Key Events Set to Shake Up the Crypto Market This Week

Jakarta, Pintu News – As the week progresses, global crypto market movements and various economic agendas in the United States are expected to heavily influence market dynamics.

The crypto market capitalization that had dropped to $2.17 trillion has now recovered to around $2.38 trillion, driven by a technical rebound after oversold conditions. Despite the temporary recovery, market conditions are still fragile, the future outlook remains unclear, and investors are still on their guard.

Key Crypto Market Events to Watch

Next week will be filled with a number of crucial agendas that have the potential to affect crypto market movements.

On Monday, all eyes will be on the Federal Reserve when President Donald Trump formally nominates Kevin Warsh to replace Jerome Powell as Federal Reserve Chairman. If confirmed, Warsh will bring his personal wealth and previous experience at the Fed to the position.

Read also: Bitcoin Stumbles, Crypto Futures Trading Volume in Russia Skyrockets!

This change in leadership could influence the direction of future policies, especially regarding interest rate decisions and inflation targets.

However, until now the market has been plagued by uncertainty, as important data such as inflation figures and the November employment report were delayed due to the government shutdown. This situation has triggered market volatility, with investors confused about the future direction of US economic policy.

Another major event will occur on Tuesday, when the Federal Reserve injects $8.3 billion into the market. This liquidity injection aims to stabilize the financial markets, which have been under pressure recently.

This injection of funds is particularly important given that the market is still trying to recover from the massive sell-off that occurred at the end of the previous week.

On Wednesday, the Federal Budget Balance data will be released, which describes the fiscal health of the government. This report covers trends in state spending and revenues, which is particularly relevant amid the current economic challenges.

In addition, on Thursday, the Federal Reserve will also publish its Balance Sheet data. This report will provide a snapshot of the Fed’s financial position and future policy plans, including how it will handle inflationary pressures and weak economic growth.

Crypto Market Sentiment and Trends

The crypto industry recorded a growth of about 1.96% on February 8, 2026, although uncertainty still plagues the overall market. Bitcoin price has climbed back to the $71,000 range, and other altcoins are also showing signs of recovery.

This positive movement comes after a phase of excessive fear, reflected by the Fear and Greed Index, which bottomed out earlier in the week.

Read also: Gold Price Prediction Tomorrow, February 10, 2026

Government Shutdown Risk

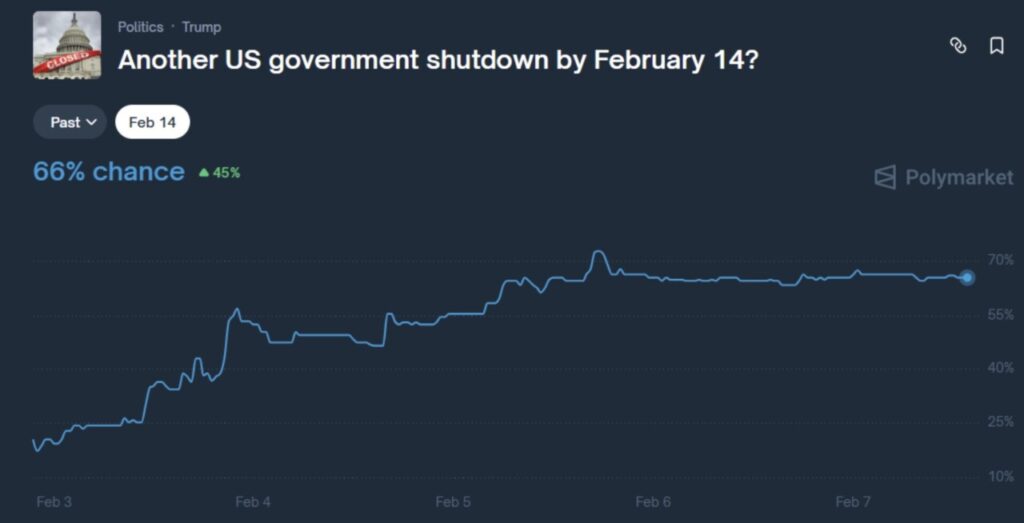

Another risk that could potentially pressure the crypto market is the possibility of a partial government shutdown. Data from Polymarket shows there is a 66% probability of a partial shutdown next week.

If a shutdown occurs, the release of a number of important economic data will be delayed and fiscal policy will become more complicated, making it difficult for the Federal Reserve to navigate the current economic conditions.

Overall, this week has the potential to be a defining period, not just for the crypto market but for the economy in general. With many important reports and events on the horizon, investors need to remain vigilant and prepared for risks amidst a volatile economic environment.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Top Crypto Market Events to Watch This Week. Accessed on February 9, 2026