7 Ripple (XRP) 2026 Price Predictions: AI Projects Targets Up to US$6

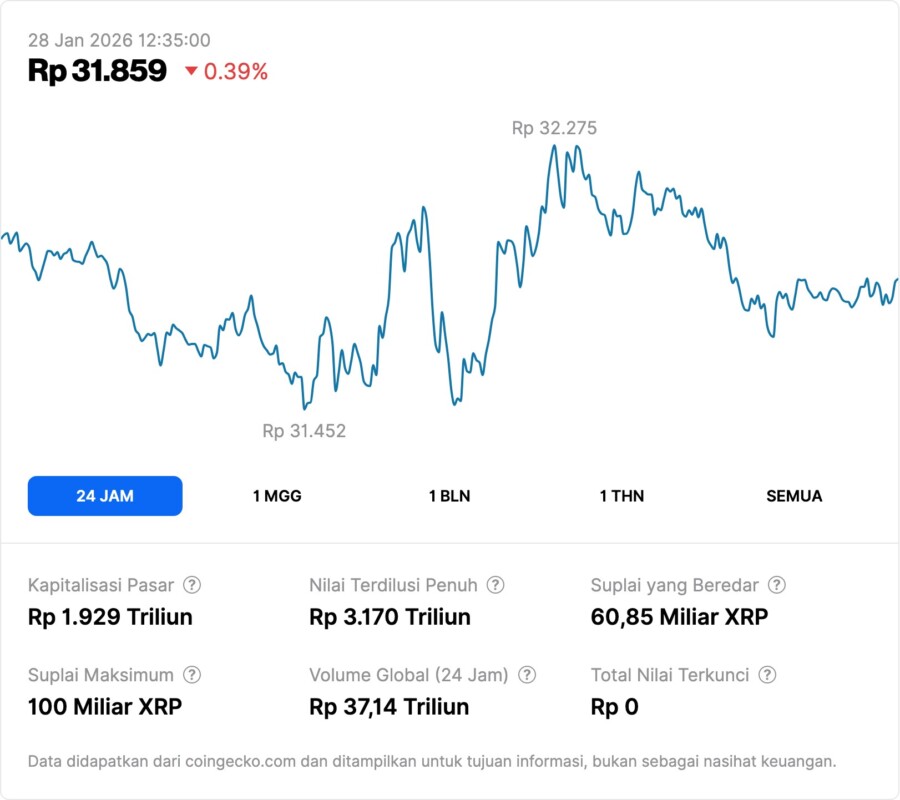

Jakarta, Pintu News – Price predictions for Ripple through 2026 are enriched by an artificial intelligence(AI)-based model that scenarios the potential price movements of the fifth-largest crypto with several possible directions based on ETF demand, network activity, and market dynamics.

1. Overview of AI Predictions for XRP

The prediction model built using AI (Claude AI) starts the projection based on a base price of around US$2.15. The price scenario for XRP is divided into three possible paths based on the strength of market catalysts such as ETF capital flows and selling pressure on exchanges.

These projections reflect that the price of XRP does not move in a linear fashion, but is heavily influenced by how institutional demand, regulation, and network activity evolve throughout 2026.

Also Read: Gold Dominates, Bitcoin (BTC) Slumps on Yen Intervention Fears, Why?

2. Bullish Scenario: XRP Reaches US$4-US$6

In the most optimistic scenario according to the AI model, the price of XRP could jump between US$4 and US$6 by the end of 2026. This range translates to a potential increase of more than 215 percent from the base price used in the prediction.

This target becomes possible if XRP ETF inflows exceed US$5 billion, while the amount of XRP available on exchanges continues to decrease, reducing selling pressure and boosting spot demand.

3. Base Scenario: Range $2-$3

AI’s forecasts also lay out a more moderate baseline scenario, where XRP is expected to remain hovering between US$2 and US$3 towards the end of 2026. In this case, ETF capital flows remain steady but unspectacular.

Key drivers for this scenario include the gradual growth of network adoption, as well as the controlled release of escrow tokens that help keep price support above key levels.

4. Bearish Scenario: Price Pressure to LED at $1.50-$1.80

The other side of the AI model forecasts a possible bearish scenario, where XRP could weaken to a range of US$1.50 to US$1.80. This may happen if demand for ETFs weakens and global macroeconomic pressures increase.

In this scenario, price momentum could be weak with a long consolidation around historical support levels.

5. Fundamental Factors and Market Risk

This forecast combines technical elements and fundamental factors such as ETF demand, regulation, and on-chain dynamics on the XRP Ledger (XRPL) network. While AI provides a wide price range, the real impact on price is highly dependent on regulation and institutional capital flows.

Macro risks such as broader crypto market volatility and global risk sentiment are also key influences on XRP’s price direction in 2026.

6. Comparison with Other Predictions

In addition to AI’s model highlighting the possibility of prices up to US$6, some other analysts have predicted even higher targets in extremely bullish conditions. However, there are also more cautious predictions with the average price being in the US$2-US$4 range, illustrating the broad spectrum of market projections.

This shows that the market consensus is still wide open and influenced by various fundamental assumptions that differ between prediction models.

7. Final Note to Investors

The 2026 price prediction for XRP provides a framework of potential price direction under diverse market conditions, from conservative to highly optimistic. Investors are advised to consider various fundamental factors such as ETF demand, regulatory developments, and network adoption trends before making an investment decision.

Also Read: Ripple (XRP) Drastic Decline: Analysis and Outlook in 2026

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- XRP Outlook For 2026: AI Model Signals New Record Ahead – Can Price Reach $6? Accessed January 28, 2026.