Bitwise CIO Says Crypto Winter Began in 2025 — The Real Question Is: When Will It End?

Jakarta, Pintu News – Matt Hougan, Chief Investment Officer (CIO) of Bitwise Asset Management, said that the market is currently experiencing a crypto winter.

According to his analysis, the crypto winter started as early as January 2025, but the huge inflow of funds from institutions has “masked that reality,” so the depth of the market decline is not obvious. The main question now is: how long will this winter last?

Market Weakness Signals an Ongoing Crypto Winter

In a recent market commentary, Matt Hougan rejected the notion that the recent price weakness is just a temporary dip. Instead, he described the current situation as a “full-blown crypto winter,” pointing out the sharp declines in various major assets.

Read also: Gold vs. Bitcoin: Historical Patterns Show Potential for Capital Shift to Crypto Assets

He highlighted that the price of Bitcoin is now down about 39% from its record high in October 2025. Meanwhile, Ethereum has plummeted by about 53%. Many altcoins have experienced even more severe declines.

“This is not a ‘bull market correction’ or a ‘temporary dip’. This is a full-fledged crypto winter-like 2022-a la Leonardo DiCaprio in The Revenant-triggeredby factors ranging from excessive leverage to massive profit-taking by incumbents,” Hougan said.

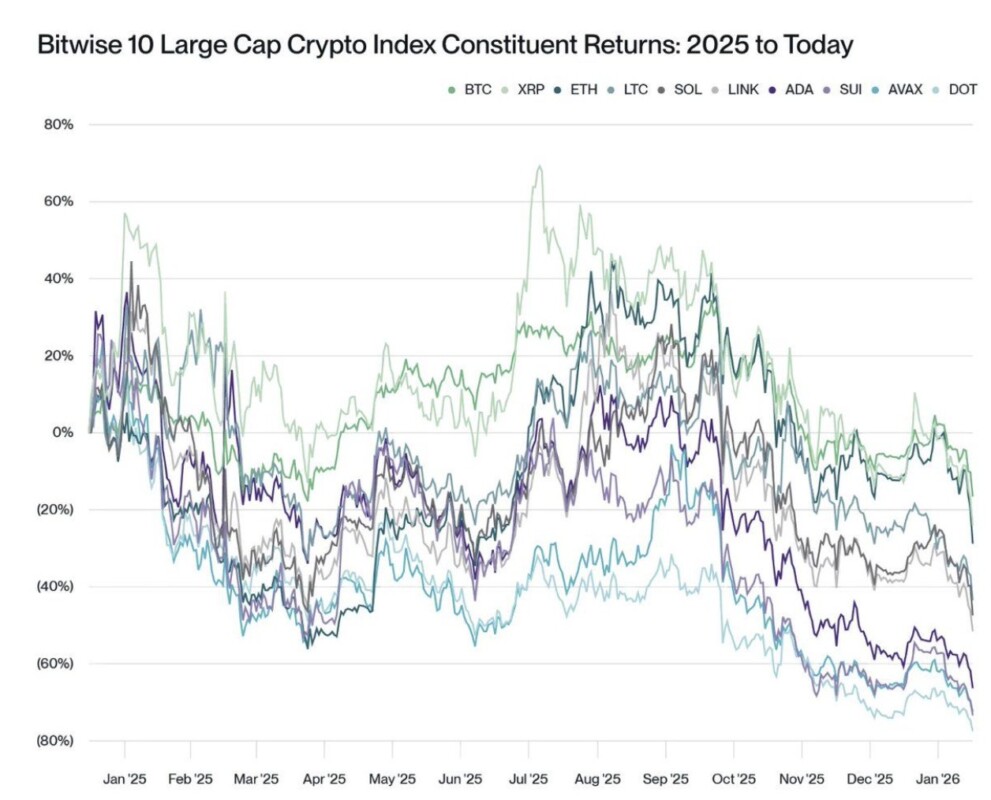

He explains that institutional demand has played an important role in making up for the decline. Based on data from the Bitwise 10 Large Cap Crypto Index, Hougan pointed out a clear difference.

