Exploring Arbitrum’s Ecosystem Development: Insights and Outlook

Despite the progress made in Zero-Knowledge technology and the recent Optimism update, Arbitrum continues to maintain its dominance in the Layer-2 sector. The Arbitrum ecosystem is expanding rapidly, with several new protocols attracting crypto enthusiasts’ attention. To learn more about the current state of Arbitrum and its potential future development, check out the following article.

Article Summary

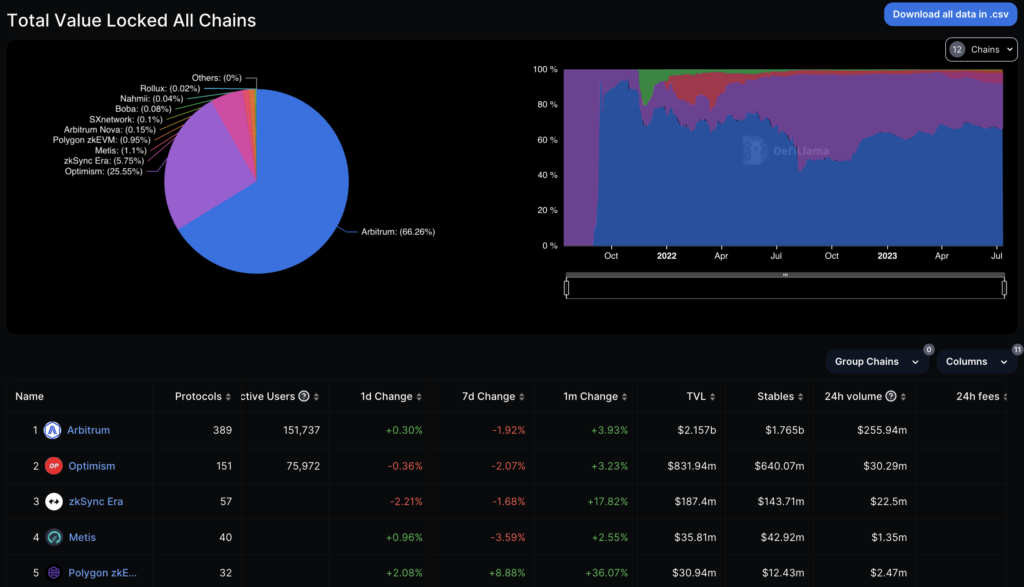

- 🔗 Arbitrum has a total value locked of US$ 2.16 billion, equivalent to 66.27% of the entire layer-2 TVL. Making it as layer 2 with the highest TVL

- 🏆 Post-ARB airdrop, Arbitrum has managed to maintain its dominance. Reflected in the number of transactions, users, and on-chain metrics above the historical average.

- 📊 Arbitrum’s development is inseparable from the presence of new protocols in its ecosystem. Protocols such as Pendle, Camelot, and GND Protocol have recently caught the crypto space’s attention.

- 👀 Arbitrum still has the potential to continue to enlarge its ecosystem and dominance if EIP-4844 or Proto-Danksharding updates are successfully implemented.

Current State of Arbitrum

Arbitrum is a Layer 2 blockchain on Ethereum built by the Offchain Labs team and launched in September 2021. It uses a technology called Optimistic Rollups, which allows it to process a large number of transactions off-chain while maintaining the security and decentralization of the Ethereum network.

Arbitrum is layer-2 with the highest total value locked (TVL), US$ 2.16 billion or equivalent to 66.27% of the entire L2 TVL. Furthermore, there are currently 389 protocols in the Arbitrum network. Making it a network with the most protocols compared to other layer-2 competitors. This figure surpasses some old big networks such as Avalanche, Fantom, and Solana.

Regarding transaction volume, Arbitrum is also the highest among other Layer-2s, with a last 24-hour volume of US$ 255.94 million. Compared to other networks, this amount was only lost to Ethereum (US$ 1.24 billion) and BSC (US$ 523 million). As for the number of users, it has reached 8.3 million.

Read the following article to learn more about the technology and how Arbitrum works.

