GameFi Starts to Rise in 2026: These 3 Crypto Lead the Rally Trend!

Jakarta, Pintu News – GameFi tokens were once considered dead after a very bad year in 2025. The sector ended the year with a decline of around 75%, which caused investor interest to almost vanish. However, early 2026 is starting to show different signs.

Usage and price data is starting to slowly increase across several gaming-focused networks. While it’s still early days, for the first time in months, these numbers suggest that GameFi may be starting to stabilize – with a select few tokens starting to move first.

GameFi is Starting to Show Signs of Life – What’s Happening?

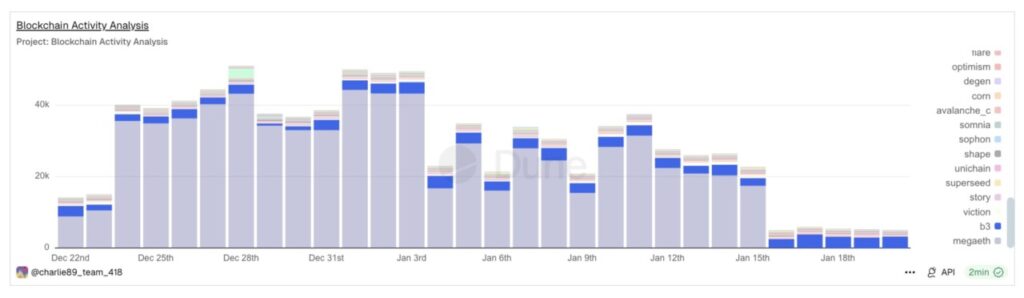

The first signal came from on-chain activity. When scrolling through early 2026 Dune Analytics dashboard data across various EVM networks, one metric stood out: average transactions per active wallet. This metric measures the depth of user activity, not just the number of wallets.

Read also: Sei Crypto News: Bhutan Ready to Run Sei Validator in Early 2026!

For the fourth consecutive day, B3 – the gaming layer built on top of Base – led all major networks in this metric, outperforming Optimism, Mantle, Flow and others. This is important because true gamer behavior is seen in repeated actions by the same user.

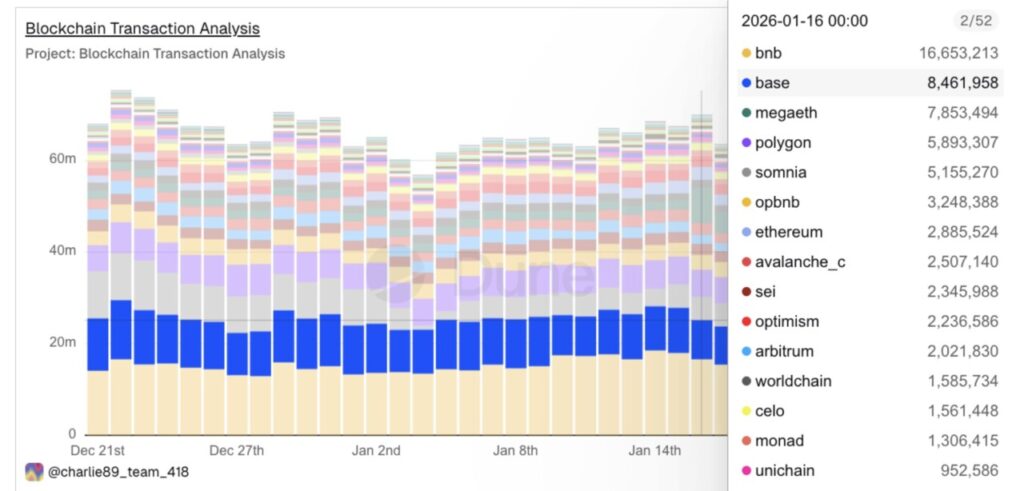

The Base network itself reinforces this signal. In addition to B3’s dominance in activity per wallet, Base also took the top spot in total daily transactions during the same period, suggesting that gaming activity is driving overall network usage.

