3 Secrets Behind Ethereum’s “Leverage Reset” That Can Make Your Wallet Thick!

Jakarta, Pintu News – Ethereum is currently struggling to break back through the psychological level of $2,000 or around Rp33,774,000 amid global market uncertainty. Although it looks fragile, a recent data from the derivatives market provides a glimmer of hope for investors who are waiting for a revival momentum. A phenomenon referred to as “leverage reset” has just occurred, clearing out high-risk positions and paving the way for a more stable and healthy price recovery in the future.

Binance’s Leverage Ratio Hits a Low Point

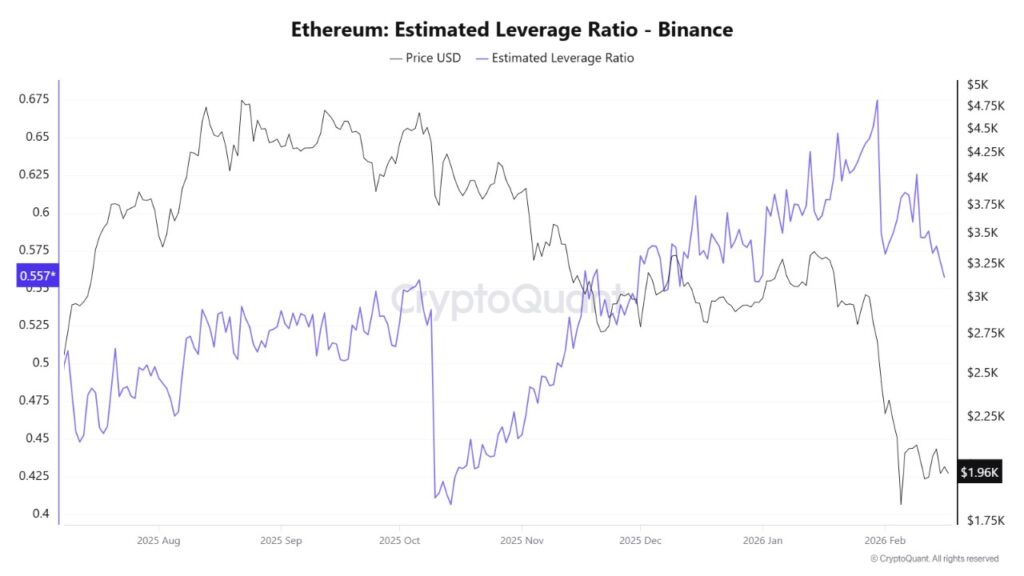

Based on the latest analysis from CryptoQuant, the leverage ratio (Estimated Leverage Ratio) for Ethereum on the Binance exchange has just dipped to 0.557. This is the lowest level since December last year, after peaking at 0.675 when the market was in an aggressive phase. This drop indicates that many traders have closed their high-risk “loan” positions and switched to more conservative investment strategies.

The decline in leverage is not just a normal technical fluctuation, but a reflection of the purging of excessive speculative risk in the market. When leverage is high, prices tend to run wild as it’s easy for mass liquidations to force prices to parachute in a short period of time. With the ratio now lower, Ethereum’s market structure is much more robust as price movements will be driven byreal demand rather than system coercion due to margin failures.

Also Read: Warren Urges Fed and Treasury to Reject Crypto Billionaire Bailout, Afraid to Favor Trump?

Ethereum (ETH) Sets Foundation at IDR 32 Million

Although selling pressure is still present, the price area between $1,900 to $2,000 (approx. IDR32,085,300 – IDR33,774,000) now serves as a short-term stabilization zone. Technically, Ethereum is still below the 200-day moving average line, which is currently a major resistance wall that must be broken to confirm a trend reversal. However, trading volumes that have started to flatten out suggest that the massive distribution or selling phase may be starting to reach saturation point.

For investors, this consolidation phase is often considered a period of “repositioning” before a more decisive directional movement occurs. If Ethereum (ETH) is able to hold above this critical support level, the opportunity for a rebound towards higher price targets will be even wider. Analyst Sebastian Villafuerte emphasizes that this clearing of leverage is a crucial step to create a strong new price base before the cryptocurrency tests the 2025 highs again.

Smart strategies for market recovery

Understanding the dynamics of leverage is very important, especially for first-time investors looking to get into cryptocurrency. Decreasing leverage means there is less risk of a “flash crash” due to chain liquidation, creating a calmer trading environment for spot asset holders. Keep an eye on macro signals and global liquidity, as these external factors still play an important role in determining when bullish momentum will truly return.

For now, the wisest strategy is to keep an eye on the nearest resistance level at $2,020 or equivalent to IDR34,111,740. Consistently breaking through this mark will be a strong signal that buyers are back in control of the market. Don’t forget to always use strict risk management and diversify, so that your portfolio remains safe even though the market is in this challenging transition phase.

Also Read: Tron (TRX)’s Glory in 2026: King of Transactions and Digital Payment Infrastructure

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Sebastian Villafuerte. Ethereum’s Leverage Reset Clears The Path For A Healthy Rebound – Analyst. Accessed February 20, 2026.