Arbitrum Ecosystem Development

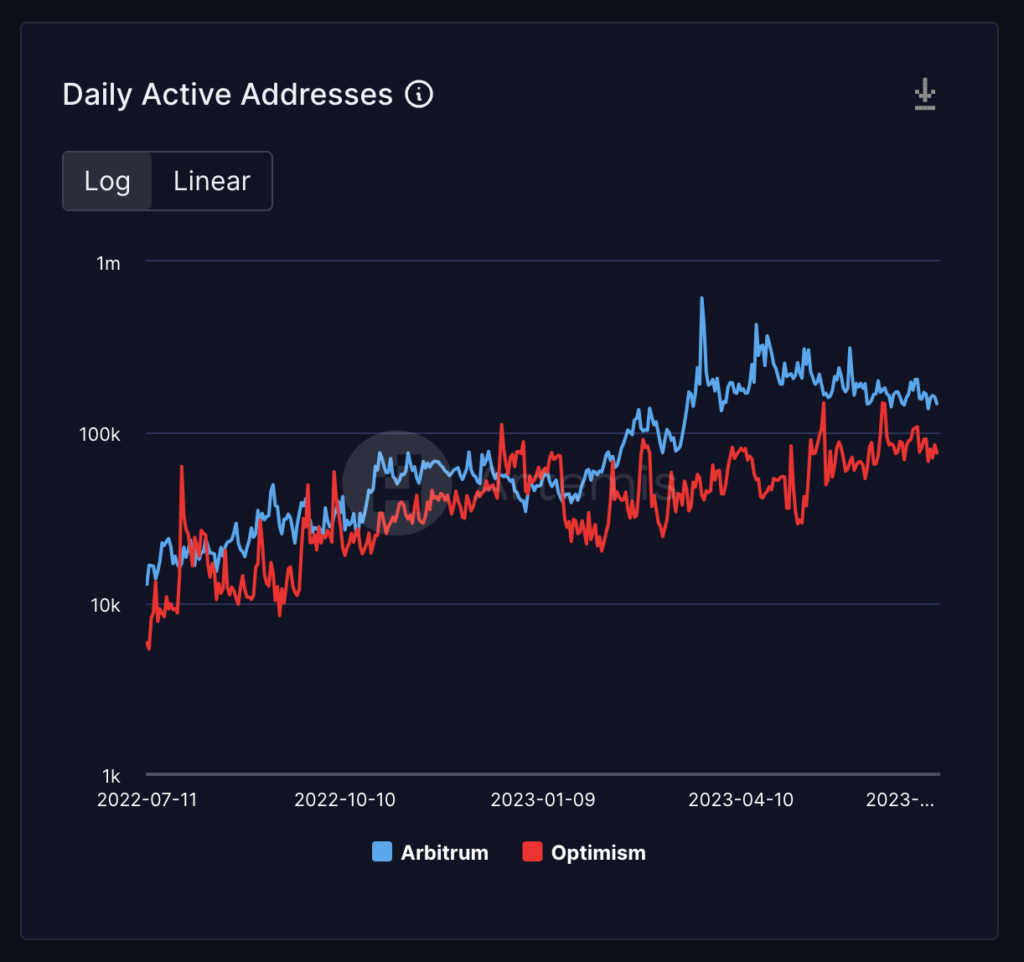

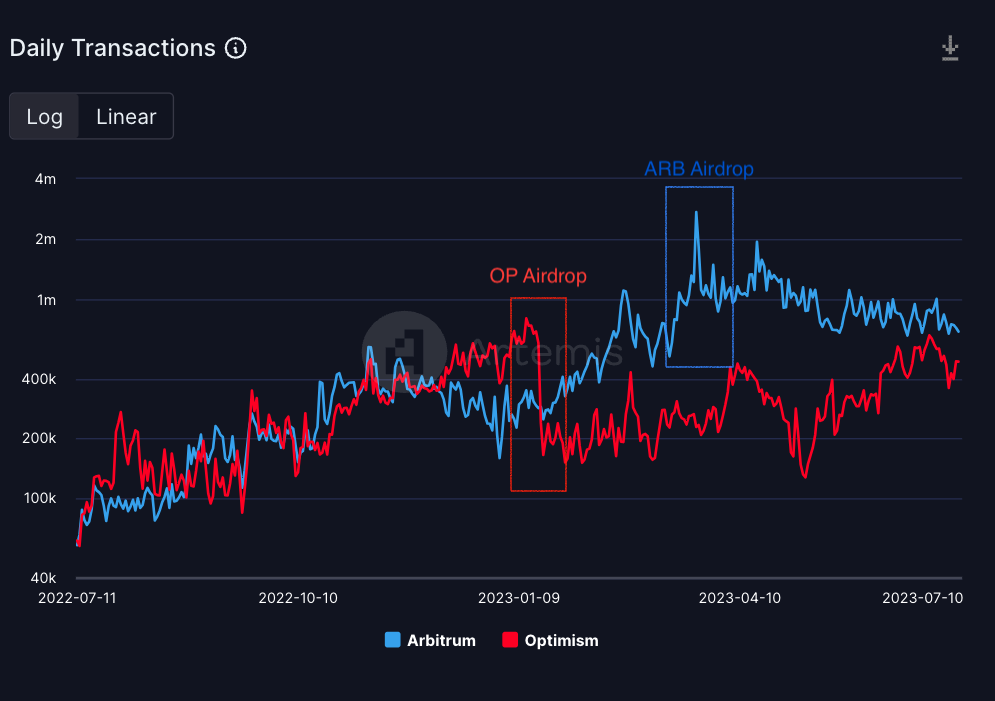

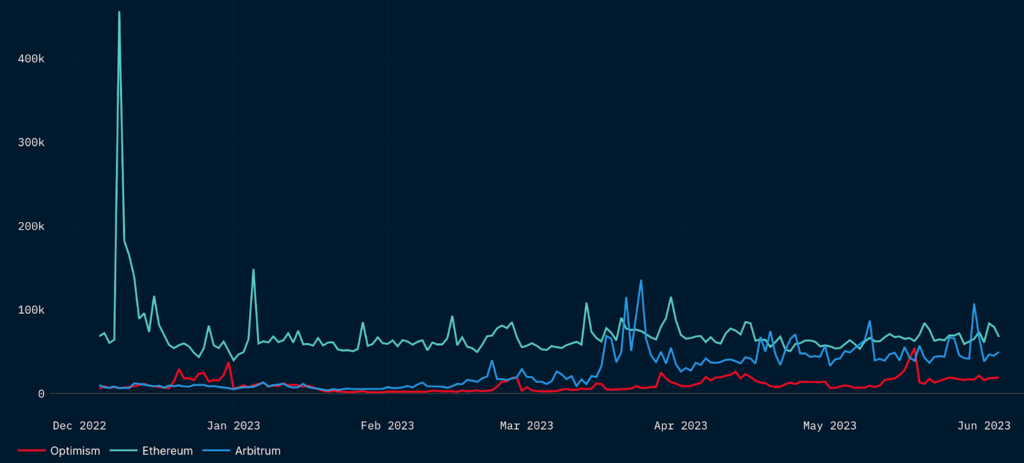

The challenge for new Layer-2 Ethereum networks like Arbitrum and Optimism is maintaining the number of users and transaction rates. The reason is that both blockchains were able to get such rapid growth in users and transactions thanks to incentive programs and airdrops. Inevitably, when the incentives ended, there was concern about the decline in users of each blockchain.

This concern occurred on the Optimism network. The number of Optimism users has decreased after the OP token airdrop and the end of the incentive program earlier this year. This indicates the motives of most users who solely pursue OP airdrops or aim for short-term profits, rather than engaging with the network for long-term reasons.

However, Optimism did not let the decline drag on. The Bedrock upgrade is one of Optimism's efforts to attract users' attention. Find out more about Optimism Bedrock in the following article.

On the other hand, after Arbitrum launched the ARB token at the end of March 2023, the number of users and daily transactions were still maintained. This shows that Arbitrum users have a much better participation rate and organic growth than its competitors.

The growth of the Arbitrum network is also reflected in the number of new wallets making their first transaction in Arbitrum. After reaching its peak level after the ARB airdrop, the number of new wallets has gradually decreased. However, the overall number remains higher than the historical average.

