Is Bitcoin (BTC) on the Verge of a Surge? These 3 Key Signals Suggest It Might Be

Jakarta, Pintu News – Bitcoin has been experiencing sharp fluctuations throughout January. The cryptocurrency reached its highest level in almost four weeks earlier this week, before briefly dropping below $90,000 yesterday.

Amidst this turmoil, analysts highlighted some important signals that could indicate a possible short squeeze in the near future.

Bitcoin Derivatives Data Shows Growing Short Squeeze Risk

According to data from BeInCrypto Markets, the largest cryptocurrency recorded green candles during the first five days of January. Prices briefly spiked through $95,000 on Monday – a level last seen in early December – before reversing course.

Read also: Bitcoin Price Reaches $91,000 Today: BTC Reversal Could Be a Further Decline?

On January 8, the price of BTC dipped below $90,000 and touched a low of $89,253 on the Binance platform. At the time of writing, Bitcoin is trading at $91,078, registering a 0.157% gain in the last 24 hours.

Looking ahead, there are three main signals that indicate that market conditions may be shaping up for a short squeeze in Bitcoin price. For the record, a short squeeze occurs when the price moves up sharply againstshort positions.

Leverage magnifies this pressure, as traders experiencing forced liquidation must buy Bitcoin to cover their positions, pushing the price higher. This buying activity can quickly spread throughout the market.

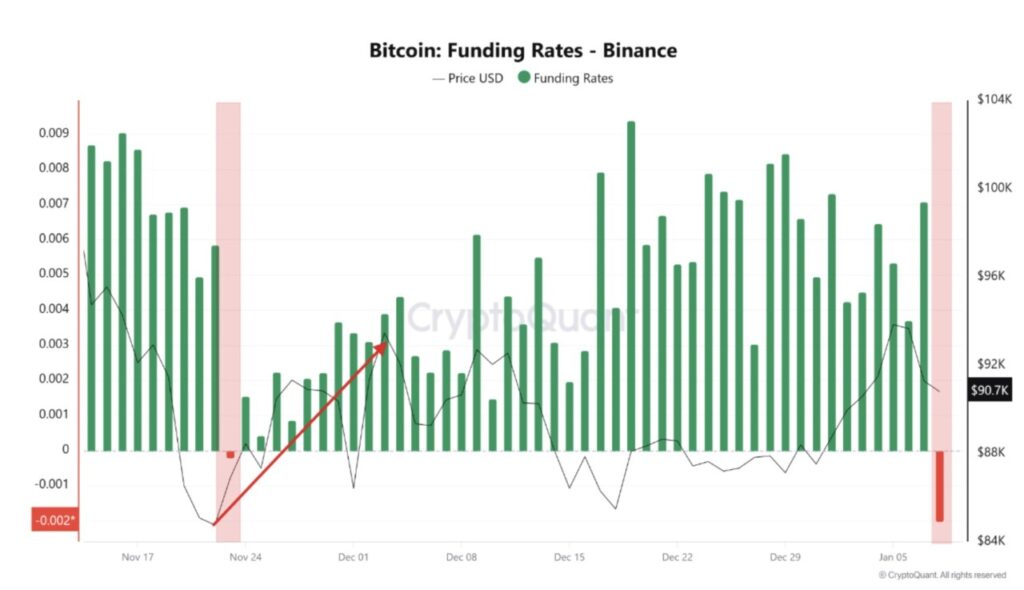

1. Negative Funding Rate Reflects Bearish Sentiment

The first signal comes from Bitcoin’s funding rate on Binance. In his latest analysis, Burak Kesmeci highlights that the funding rate has turned negative on the daily chart for the first time since November 23, 2025.

This figure shows the cost of maintaining perpetual futures positions. When the funding rate becomes negative, short positions dominate, andshort sellers have to pay a fee to long position holders to keep their positions open.

Currently, the funding rate stands at -0.002 – much lower than the -0.0002 recorded during the previous negative period in November. The previous negative change occurred before Bitcoin’s price spike from $86,000 to $93,000. This deeper negative rate in January shows that the bearish sentiment among derivatives traders is getting stronger.

