The Slide May Not Be Over—3 Signs Suggest Bitcoin Could Fall to $63,000

Jakarta, Pintu News – The price of Bitcoin has experienced one of the sharpest declines in recent months, with a correction of more than 11% since its peak in late January. Although the price has reached significant technical targets, on-chain and derivatives data suggests that the market correction may not be complete.

With buyers still cautious and whales starting to reduce their exposure, the question now becomes simple: is this the bottom, or just a stopover before going down further?

Bitcoin Reaches Downside Target After Pattern Failure

Bitcoin’s latest decline follows a fairly clear technical map. In late January, Bitcoin price broke below a head-and-shoulders pattern, confirming a trend reversal in a bearish direction.

Read also: Crypto Market Under Pressure: When Can Crypto Prices Recover from the Bearish Trend?

The January 29 breakout projected a downside target of $75,130. In early February, Bitcoin managed to reach this zone, thus validating the pattern almost perfectly.

Since January 31, Bitcoin has corrected nearly 11%, dropping from its local highs to around $75,000. This movement triggered massive liquidation and dragged the overall crypto market to lower levels.

Reaching the downside target often brings short-term relief. However, it does not guarantee that the bottom has been permanently reached. Whether or not this level will hold depends largely on the response of buyers following the technical breakdown. So far, that response has been weak.

Spot Buyers Still Absent at Crucial Support Levels

One of the biggest warning signs right now is the lack of strong accumulation around the $75,000 level.

Outflows from exchanges-which reflect how much Bitcoin is moved from trading platforms to long-term storage-have experienced a sharp decline. Around January 31, outflows were recorded at close to 42,400 BTC. After the sell-off, that number dropped dramatically to around 14,100 BTC, a drop of around 67%.

This shows that investors are not in a hurry to buy when prices drop. This is the first warning indicator.

Whale behavior adds to the concerns as a second indicator. Wallets holding between 10,000 to 100,000 BTC started reducing exposure since February 1. Their total holdings dropped from around 2.21 million BTC to 2.20 million BTC-meaning around 10,000 BTC was sold, worth approximately $750 million at current prices.

The third indicator is the NUPL (Net Unrealized Profit/Loss) of short-term holders, which measures whether recent buyers are in profit or loss. Currently, the NUPL is around -0.23, which puts traders in the capitulation zone.

However, at the low point in November, NUPL fell to -0.27 before prices recovered sharply. This suggests panic, but is not yet extreme, so it may signal that a bottom is still pending.

Overall, the decline in outflows, whale selling, and incomplete capitulation suggest that market confidence is still weak.

Derivatives Market Dominated by Short Positions, Not Real Demand

With spot buyers still cautious, the derivatives market is now the main source of potential Bitcoin price gains.

Read also: Bitcoin Price Rises to $78,000 Today: Peter Brandt Highlights BTC Breakdown Risk

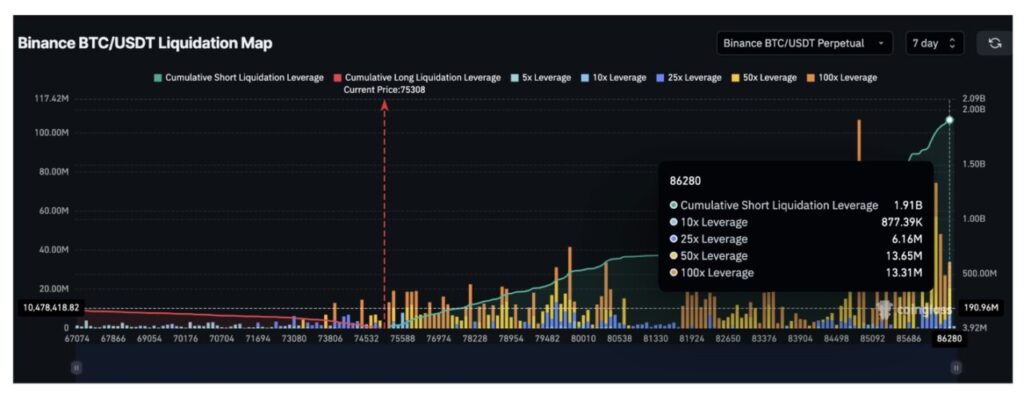

Liquidation data from Binance shows that the total leveraged short positions reached around $1.91 billion, while the long positions were only around $168 million. This creates a huge imbalance in favor of bearish sentiment.

When short positions are overcrowded, even a small rally can trigger forced buying. If Bitcoin’s price rises, short sellers are forced to close their positions, which can prompt a sharp price spike-a phenomenon known as a short squeeze.

However, this kind of rally is not a reflection of healthy demand. Rises triggered by liquidation tend to be temporary, unless supported by real accumulation. Without stronger spot buying and participation from whales, the potential price increase is unlikely to last.