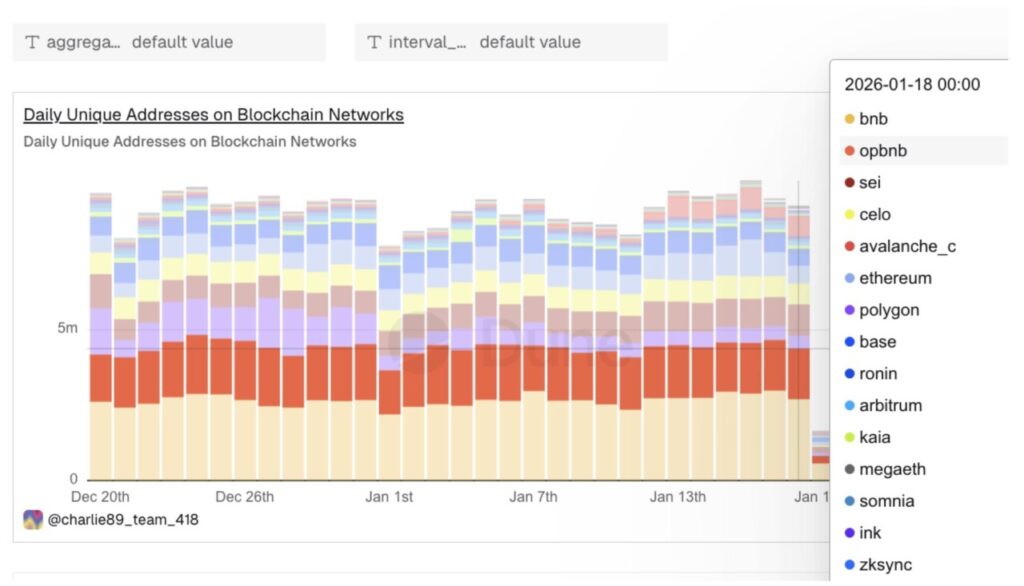

A similar pattern is also seen on Sei , another gaming-focused network. In recent days, Sei has consistently recorded a prominent number of daily unique addresses.

A closer look at the data from DappRadar shows that some Sei-based games have seen a significant spike in the number of active wallets in the last 24 hours.

The context is important: GameFi had fallen nearly 75% throughout 2025. But as the first month of 2026 begins, these signals are starting to show consistency – as highlighted by industry figures such as Yat Siu, Chairman of Animoca Brands.

This doesn’t mean that GameFi has fully awakened. However, it does suggest that the worst phase of decline and neglect may have begun to pass.

Axie Infinity (AXS): Sentiment Spike and Supportive Price Structure

Axie Infinity is starting to emerge as one of the strongest leaders in the GameFi renaissance. The price of AXS is up about 117% in the last seven days, clearly outperforming most large-cap gaming tokens as the month of January progresses.

One of the reasons AXS has taken off faster than other projects is the increase in sentiment, triggered by the community’s changing view of the project. On January 17, positive sentiment towards AXS jumped to 8.31 – the highest level in more than six months.

Read also: Steak ‘n Shake Launches Bitcoin (BTC) Bonus for Employees!

This positive sentiment measures how often the token is discussed positively on social media and on-chain channels. Spikes of this magnitude usually reflect re-engagement from the community, not late-stage speculation.

This change in sentiment is in line with the fundamental catalysts explained by Robby Yung himself. He highlighted the recent strength of AXS:

“The catalyst in this case was the AXS tokenomic model change, which was very well received by the community, and drove increased purchases as the community was re-energized – it was truly a grassroots-led movement,” he said.

Although the sentiment level decreased slightly, it remained high compared to previous weeks, keeping the attention on AXS.

Technically, AXS started its rally in early January and is now consolidating after a sharp rise. This pause phase forms a pattern similar to a “bull flag,” where the price digests the rise without disrupting the trend. As long as the pattern of higher lows persists, this structure is still considered healthy, not a sign of trend exhaustion.

