US Political Crisis Shocks Crypto Markets, Losses Reach $100 Billion!

Jakarta, Pintu News – The crypto market suffered a sharp decline losing around $100 billion at the end of last week, triggered by heightened political uncertainty in the United States. Fears of a possible US government shutdown were partly to blame for the massive sell-off by traders.

Political Tensions Trigger Crypto Sales

Data from TradingView shows that the crypto market capitalization fell from $2.97 trillion to $2.87 trillion within six and a half hours on Sunday at 21:30 UTC. Bitcoin is down 3.4% in the last 24 hours. Ethereum was hit even harder, with a 5.3% drop in a day. More than $360 million of leveraged crypto positions were also wiped out in a day, with $324 million of long positions liquidated, according to data from Gate.

The uncertainty is fueled by Senate Democrats’ threat to block a funding package that includes funds for the Department of Homeland Security, following the shooting incident by federal agents in Minneapolis. Senate Democratic leader Chuck Schumer expressed dissatisfaction with the proposed bill, criticizing the lack of sensible reforms in the management of the Department of Homeland Security.

Also Read: Silver Price Prediction 2026-2030, How will it fare in the next 5 years?

Increased Bets on Government Shutdown

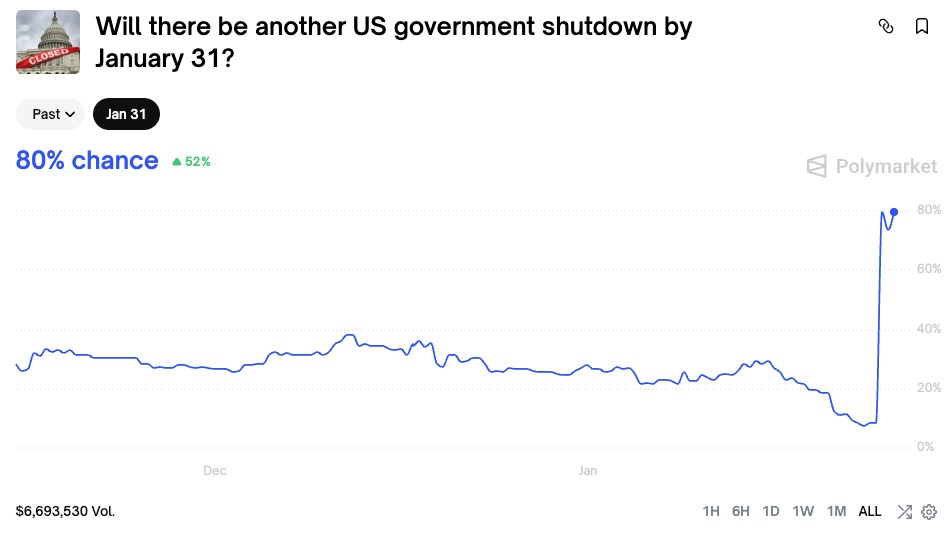

The odds of a US government shutdown increased sharply in prediction markets such as Kalshi and Polymarket. On Kalshi, the chance of a government shutdown until the end of January jumped from under 10% on Saturday to 78.6% on Sunday. Polymarket showed a similar spike to 80%.

These added tensions come from President Donald Trump’s threat to raise tariffs on imports from Canada to 100% if the country strikes a deal with China, as well as the deployment of US warships in the Middle East which increases tensions with Iran.

This situation adds to traders’ concerns of a possible further decline, given the market’s experience during previous government shutdowns. During the longest US government shutdown lasting 43 days, Bitcoin (BTC) price dropped from a peak of $126,080 to below $100,000, triggered by prolonged disagreements in Washington as well as Trump’s tariff threats against China.

Market Reaction and Investor Sentiment

During this period of uncertainty, gold has performed more strongly than Bitcoin (BTC), suggesting that investors prefer traditional safe-haven assets. Meanwhile, the Crypto Fear and Greed Index, which tracks Bitcoin and crypto market sentiment, fell five points on Monday to 20 out of 100, marking six consecutive days in the “extreme fear” zone.

This decline demonstrates the market’s rapid response to political and economic instability, reinforcing the view that crypto assets are still highly vulnerable to changes in sentiment and global macroeconomic conditions.

Political Uncertainty Has a Big Impact on Crypto

Political dynamics in the United States have had a significant impact on the crypto market, with uncertainty leading to heavy selling and declines in market value. Geopolitical tensions and uncertain economic policies continue to influence investment decisions and demonstrate how sensitive crypto markets are to global issues.

Also Read: 3 Cryptocurrencies that are Ready to Rise Again in 2026

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Cointelegraph. Crypto Wipes $100 Billion, US Government Shutdown Fears. Accessed on January 26, 2026