“Funding is increasingly negative, while prices remain under pressure. This combination increases the likelihood of a larger short squeeze. A Bitcoin price spike in the near future is not surprising,” Kesmeci wrote.

2. Open Interest Rises as Bitcoin Price Falls

The second signal came from the observation of another analyst who noted that Bitcoin’s price was falling, while open interest was increasing. This combination was interpreted as a strong indication of a potential short squeeze.

Read also: Morgan Stanley Ready to Launch Crypto Wallet, Along with Plans for Bitcoin, Ethereum, & Solana ETFs!

“This is a classic sign of an impending short squeeze!” the analyst wrote.

Open interest describes the number of derivative contracts that are still open. When this number rises alongside a price drop, it usually indicates that new positions are being opened in the direction of the price movement – in this case, short positions – rather than long positions being closed.

This creates an imbalance of risk. When too many traders are short, the market becomes vulnerable to rapid liquidation if prices begin to recover, which can trigger sudden price spikes.

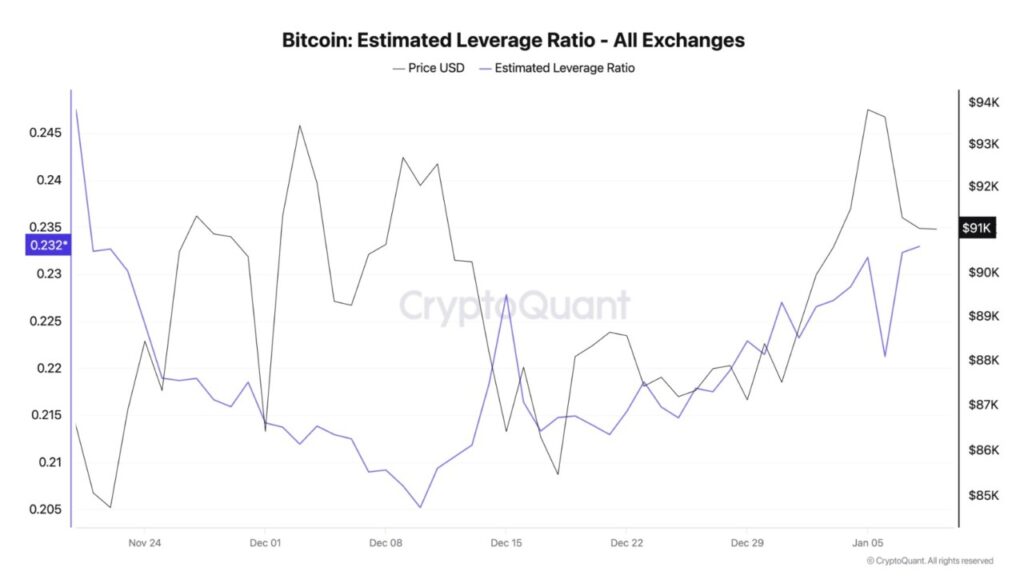

3. High Leverage Increases Liquidation Risk

Finally, Bitcoin’sEstimated Leverage Ratio has reached its highest point in the past month, according to data from CryptoQuant.

This indicator measures how much borrowed capital is used in the trading positions of market participants. High leverage increases the potential for both profits and losses, so even small price movements can trigger mass liquidations.

For example, a trader using 10x leverage could be liquidated if the Bitcoin price moves just 10% in the wrong direction. The current ratio shows that many traders in the market have increased their risk exposure, betting on a continuation of the downward trend in prices. However, high leverage is very risky if the Bitcoin price suddenly turns up.

Conclusion: Short Squeeze Risk Increases, but Not Certain to Happen Yet

With these three indicators – a negative funding rate, open interest that rises as the price falls, and high leverage – the Bitcoin market is increasingly vulnerable to sharp price spikes in the event of a reversal that triggers mass liquidation of overly risky short positions.

However, whether a short squeeze will actually occur still depends on broader external factors, such as macroeconomic developments, demand in the spot market, and overall risk sentiment.

Without a strong bullish trigger, bearish positions can remain dominant and slow down or weaken the potential short squeeze.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Short Squeeze Signals January. Accessed on January 9, 2026