7 Facts on Crypto Super Cycle Prediction by CZ that Could Change the Cryptocurrency Market

Jakarta, Pintu News – Binance founder Changpeng “CZ” Zhao has suggested that the cryptocurrency market may be entering a phase of the crypto super cycle, a period of long-term structural growth that differs from typical market cycles. This prediction comes after a significant shift in regulatory approaches in the United States and an increase in institutional capital participation, which together are driving new discussions about the direction of the digital asset market.

1. What is Crypto Super Cycle According to CZ

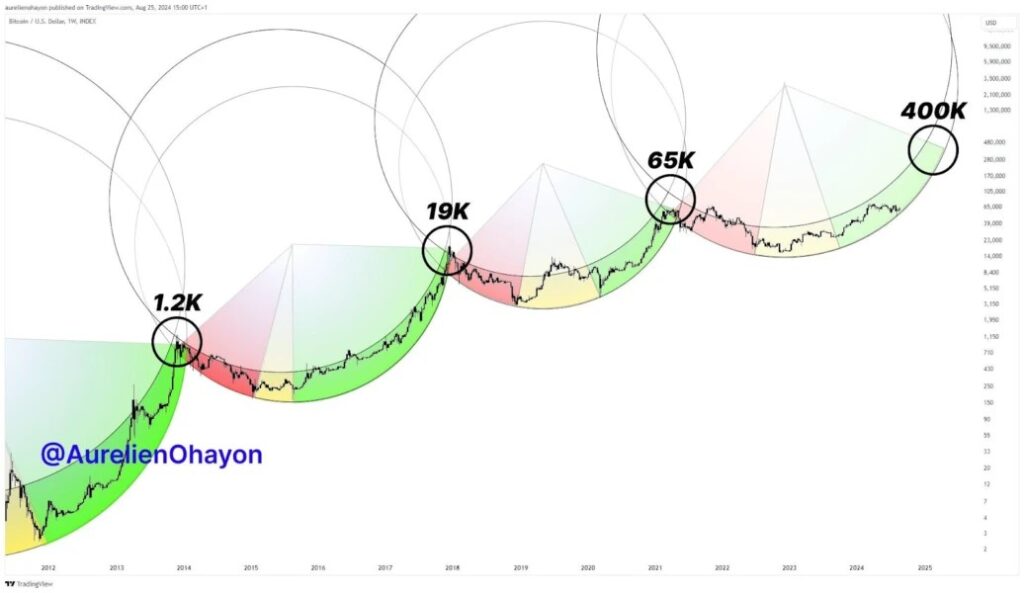

CZ describes the crypto super cycle as a phase where market adoption and investor participation reach a much stronger momentum than a standard cycle. This definition differs from the traditional bull run in that it is not just about a temporary price increase, but about a fundamental shift in the global demand and acceptance of digital assets. The statement suggests that this period of growth could be longer and broader than the cycles seen over the past few years.

The idea of this super cycle is gaining attention because it focuses not only on Bitcoin , but also on how institutional capital flows can expand the crypto market as a whole, including other altcoins and blockchain infrastructure.

Also Read: XRP 2026 Price Prediction: Is This Investment Still Promising?

2. The Role of US Regulation in Driving the Super Cycle

CZ attributes his prediction of a super cycle to a sharp change in regulatory policy in the United States that began to facilitate the cryptocurrency industry. One notable moment was the passage of the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act, which provided the first legal framework for stablecoins at the federal level.

In addition, legislative advancements such as the potential CLARITY Act are seen to simplify the regulation of digital assets under the SEC and CFTC collaboratively, thus providing greater legal clarity for market participants.

3. Effect of Regulatory Clarity on Institutional Demand

These regulatory clarifications have helped open up institutional capital flows into the cryptocurrency market, particularly through products like the Bitcoin spot ETF which has attracted more than $56 billion of new capital since its launch in 2024. This shows great investor interest in participating in the crypto market as a new asset class.

Such capital inflows are considered to be one of the key drivers behind a potential super cycle, with institutions viewing digital assets not just as speculation, but as part of a long-term investment strategy.

4. Caution in CZ Statement

While optimistic, CZ also emphasizes that his predictions are not absolute guarantees and that the market could evolve gradually. Statements like “I could be wrong, but a super cycle is coming” show caution and recognize the inherent uncertainty in the digital asset market.

This gives context that the shift to a super cycle takes time and does not mean instant price increases in a matter of weeks.

5. Bitcoin’s Role in the Super Cycle

In this prediction, Bitcoin remains at the center of the narrative as the dominant asset likely to lead the growth phase of the super cycle. The involvement of large financial institutions such as banks accumulating Bitcoin is considered part of a new pattern of demand that is more stable and long-term in impact.

This positive sentiment also reflects Bitcoin’s potential role as a store of value and a buffer against global economic uncertainty, contributing to the outlook for the super cycle.

6. Implications for the Altcoin Market

CZ’s statement does not only impact Bitcoin, but also has an effect on the altcoin market where increased market confidence and institutional capital can trigger the growth of other digital assets such as BNB, Ethereum , or new projects with strong fundamentals.

Broader institutional capital participation is often associated with portfolio diversification that includes altcoins as an additional component of a mature crypto market.

7. Controversies and Challenges of Super Cycle Predictions

CZ’ s super cycle prediction was accompanied by a discussion of the challenges that remain, particularly in terms of regulation, retail adoption, and global market dynamics. Factors such as volatility, monetary policy, and investor sentiment remain variables that affect the likelihood of the super cycle being realized.

This discussion confirms that while super cycle predictions attract attention, they are not independent of the complex external risks and variables in the cryptocurrency ecosystem.

Also Read: Raydium Price Prediction 2026: Significant Upside Potential in the Solana Ecosystem

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeinCrypto. Binance Founder ‘CZ’ Sees Crypto ‘Super Cycle’ Fueled by Historic Shift in US Policy. Accessed January 12, 2026.