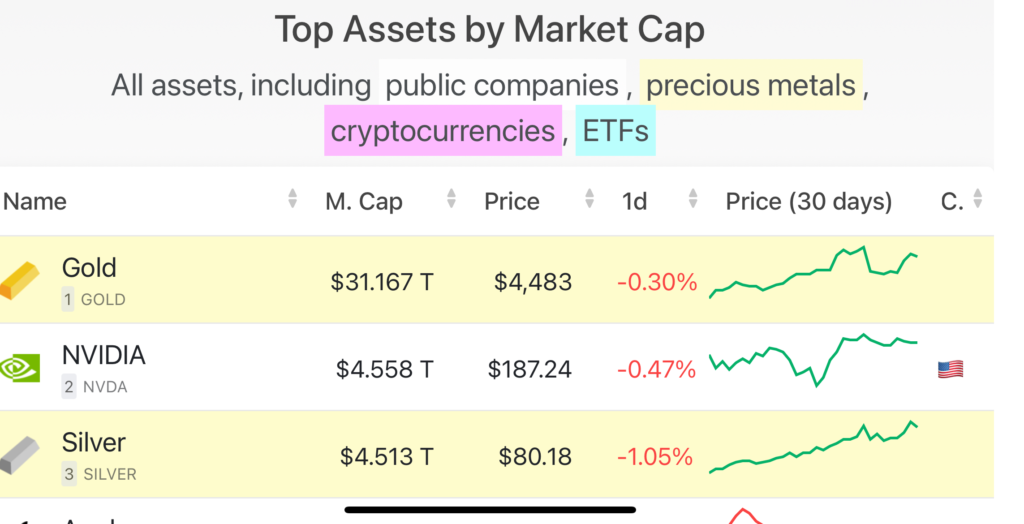

According to data from analytics platform CompaniesMarketCap, gold currently has a market capitalization of $31.1 trillion, taking the top spot. This rise marks a return of investor confidence in gold as a safe haven asset amid global economic uncertainty.

Meanwhile, silver wasn’t left out of the competition either. Silver briefly unseated Nvidia for second place, although only briefly before Nvidia took over again.

Silver and Nvidia have continued to compete fiercely in recent months. Nvidia itself is experiencing a significant increase in demand due to the need for computing resources to support artificial intelligence. However, when markets experience uncertainty, investors tend to return to traditional assets such as silver, which has reached a new record high of around $80.

Also read: Ripple (XRP) Named Best Investment in 2026 According to CNBC

Global Conflict and Interest Rate Expectations Drive Gold and Silver Surge

Over the past year, there has been a massive migration of investors into precious metals. Global conflicts and trade disputes have prompted investors to seek safety in gold and silver. Both metals are considered effective hedges against inflation and economic instability. This rise in demand has pushed gold and silver prices to new highs, with gold touching around $4,500.

On the other hand, the expected monetary policy of the US Federal Reserve also plays a role in this trend. With new leadership, the market is anticipating significant interest rate cuts, which will generally favor rising commodity prices. Investors, thus, see gold and silver as attractive investment options in the face of these potential policy changes.

Read also: Ripple postpones IPO plans despite raising $500 million, why?

Fed easing hopes a potential catalyst for Bitcoin

Despite the increased momentum for precious metals, Bitcoin (BTC) and other crypto assets have not experienced a similar surge. However, many analysts believe that policy changes from the Federal Reserve in 2026 could be an important catalyst for the crypto space.

Owen Lau, managing director of Clear Street, in a recent interview, stated that a lower interest rate policy would trigger investor interest, both retail and institutional, in riskier assets such as Bitcoin (BTC).

Lau emphasized that looser monetary policy could drive more funds into digital assets, often referred to as digital gold. This suggests significant growth potential for crypto markets in the future, as investor preferences shift from conventional to digital assets.

Conclusion

In conclusion, the significant rise in the market capitalization of gold and silver demonstrates investors’ renewed confidence in precious metals as safe assets. While technology and digital assets such as Bitcoin (BTC) continue to evolve, in volatile market conditions, gold and silver are still considered the most stable and reliable investment options.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Cointelegraph. Stores of Value: Gold and Silver Top Global Asset Charts. Accessed on January 8, 2026

- Featured Image: Generated by Ai