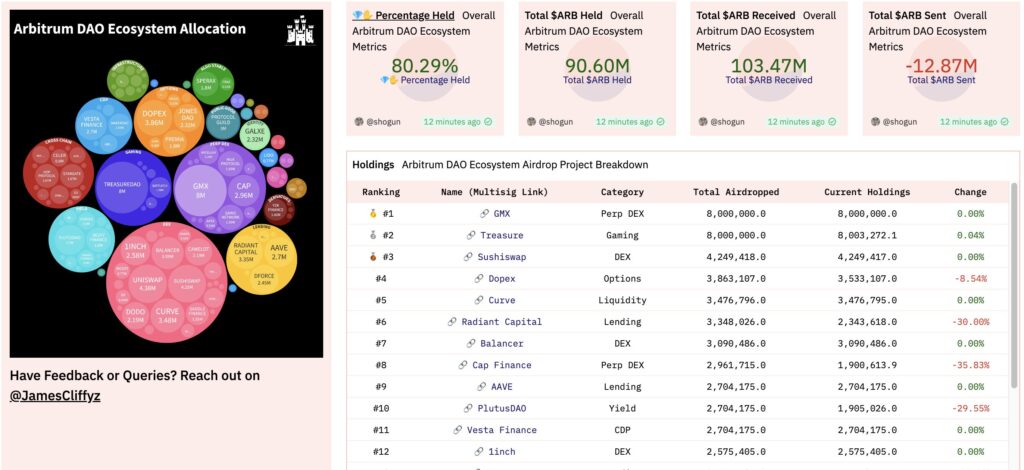

The growth in the number of users, transactions, new wallet creation, and on-chain metrics shows that Arbitrum’s incentive program and ARB launch are much more effective in attracting and keeping users who believe in Arbitrum’s long-term prospects. Castle Capital’s findings also reinforce that as much as 80% of the total US$125 million ARB tokens airdropped to the DAO is still held in each project’s multi-sig.

Find out more about the ecosystem and various applications on the Arbitrum network in the following article.

Applications in the Arbitrum Ecosystem

The rapid growth of the Arbitrum ecosystem in recent times has also grown DeFi applications in it. In addition to big names like GMX, Radiant, and Stargate, here are some DeFi apps that are on the rise in Arbitrum:

Pendle

Pendle is a permissionless DeFi protocol that facilitates tokenizing and trading future yield using an Automated Market Maker (AMM) system. By using Pendle, users can maximize their profits in various market conditions by applying multiple advanced yield strategies.

As seen from the DefiLlama data above, Pendle’s TVL on Arbitrum amounted to US$ 60.84 million as of July 2023. Meanwhile, if you count the TVL on networks other than Arbitrum, the amount reached US$ 136.5 million. Pendle’s interest and users also continue to increase, reflected in the rapid growth of TVL from the beginning of 2023 to July 2023.

Pendle’s primary goal is to provide an ecosystem for users with yield-generating assets to boost their profits and lock in potential gains upfront. In addition, users can also buy assets at a lower price than the market price. This is because Pendle divides yield-bearing assets into principal tokens and yield tokens, lowering the price of principal tokens.

Pendle is one of the protocols predicted to become a leader in this sector. The reason is the innovations made by Pendle are the first and have yet to be done by other platforms. Moreover, Pendle is also multichain. It supports other DeFi platforms, including Ethereum, BSC, and Aave.

Camelot

Camelot is a dual AMM-based DEX that supports volatile and stable swaps. By using Camelot, there is a dynamic directional fees feature that allows users to set transaction fees for each pool when performing swaps. Besides being a DEX, Camelot is also a launchpad for protocols that want to launch on the Arbitrum network.

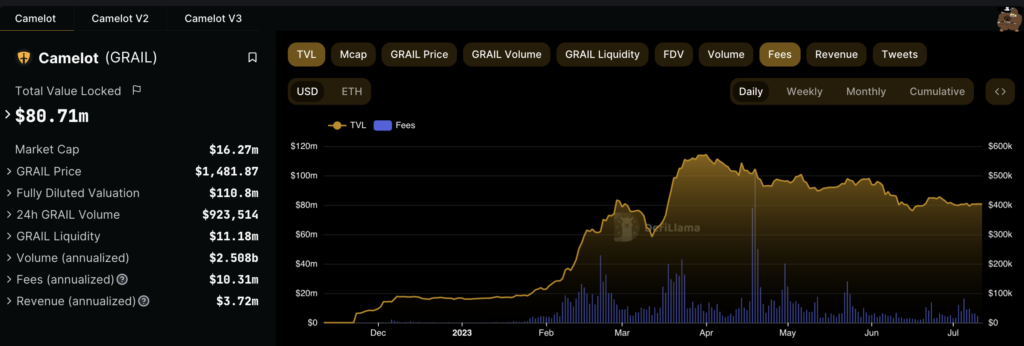

As of July 2023, Camelot has become the fourth largest DEX on the Arbitrum network, with a TVL of US$80.71 million. It is noteworthy that Camelot earned this amount solely by operating on the Arbitrum network, unlike other DEXs such as Uniswap V3, Balancer V2, and Curve, which operate on at least five networks.