Assets that have strong institutional backing, such as Bitcoin, Ethereum, and XRP , have seen relatively milder declines since January 2025. While tokens that gained ETF access in 2025, such as Solana , Chainlink , and Litecoin (LTC), saw deeper declines.

However, assets that had no institutional exposure at all fell between 60% and 75%. According to him,

“What differentiates the three groups is basically whether or not institutions have the ability to invest in them.”

ETF and Digital Asset Treasuries (DAT) Collect Over 744,000 Bitcoins

During this time, exchange-traded funds (ETFs) and Digital Asset Treasuries (DATs) have accumulated more than 744,000 Bitcoins, worth around $75 billion. According to Matt Hougan, without this level of institutional support, Bitcoin’s losses would likely have been much greater.

“The crypto retail market has had a brutal winter since January 2025. Institutions have only masked that reality for a few assets, and even then only temporarily,” Hougan said.

He also responded to a question that many market participants ask: why do crypto prices continue to fall despite positive developments such as increased institutional adoption, regulatory progress, and wider acceptance from Wall Street?

The answer is simple. In the depths of crypto winter, good news usually has no immediate impact on prices.

“For those of you who followed crypto during previous winters-both 2018 and 2022-you’ll remember that good news doesn’t matter when winter is in full swing. The crypto winter does not end with euphoria, but with exhaustion,” he added.

Even so, Hougan notes that these positive developments do not simply disappear during bear markets. Instead, they accumulate as what he calls “potential energy” that could trigger a recovery when market sentiment begins to improve.

Triggering Factors for Recovery and Signs of Winter’s End

Hougan revealed several factors that could potentially lift market sentiment, including stronger economic growth fueling arisk-on rally, positive surprises regarding the Clarity Act, signs of Bitcoin adoption by sovereign nations, or simply the passage of time.

Read also: Donald Trump Passes $1.2 Trillion Budget, US Government Shutdown Officially Ends!

Referring to historical cycles, Hougan said that crypto winters generally last about 13 months. If the current winter really started in January 2025, then it is possible that the end of this phase is near.

He emphasized that the current mood of despair and lethargy is typical of the late-winter phase of crypto. He also emphasized that there were no fundamental changes to crypto during this market downturn.

“I think we will bounce back quickly, faster than many people think. Hey, it’s been winter since January 2025. Spring will definitely come soon,” Hougan said optimistically.

When Did the Crypto Bear Start? The Debate Over Timelines

While Matt Hougan calls the start of the bear market January 2025, not all analysts agree with this view. Julio Moreno, Head of Research at CryptoQuant, acknowledges the difference in asset performance caused by institutional exposure, but he disagrees on the timing of the start of the crypto winter.

“I disagree that winter starts in January 2025. Bitcoin price was still in a long-term uptrend throughout 2025, even reaching a new record high in October. The fact that we didn’t see a big price spike(blow-off top) or close the year with a positive result, doesn’t mean we’ve entered a bear market in 2025. According to on-chain and market data, Bitcoin winter only started in November 2025,” Moreno wrote.

The start time is very important. Historically, crypto winters last about 13 months. If the market decline begins in January 2025 as Hougan claims, then a recovery may be imminent. But if Moreno is right and the market peak occurs in November 2025, then the bearish phase could continue.

“The timing of the start of the decline has implications for when this winter will end. My current expectation is in the third quarter of 2026,” Moreno said.

Whether the recovery will come earlier in 2026 as Hougan predicts, or be delayed until Q3 as Moreno projects, is still a question mark. But one thing is certain: the market is in a deep downward phase.

History shows that phases like this rarely end due to one big trigger, but rather due to the accumulation of changes over time. If previous cycles are any guide, then the foundations for the next recovery may be forming-even if they are not yet visible on the surface.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitwise CIO Claims Crypto Winter Began in 2025-Now the Question Is When It Ends. Accessed on February 5, 2026