5 Conditions for the Crypto Market to Hit an All-Time High in 2026, Here’s what needs to happen!

Jakarta, Pintu News – The crypto industry has shown positive momentum since early 2026, but according to analysts from Bitwise Asset Management, there are still three major checkpoints that must be passed for the market to reach a new all-time high again.

The demand for an increase in the total market capitalization and price rallies of assets such as Bitcoin and Ethereum will largely depend on macro conditions, regulation, and the state of global capital markets. This analysis serves as a reminder to investors and market participants that growth potential is still conditioned by a number of external factors.

1. Market Stability After a Major Liquidation Event

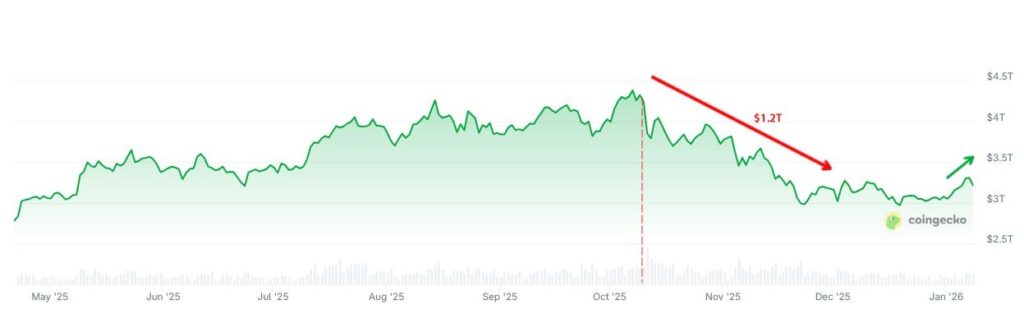

The first condition according to Bitwise is that the market must show clear stability after a major event that depressed the market in late 2025. One of the most impactful events was the crash on October 10, 2025 which led to the liquidation of over US$19 billion worth of downside contracts in a single day, creating concerns that hedge funds or large market makers would be forced out of the market.

According to Bitwise, these concerns have now largely subsided as no major entities had to halt operations after the event. That the market was able to absorb the pressure of a major liquidation without further disruption is an indication that the crypto sector is starting to mature and is capable of dealing with extreme volatility.

Also Read: Ethereum (ETH) Keeps Going, Is 2026 the Right Time to Buy?

2. Crypto Market Structure Bill Passage in the US

The second checkpoint is the passage of important legislation in the United States known as the CLARITY Act, which is currently running in Congress and is targeted for passage in the Senate in mid-January 2026. Bitwise believes that the success of this legislation will provide a stronger legal foundation for the cryptocurrency industry in the US.

The law is expected to encapsulate the core principles of the crypto industry, increasing legal certainty for large investors, including institutional ones. Without a clear legal umbrella, opportunities for long-term growth could be hampered due to the risk of sudden policy changes.

3. Stable Public Equity Market Conditions

The next requirement according to Bitwise is the importance of a relatively stable equity market. While cryptocurrencies are not highly correlated with the stock market, major upheavals in equities – such as a drop in global indices like the S&P 500 by more than 20% – can drag down all risky assets, including cryptocurrencies.

A strong stock market or at least no major correction helps maintain risk-on sentiment among investors, which is necessary to support the digital asset rally. That way, the momentum already seen in early 2026 can continue without major macro disruptions.

4. Positive Regulatory Momentum and Institutional Adoption

In addition to legislation in the US, friendlier regulatory momentum in several global jurisdictions could be another important factor driving crypto asset prices up. Bitwise points out that the increasing adoption of traditional financial institutions as well as the tangible use of blockchain technology strengthens the long-term growth prospects of the market.

For example, the increasing number of crypto-affiliated investment products or ETFs based on Bitcoin and Ethereum also reflects greater institutional interest, which is often followed by significant capital flows. These capital flows become part of the momentum that can help the market break through previous price limits.

5. Controlled Macro Sentiment & Risks

The final checkpoint that also needs to be met is macro market sentiment that remains conducive. This includes manageable global inflationary pressures, non-volatile central bank strategies, and positive global economic expectations. While Bitwise does not explicitly emphasize interest rate changes, some analysts feel that a combination ofdovish fiscal and monetary policies could support investments in riskier assets such as crypto.

The strong sentiment will help attract investor capital back into the cryptocurrency market, including to major assets such as BTC and ETH, giving them a chance to reach higher price levels in the rest of 2026.

Conclusion

Bitwise’s analysis shows that although the crypto market started 2026 with positive momentum, there are still three major checkpoints that need to be passed before the chance of reaching a new all-time high can become a reality.

Market stability after major liquidations, passage of legislation, and general capital market conditions are key factors that determine market direction. This confirms that to reach new price peaks, crypto needs not only internal strength but also support from external macro and regulatory conditions.

Also Read: New Strategy in the Crypto World: 680,000 BTC Acquisition by Strategy!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

– Martin Young/Cointelegraph. 3 ‘checkpoints’ stand between a crypto all-time high in 2026: Bitwise. Accessed January 15, 2026.