Ethereum Reserve Drop on Binance Sparks Market Speculation

Jakarta, Pintu News – Ethereum slipped below the $3,000 level again, signaling a return of selling pressure in the broader crypto market. This forced market participants to stay in the defensive zone, despite attempts at recovery. The decline in Ethereum reserves on Binance is a focal point, as it could affect future supply and demand dynamics.

Declining Reserves on Binance

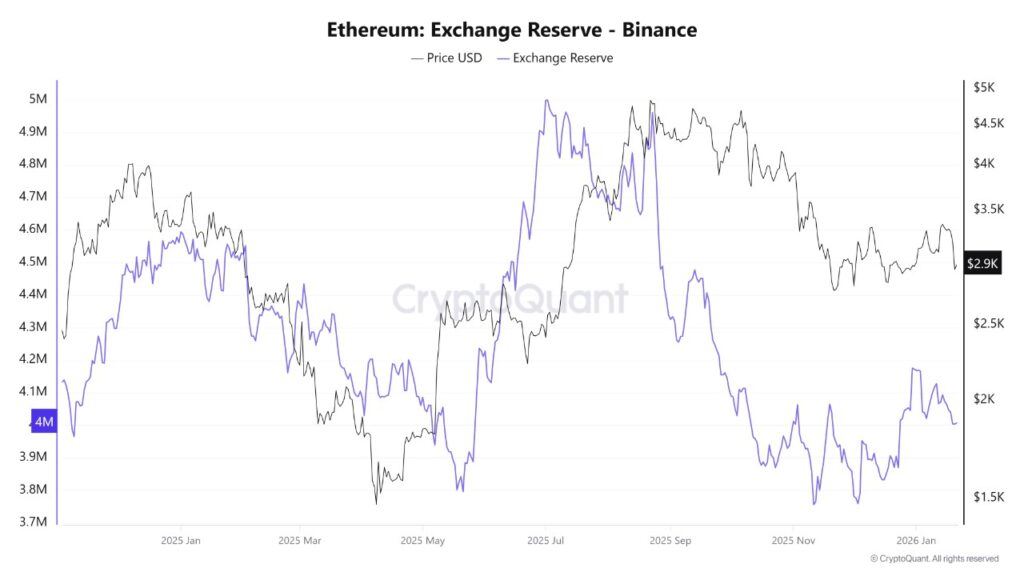

Since the beginning of 2026, Ethereum reserves on Binance have decreased from about 4.168 million ETH to about 4.0 million ETH. This decline suggests that there is a steady drawdown despite the continued pressure on the Ethereum price. The fact that Binance is a major liquidity center for Ethereum (ETH) in both spot and derivatives markets, makes the change in their reserve balance very significant.

This decline in reserves occurred without any appreciable increase in inflows back to the exchanges. This suggests that sellers are in no hurry to add to liquid supply at current price levels. This usually reflects a market where investors prefer to hold their assets rather than actively distribute them, either by keeping them in cold storage or using them in DeFi.

Also Read: Is Gen Z Investing Only in Crypto a Smart Decision or Not? Here’s What Analysts Say!

Losing Control at $3,000 Level

Ethereum (ETH) is showing fresh weakness after failing to hold above the key $3,000 level, with prices now hovering around $2,970. After stabilizing for a while earlier in the month, Ethereum tried to rebound towards the $3,300-$3,400 supply zone. However, the momentum quickly faded as sellers stepped back in and pushed the market down.

From a technical perspective, Ethereum is still stuck below its major moving averages, which reinforces the bearish structure. The latest rejection near the downtrend of the 200-day average suggests that upside attempts are still capped by overhead resistance. Meanwhile, a break below $3,000 shifts market sentiment back into risk aversion mode, especially as crypto traders remain sensitive to broader macro uncertainties.

Recovery Potential and Challenges

The current price action reflects more of a fragile recovery attempt than a confirmed reversal. Ethereum’s latest decline puts the focus on the $2,850-$2,900 support range as the next area. This area has previously been a point where buyers entered during previous sell-offs.

If this zone fails to hold, the market may visit deeper levels from the previous correction phase. For the bulls to take control, Ethereum needs to quickly reclaim $3,000 and build stronger demand above that threshold. If demand suddenly returns, the ensuing tightening of supply could reinforce the upside impulse that follows.

Conclusion

The current dynamics in the Ethereum market suggest that volatility and uncertainty still dominate. The drop in reserves on Binance, meanwhile, gives an indication that there may be a change in the balance of supply and demand that could affect prices in the future. Investors and traders should stay alert to these changes and how they could affect their investment strategies.

Also Read: XRP price slumps, will it surge at the end of January 2026?

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Ethereum Supply Tightens on Binance as Reserves Hit Lowest Level Since 2016. Accessed on January 23, 2026