This is because after a short squeeze pushes the price up, more long positions can emerge, which keeps the downside risk in place.

For now, the derivatives market only offers volatility, not stability. What the BTC price really needs right now is demand from the spot market-and it’s still nowhere in sight.

Bitcoin’s Key Price Levels Show Potential to $69,000 and Lower Risk Zones

If Bitcoin fails to maintain the current support level, technical and on-chain models show clear downside targets.

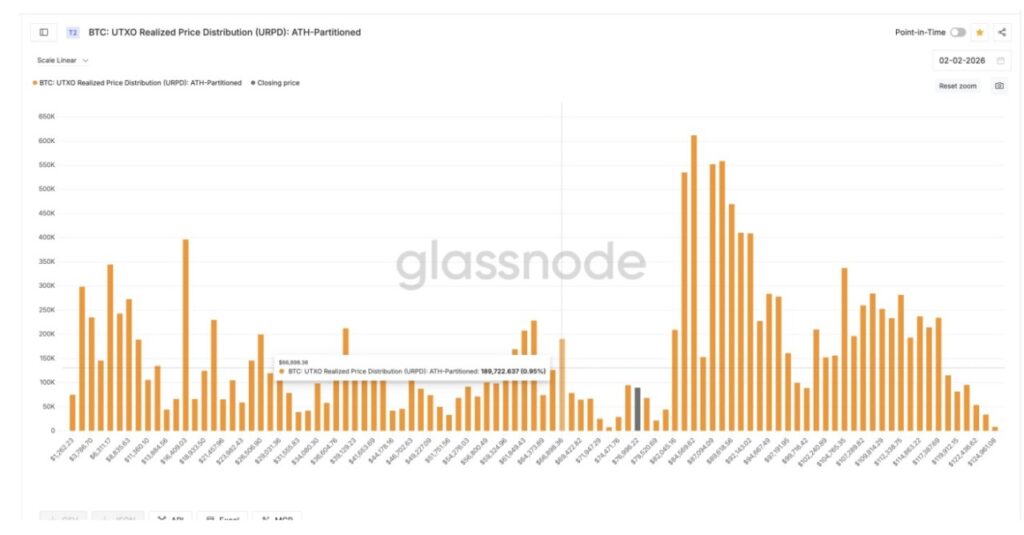

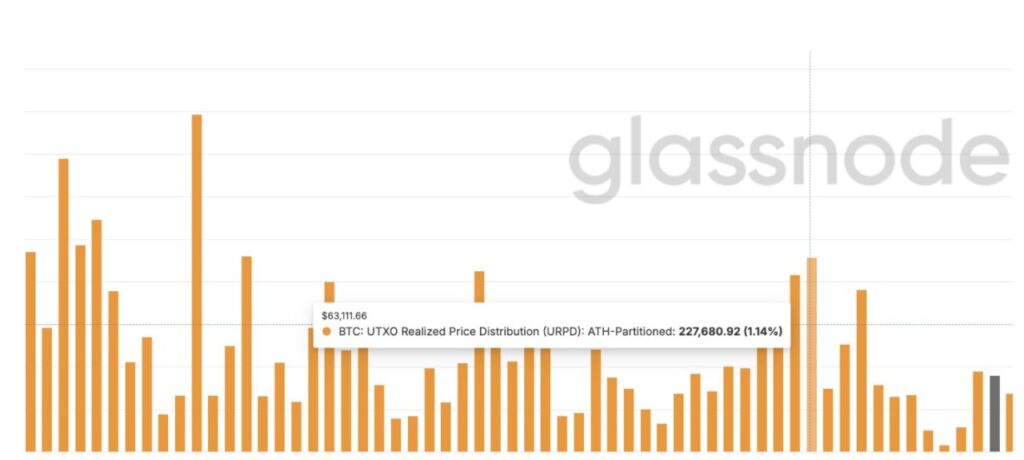

The UTXO Realized Price Distribution (URPD)-which shows where Bitcoin supply was last purchased-identifies zones of accumulation that often act as support when the price drops.

The strongest URPD cluster in the short term is around $66,890, where about 0.95% of the supply is concentrated.

Below that, there is another large cluster around $63,111, which holds around 1.14% of supply. These zones could attract buying interest if the price continues to decline, making them the strongest on-chain support for BTC in the near term.

Technically, if Bitcoin breaks below $75,630-$75,130, it opens up the potential for a drop towards $69,500. If that level is also lost, then the price could drop to the $66,000-$63,000 range, which is the main URPD cluster region. In a deeper downside scenario, $61,840 is the next relevant support point.

On the contrary, for price recovery, Bitcoin faces resistance in the range of $79,890 and $84,140. To restore the bullish structure, the price needs to move steadily above $84,140. Until that happens, downside risks still dominate.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Is This The Bitcoin Bottom? 3 Metrics Still Point To $63,000 As The Key Risk Zone. Accessed on February 3, 2026