Trend support is getting stronger. The 20-day exponential moving average (EMA) continues to climb closer to the 100-day EMA – an important intermediate trend indicator. If this bullish crossover is confirmed, then the trend continuation scenario will be further strengthened. A clean daily close above $2.20 would signal a breakout from the consolidation phase, with an upside target of $3.11 or more.

The invalidation level is also clear. A sustained drop below $1.98 will weaken this bullish structure. If the price drops deeper below $1.63 and eventually breaks the 100-day EMA line, then this setup is considered a failure.

The Sandbox (SAND): Trigger Effect from Axie Spreads to Other Big GameFi Tokens

The Sandbox is starting to follow in the footsteps of Axie Infinity, reinforcing the view that the rise of GameFi is not just limited to a single token. SAND has gained about 27% in the last seven days, and almost 9% on January 21-a pretty significant move for one of the game tokens with the largest market capitalization.

The order of these moves is important. Axie moved first, while Sandbox followed later, despite SAND having a larger market capitalization. This pattern is in line with how Robby Yung describes the dynamics of the sector, noting that Axie is often a bellwether for the overall GameFi market. As he puts it:

“AXS is a leading indicator in this category, so if we see movement there, it usually bodes well for the rest of the sector,” he said.

On-chain data also supports this positive outlook. Since January 16, the flow of SAND balances on exchanges has seen a sharp reversal. At the start of the month, there was a net inflow of about 4.36 million SAND to the exchanges – a signal that many were selling.

Now, that flow has reversed to a net outflow of about 2.33 million SAND, indicating that the tokens were withdrawn from the exchange, rather than put up for sale.

Increased buying pressure as prices strengthen is a positive signal, even more so for large-cap tokens.

In terms of price structure, SAND is forming a “cup and handle” pattern, a technical formation that often indicates a breakout. A rounded bottom formed throughout December, followed by a strong rise in early January. Currently, the price is consolidating in the “handle” area.

A clear daily close above $0.168 would break the neckline and open up up upside potential towards $0.190, and could even extend into the $0.227 zone.

Read also: Solana Mobile Launches SKR Crypto Airdrop for Seeker Users! Here’s How to Claim

The invalidation level (invalidation of the bullish scenario) is quite clear. If the price drops below $0.145, the technical structure will weaken. A deeper drop below $0.106 will invalidate this bullish setup completely.

Decentraland (MANA): Accumulation by Whales Signals Initial Positioning

Decentraland is currently one of the weakest short-term performing GameFi tokens among sector leaders, yet it is precisely because of this that it is starting to attract the attention of major investors. MANA was up about 7% on January 21 and about 15% in the past seven days – still lagging behind Axie Infinity and The Sandbox in percentage terms.

What’s interesting is how the whales (big wallet owners) started placing positions while MANA’s price performance was still lagging.

Since January 17, wallets holding large MANA balances have increased their holdings from around 1.00 billion tokens to 1.02 billion – an addition of around 20 million MANA (worth nearly $3.2 million) in just a few days. At one point, the whale balance even briefly touched 1.03 billion before a slight reduction.

However, the decline was shallow and was followed by accumulation again, indicating that it was more positioning than distribution.

From a technical standpoint, MANA appears to be experiencing a breakout from an inverse head-and-shoulders pattern on the daily chart – a pattern that often marks a transition from a downtrend to a recovery if it manages to hold. The breakout zone is around $0.159, with strength continuing to increase as prices close higher.

For confirmation, MANA needs a daily close above $0.161. If that is achieved, the next upside targets are around $0.177, $0.20, and potentially up to $0.221, with follow-on resistance near $0.24 if GameFi momentum continues to strengthen.

A drop back below $0.152 would weaken the breakout signal, while a drop below $0.137 would invalidate the entire technical structure.

MANA may be the slowest moving for now, but the behavior of the whales suggests that this could soon change – especially if the narrative of the rise of GameFi continues to grow.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. GameFi Tokens Leading 2026 Recovery. Accessed on January 22, 2026