Antam Gold Price Chart Today January 29, 2026: Print New Records at the End of the Month

Jakarta, Pintu News – Antam’s gold price today, Thursday, January 29, 2026, again set a new record in line with the surge in world gold prices and strengthening domestic demand. The latest data shows a consistent upward trend throughout January, with significant acceleration in recent days. This condition places Antam gold as one of the hedging instruments that most retail investors pay attention to amid global market uncertainty.

Antam Gold Price Movement Today

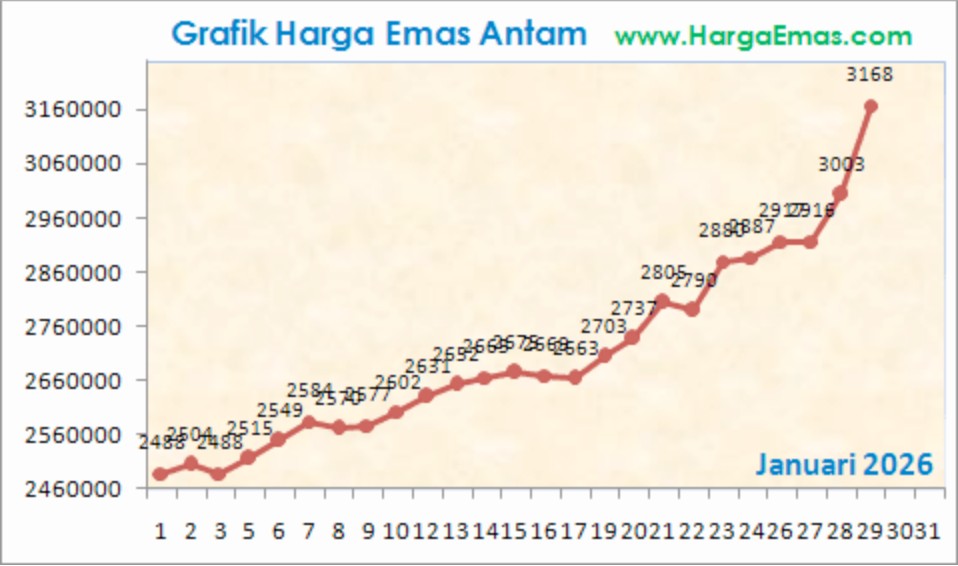

Based on the Antam gold price chart as of January 29, 2026, the price of gold bars was recorded to have penetrated the area of IDR 3,168,000 per gram. This figure shows a sharp increase compared to early January, which was still in the range of IDR 2,480,000-Rp2,500,000 per gram. On a monthly basis, the price trend shows a higher high and higher low pattern which indicates the dominance of bullish momentum.

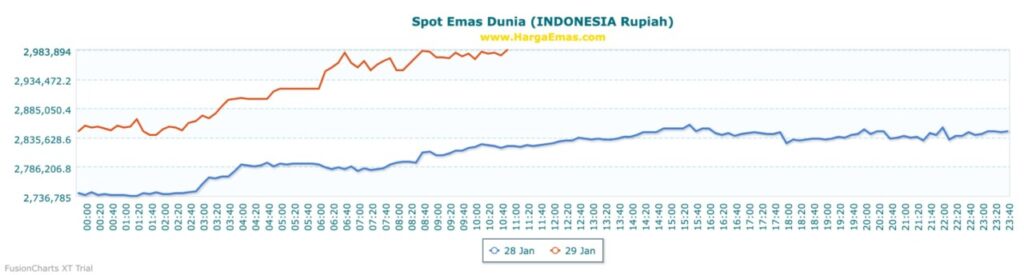

The increase in Antam’s gold price today is also in line with the surge in world spot gold prices which have broken through the level of USD 5,500 per troy ounce. With the rupiah exchange rate relatively stable at around IDR 16,700 per USD, the transmission of global price increases to domestic gold prices occurs directly. This makes Antam’s gold price chart move more aggressively than the consolidation period in the middle of the month.

Read More: 5 Key Gold Price Predictions for 2026-2030 in the Context of Global Asset Markets

Chart Analysis of Antam Gold Price January 2026

The monthly chart shows that since mid-January, Antam gold prices started to move steeper after briefly consolidating in the Rp2,650,000-Rp2,700,000 per gram area. The breakout from that zone triggered a price acceleration that continued until the end of the month. Technically, this pattern reflects the strengthening of the short to medium-term uptrend.

From a support and resistance point of view, the IDR3,000,000 per gram area has now turned into the closest psychological support. As long as the price is able to stay above this level, the potential for healthy consolidation or continued increase is still open. Conversely, a technical correction is likely to occur if the world gold price experiences a pullback after a sharp rally in a short time.

Factors Driving the Increase in Antam Gold Prices

The increase in Antam gold prices today is inseparable from the surge in interest in safe haven assets in the global market. Monetary policy uncertainty, stock market fluctuations, and rising geopolitical tensions have encouraged global investors to divert funds to gold. This condition is directly reflected in the spot gold price which is the main reference.

On the domestic side, demand for physical gold tends to increase towards the end of the month, both for long-term investment purposes and portfolio diversification. This combination of global and local factors is clearly reflected in today’s Antam gold price chart, which shows an upward trend with almost no significant correction throughout January 2026.

Antam Gold Price Outlook Going Forward

In the short term, Antam gold prices have the potential to move volatile in line with the high world gold prices that are already in extreme areas. Consolidation in a narrow range may occur as a form of market adjustment. But as long as global sentiment is still favorable for hedge assets, the structural uptrend has yet to show signs of reversal.

For the medium term, the movement of the Antam gold price chart will depend heavily on the direction of global interest rate policy and the stability of the rupiah exchange rate. If world gold is able to stay above USD 5,300 per ounce, Antam gold prices have the opportunity to maintain high levels and form a new range above IDR 3 million per gram.

Conclusion

The Antam gold price chart today, January 29, 2026, shows a very strong upward trend and set a new historical high. This movement was driven by the global gold rally and investor interest in safe assets. Although the risk of a short-term correction remains, the general trend structure is still bullish, making Antam gold still relevant as a hedging instrument in uncertain market conditions.

Also Read: 5 Important Insights Predicted SHIB Will Drop First Before Reaching New ATH

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- HargaEmas.com. Antam Gold Price Chart Today. Accessed January 29, 2026