Bitcoin (BTC) Shows Signs of Resurgence: What’s the Impact?

Jakarta, Pintu News – Recent observations on Bitcoin on-chain data show a significant change in the Bitcoin Inter-exchange Flow Pulse (IFP), indicating an increase in token flows to derivatives platforms.

IFP Bitcoin Recovery: Not yet in Bull Market Zone

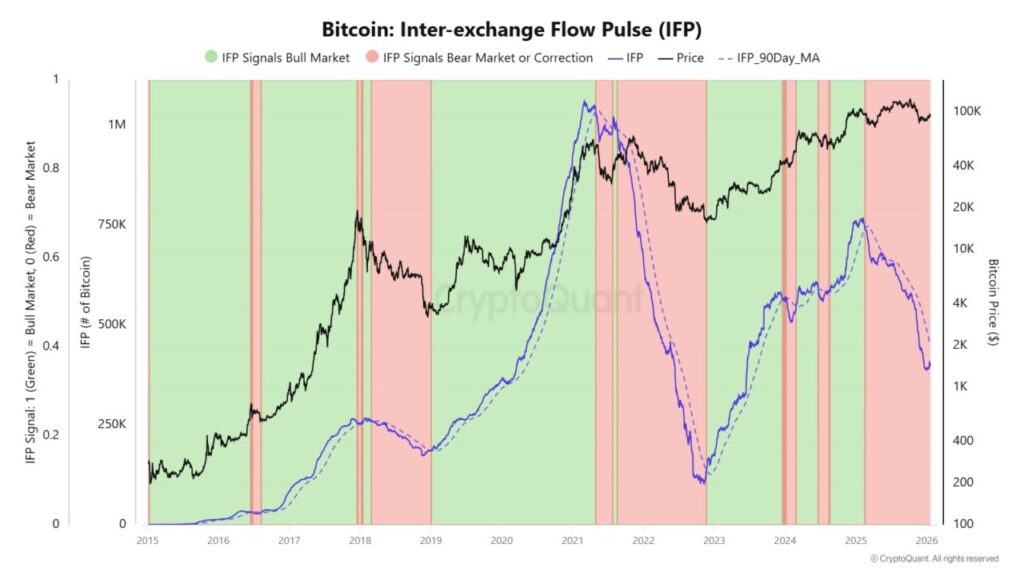

An analyst at CryptoQuant Quicktake pointed out that the recent Bitcoin IFP seems to have bottomed out. IFP is an indicator that measures the amount of Bitcoin (BTC) flowing between spot and derivatives exchanges. When the value of this metric increases, it signals that investors are making more transactions from spot platforms to derivatives platforms, indicating increased speculative interest in the market.

However, the decline in this indicator signals that traders may be reducing risk as they send lower amounts of tokens to the derivatives market. Currently, although the IFP is showing early signs of change, the indicator is still well below its 90-day moving average (MA).

Also Read: 3 Bitcoin Scenarios of 2026: Failure to Survive at $100K Could Trigger a Major Crash

Historical Analysis and Future Predictions

The presented chart shows that Bitcoin IFP peaked in the first quarter of 2025 and then reversed direction, indicating a decrease in speculative activity. After this downward trend began, the metric dropped below the 90-day MA. CryptoQuant considers a crossover like this to be a bearish signal, which signals a bear market or correction.

Although Bitcoin (BTC) subsequently reached a new high in 2025, from IFP’s perspective, the market environment remained bearish with the value of the metric continuing to decline. However, early signs of change have emerged recently, as IFP points to increased flows into derivatives exchanges as Bitcoin (BTC) prices recover.

Current Bitcoin (BTC) Price Movement

Bitcoin (BTC) has experienced a price drop in recent days, with prices falling from $95,000 to $91,200. Nonetheless, the recent increase in flows to derivatives exchanges may signal the potential for further recovery.

If the IFP manages to cross the 90-day MA, this usually leads to bullish price action for the cryptocurrency. Continued monitoring of the IFP and Bitcoin (BTC) price will provide further insight into whether speculative activity will increase enough to overcome this threshold.

Conclusion

With the Bitcoin IFP indicator showing early signs of change, market participants should pay attention to the next move. Whether this will be the start of a bullish trend or just a temporary uptick, only time will tell.

Also Read: 3 Reasons 2026 Is No Longer About Cycles, This Is What Actually Drives Crypto Prices

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin IFP Potential Turnaround: What It Means. Accessed on January 22, 2026