Is Morgan Stanley Manipulating the Bitcoin Market October 2025? Analysts Find Correlation!

Jakarta, Pintu News – Morgan Stanley’s recent application to set up exchange-traded funds (ETFs) for Bitcoin and Solana , which along with MSCI’s decision to keep digital asset companies in its index, has sparked speculation among analysts. Analysts from Bull Theory suggest that this series of events may indicate large-scale market manipulation.

Bitcoin Market Manipulation?

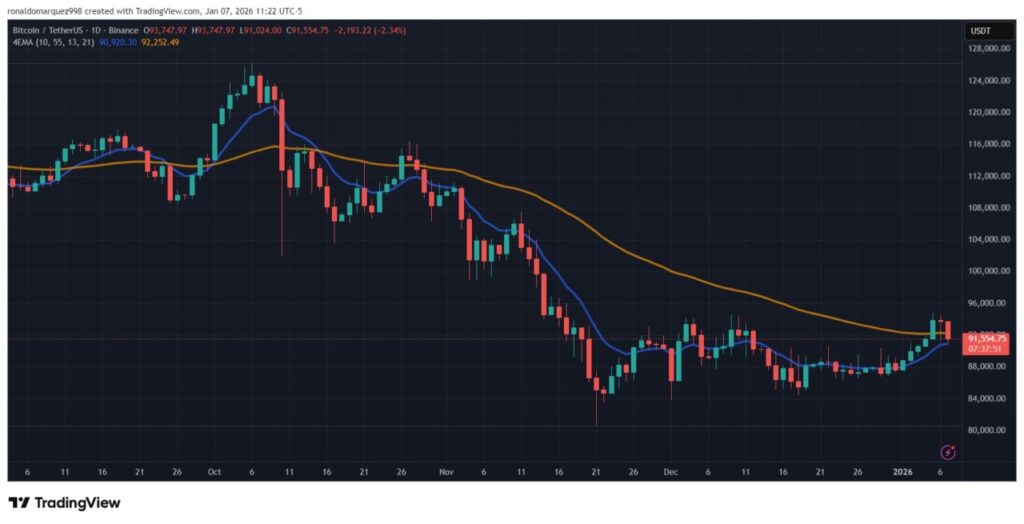

Bull Theory analysts highlighted the chronology of events involving Bitcoin (BTC), from the price crash in October to the recovery that occurred in January. They argue that this pattern resembles a planned scenario, supported by the available data.

On October 10, MSCI, formerly a division of Morgan Stanley, proposed the removal of Digital Asset Treasury Companies (DATCOs) from its global index. This sparked concern in the market and started a prolonged period of uncertainty.

Also Read: 5 Conditions for the Crypto Market to Hit an All-Time High in 2026, Here’s What Needs to Happen!

Morgan Stanley and MSCI Changes

The consultation period opened until December 31 created a three-month window of time filled with anxiety, hampering investor demand for Bitcoin (BTC). Passive investors became skeptical, index-linked funds faced potential forced sales, and as a result, prices experienced a sharp decline.

Bitcoin (BTC) itself fell by around 31%, and other cryptocurrencies took an even bigger hit, recording the worst quarter for the crypto market since 2018. However, on January 1, 2026, Bitcoin (BTC) experienced an unexpected surge, rising 8% in just five days.

Calculated Steps?

This sudden rise left many analysts perplexed, especially since the unrelenting selling suddenly stopped. Then, on January 5 and 6, Morgan Stanley announced its plans for Bitcoin (BTC), Ethereum , and Solana (SOL) ETFs.

MSCI’s decision not to proceed with the proposed removal of crypto-heavy companies from its index followed the announcement. This series of events raised suspicions about possible coordinated efforts to manipulate market conditions.

Conclusion

Analysts from Bull Theory assert that as the market returns to liquidity, the same entities that may have orchestrated the previous decline are now in a strategic position to benefit from the rebound. At the time of writing, Bitcoin (BTC) is trading at $91,550, a 2% drop from its previous two-month peak of $95,000.

Also Read: The Pattern Repeats? Ripple (XRP) is Ready to Surge Like 2017!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects

this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Did Morgan Stanley Orchestrate Bitcoin October Crash? Analysts Draw Correlations. Accessed on January 9, 2026