5 Reasons Hedera (HBAR) Could Rally 57% in 2026

Jakarta, Pintu News – Recent price analysis shows that Hedera has the potential to experience a significant rally of up to approximately 57 percent in 2026 if key resistance levels are successfully broken. This movement is driven by breakout signals from a developing technical pattern, but market conditions and price structure still indicate the risk of high volatility. Crypto investors need to understand the combination of technical analysis and fundamental factors to assess the opportunities and risks of HBAR’s further movement.

1. Potential Breakout In Descending Broadening Wedge Pattern

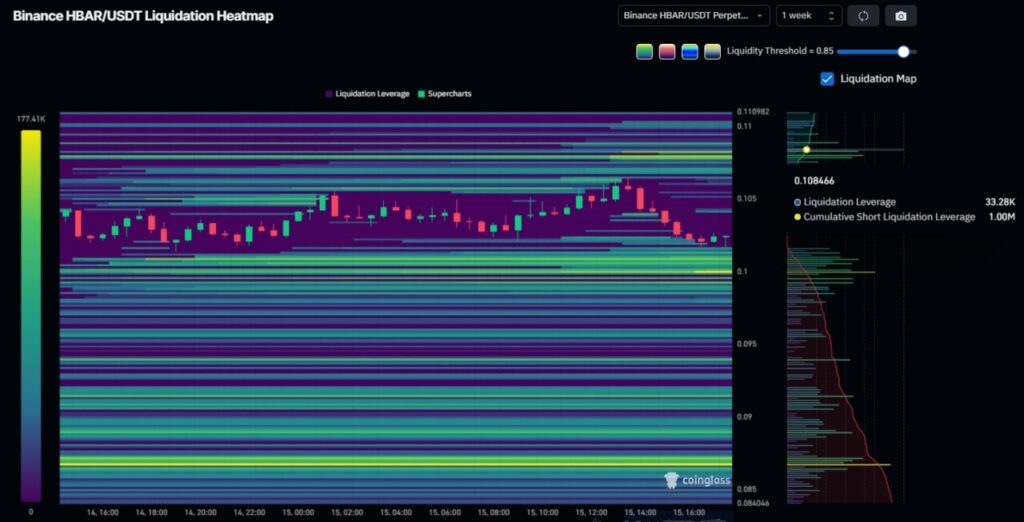

The price of Hedera (HBAR) is now trading near the resistance level around $0.1030, which is an important point to confirm a technical breakout. If HBAR is able to maintain this level as support, the market sentiment could potentially shift from consolidation to a broader recovery phase. The descending broadening wedge pattern captured on the chart suggests a rally probability of around 57 percent after a successful breakout.

The technical signals around the pattern reflect that the price momentum is starting to change, although there is still a risk of the breakout failing and moving back down. Investors need to pay attention to trading volume and daily closing prices to ascertain the validity of this breakout move. If the resistance level is not broken, the price may consolidate longer in a narrow range before the next trend is established.

Also Read: 7 Crypto in the Spotlight Ahead of Chinese New Year 2026, Seasonal Momentum or Just a Trend?

2. Rally Target and Short-term Price Structure

Additional analysis suggests that the breakout could trigger a rally to around $0.1252 or even extend the move if strong momentum continues. This target suggests the potential for significant upside from current price levels, but will still have to face a number of subsequent resistance levels. Targets above key resistance could be profit-taking areas for aggressive traders.

However, if HBAR fails to hold key support levels around $0.094 – $0.098, additional selling pressure could trigger a correction to lower support levels. This suggests that the success of the rally largely depends on the supply-demand dynamics at these key levels.

3. Technical Data and Crypto Market Sentiment

Broader technical indicators show mixed signals, with several neutral moving averages and an RSI that is not yet strongly bullish or bearish. This reflects greater market uncertainty in the altcoin segment including HBAR, where upside strength has not always been steady. This confirms that a potential rally remains to be tested by further price confirmation.

The overall crypto market sentiment also affects the movement of HBAR, as altcoins often follow the direction of BTC and ETH amid global volatility. Strong demand for HBAR could be triggered by the technical narrative if investors see short-term upside, but macro market sentiment will play a big role in sustaining the rally.

4. Fundamental Factors and Ecosystem Adoption

In addition to technical aspects, developments in the adoption of the Hedera ecosystem as well as increased network usage could also potentially support the medium to long-term price outlook. Hedera is known for its hashgraph technology focused on transaction speed and security, which continues to attract interest in various enterprise use cases. However, the technical fundamentals of the network need to be accompanied by increased on-chain activity and real adoption to strengthen this bullish narrative.

Long-term price analysis by other sources shows moderate to high predictions of increases from late 2026 onwards, depending on adoption momentum, network management, and market conditions. This shows that short-term and long-term trends can diverge if external factors change.

5. Implications for Crypto Investors

For cryptocurrency investors, the potential rally of Hedera (HBAR) signals an interesting speculative opportunity in the context of altcoins being more volatile than Bitcoin or Ethereum. However, risks remain high due to price dependence on technical breakouts and general market uncertainty. Investors are advised to combine technical analysis with strict risk management and understand the structure of key support and resistance levels before opening positions.

Continuous monitoring of market sentiment, trading volumes, as well as fundamental developments of the HBAR network can help in navigating potential price movements and determining investment strategies according to their respective risk profiles.

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeinCrypto. Hedera (HBAR) Price Breaks Out in Preparation for 60% Rally. Accessed February 16, 2026.