5 Market Signals: Ripple (XRP) Funding Plunges to Lowest Level Since April, What Does It Mean?

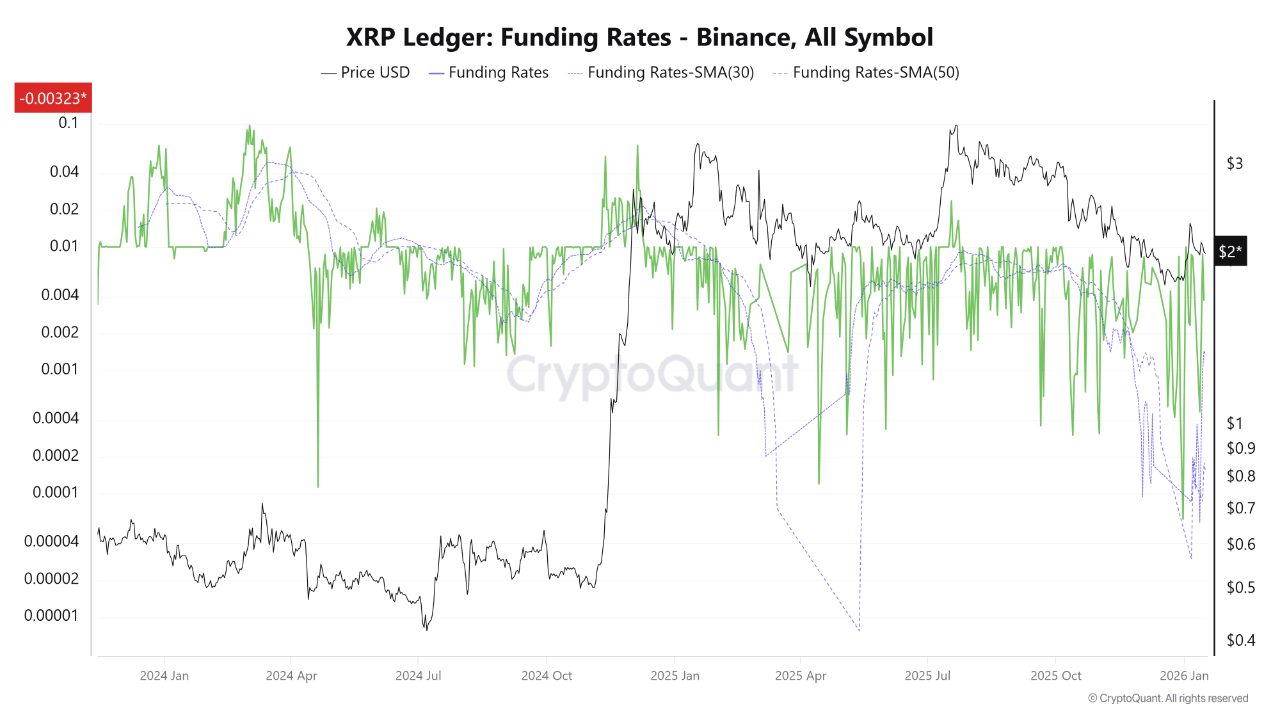

Jakarta, Pintu News – The cryptocurrency market recorded another interesting move when the funding rate of Ripple hit its lowest point since last April. The drop signals a major shift in trader sentiment and could be an early signal of a shift in XRP’s price trend. With volatility on the rise, investors are now highlighting the role of funding in reading the future direction of the crypto market.

1. XRP Funding Hits Lowest Level Since April

In the latest data from derivatives exchanges, XRP funding levels dropped significantly to a nine-month low. This suggests that most traders are now taking short positions, betting that the price of XRP will fall.

For novice investors, the funding rate is the mechanism that keeps the balance between long and short contracts in the crypto derivatives market. When the funding rate is negative, it means that more traders are betting that the price will fall – and this is exactly what is happening with XRP right now.

Also Read: 5 Fun Facts: Bitcoin Often Rebounds in February – Lessons from Historical Data

2. Crypto Market Sentiment Begins to Change

The drop in XRP’s funding rate is not just a number on a screen; it reflects a psychological shift in the crypto market. After rallying alongside Bitcoin and Ethereum , XRP is now facing increasing selling pressure.

However, some analysts see this as a potential “hidden buying opportunity”. When markets are overly pessimistic, price reversals often occur – a phenomenon known as a short squeeze. If that happens, XRP could surge back up in no time.

3. Fundamental Factors: Ripple’s legal case is still a burden

One of the main reasons behind the negative sentiment is the legal uncertainty that still looms over Ripple Labs, the company behind XRP. Although Ripple won a partial judgment against the US Securities and Exchange Commission (SEC), the legal process is not completely over.

This uncertainty is holding back the interest of institutional investors. In the short term, crypto markets are sensitive to this kind of legal news – especially those involving large assets like XRP.

4. Ripple Network Activity Remains Solid

Interestingly, even though XRP funding and price are down, Ripple’s network activity remains stable. Cross-border transaction volumes and usage of the On-Demand Liquidity (ODL) protocol remain high.

This shows that Ripple’s fundamental value is still strong. This means that if the crypto market pressure eases, XRP could rally back due to its utility in the real world – something that many other tokens lack.

5. Opportunities and Risks for Crypto Investors

For investors, the current condition can be seen from two sides. On the one hand, a decrease in the funding rate is a sign of caution; the market could continue to weaken. But on the other hand, extreme conditions like this are sometimes a turning point for prices.

With the price of XRP remaining relatively stable at around $0.50 or around Rp8,443, patient investors can take advantage of this momentum for long-term accumulation – of course by keeping in mind risk management in the highly volatile cryptocurrency market.

Conclusion

Ripple ‘s (XRP) funding falling to its lowest level since April gives a strong signal that the market is out of balance. However, the history of the crypto market shows that a period of fear often precedes a resurgence. For wise investors, understanding funding rates is not just about numbers, but also about reading the market psychology more deeply.

Also Read: 5 AI Perspectives: Will XRP Fall Below $1 in February 2026?

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- NewsBTC. XRP Funding Rate Drops To Lowest Level Since April. Accessed February 9, 2026.