However, the standout feature of Camelot is its new liquidity approach based on non-fungible staked positions (spNFTs). So, once a staked position’s LP belongs to those listed pairs, the spNFT starts generating yield with rewards from the Camelot. Thus, users will not only be rewarded according to their staked tokens but will also get GRAIL and xGRAIL tokens.

GND Protocol

GND Protocol is one of the dark horses in the Arbitrum network. Newly launched in early May 2023, GND Protocol managed to attract the crypto community’s attention. This is reflected in their TVL, which has reached US$ 39.85 million in just two months.

GND Protocol currently has two main products, namely yield-bearing and revenue-generating sources. GND Protocol’s first product is $gmUSD, the first fully stablecoin-based yield-bearing ($gDAI and $gmdUSDC). The supply of $gmUSD is backed by a minting protocol within the Protocol Smart Arbitrage Leverage Mechanism (PSALM). As a yield-bearing asset, the value of $gmUSD can be appreciated by 15-25% annually.

The second product is GND Farm, where users can become liquidity providers of various pairs and earn competitive yields. Since its launch, GND Farm now has more than 35 farms.

The Future of Arbitrum

Arbitrum is a dominant player in the L2 sector, but there is always room for improvement. In terms of transaction fees, for example, although they are already much lower than Ethereum, they can still be even more affordable. The EIP-4844 or Proto-Danksharding update will play a crucial role in achieving this goal.

Simply put, Proto-Danksharding is an update that introduces a blob transaction type, also known as a blob-carrying transaction. In the future, blob-carrying transactions will be processed separately so that Proto-Danksharding will lower all rollup transactions.

Thus, the fees developers running L2 like Arbitrum have to pay will be cheaper. Lower transaction costs could also attract more users and development teams to Arbitrum. Solidifying its position as a market leader in the L2 sector.

You can learn more about EIP-4844 or Proto-Danksharding and its various impacts in the following articles.

The Arbitrum development team is currently focusing on building its infrastructure by developing Arbitrum Orbit. This Layer-3 platform is designed to operate on top of Arbitrum, enabling the development team to have flexibility in creating Layer-3 solutions by modifying the scalability aspect through Arbitrum Rollup and ensuring security through Arbitrum Anytrust.

If you choose Arbitrum Rollup, then the L3 will have characteristics like Arbtrum One, which prioritizes security, but scalability is also solved quite thoroughly. Meanwhile, if you select Arbitrum Anytrust, the L3 will have attributes like Arbitrum Nova, which focuses on scalability with extreme speed and comes with almost zero cost but a little security trade-off.

The following article will help you understand more about layer-3 and other layers on the blockchain.

How to Buy ARB Token on Pintu?

You can start investing in ARB by buying it in the Pintu app. Here’s how to buy crypto on the Pintu application:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for ARB.

- Click buy and fill in the amount you want.

- Now you have ARB as an asset!

In addition, the Pintu application is compatible with various popular digital wallets such as Metamask to facilitate your transactions. Go and download the Pintu cryptocurrency app on Play Store and App Store! Pintu is regulated and supervised by CoFTRA and Kominfo.

You can also learn more crypto through the various Door Academy articles which are updated every week! All Pintu Academy articles are for educational purposes, not financial advice.

Reference

- Chase Devens, Inside the Arbitrum Ecosystem Boom, Messari, accessed on 10 July 2023.

- Amir Ormu, What did DAOs do with their $ARB airdrop? The Castle Chronicle, accessed on 10 July 2023.

- Darren Lim, A Look into Arbitrum After the Airdrop, Nansen, accessed on 11 July 2023.

- Stephanie Dunbar, Ecosystem Brief: The Convergence of Optimistic and Zk Solutions, Messari, accessed on 11 July 2023.

- James Chung, Pendle: A Yield Derivatives Layer for DeFi. Consensys, accessed on 11 July 2023.

- Chain Debrief, All You Need To Know About GND Protocol, accessed on 11 July 2023.

- Christine Kim, Proto-danksharding: What It Is and How It Works, Galaxy Research, accessed on 12 July 2023.

- Coincu, Arbitrum Orbit, First Visualization Of Layer 3 Concepts, Coin Market Cap, accessed on 12 July 2023.

Share