Understanding Blockchain Layer

Blockchain technology is a combination of various technologies such as mathematical algorithms, cryptography, and encryption-decryption. This combination created the distributed ledger technology we know today. In the process of operationalizing the blockchain, there are several layers each with different roles. Apart from that, you may also have heard of the term blockchain layer 1 or 2 which refers to the function of each blockchain. This article will explain what blockchain layers are, their respective functions, and explain their differences.

Article Summary

- ⚙️ Blockchain uses a layer system so that the system is not centralized in just one entity. All layers have different roles that are equally important for a decentralized network.

- 🧰 There are five layers that act as the technological infrastructure of a blockchain network. From the very foundation to the outside: Infrastructure and hardware layer, data layer, network layer, consensus layer, and application layer

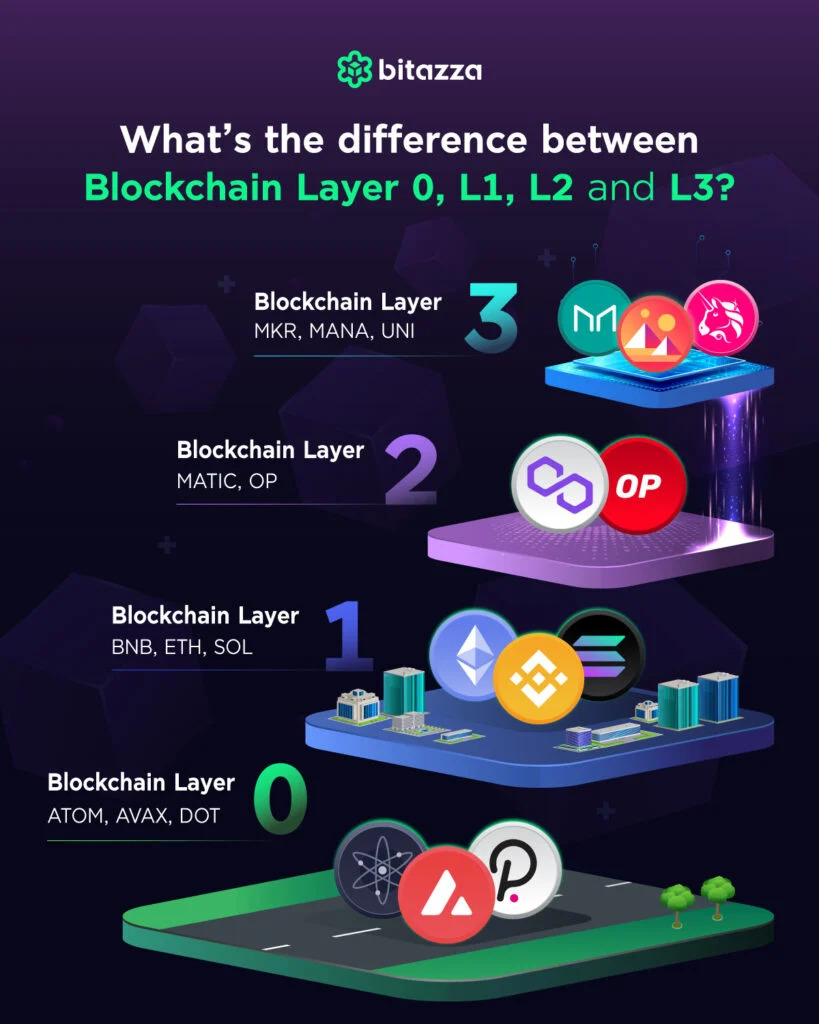

- 🧠 In addition to the existence of a layer system in blockchain, the term layer is also for discussing types of blockchains based on their functions and capabilities. In general, there are four layers, namely layers 0, 1, 2, and 3.

What are Layers in Blockchain?

Blockchain Layer is a combination of several technologies that ensure the blockchain network can operate optimally. So, these technologies form tiers like a building, where each level manages a specific function.

Then, why does the blockchain need to use different layers? This relates to the decentralized nature of blockchain where no single entity rules everything. Thus, network functions are spread over several layers. This separation helps improve a blockchain’s decentralization, speed, and security. These three aspects are the Blockchain Trilemma.

Additionally, you can read more about what the Blockchain Trilemma is and why it is important in the article “What is the Blockchain Trilemma?”.

Blockchain Trilemma is a problem faced by all blockchains. Basically, a blockchain has to prioritize between three aspects of the trilemma and sacrifice one of them. Blockchain technology is still far from achieving a balance between the three aspects of decentralization, security, and scalability.

Understanding Blockchain Layer

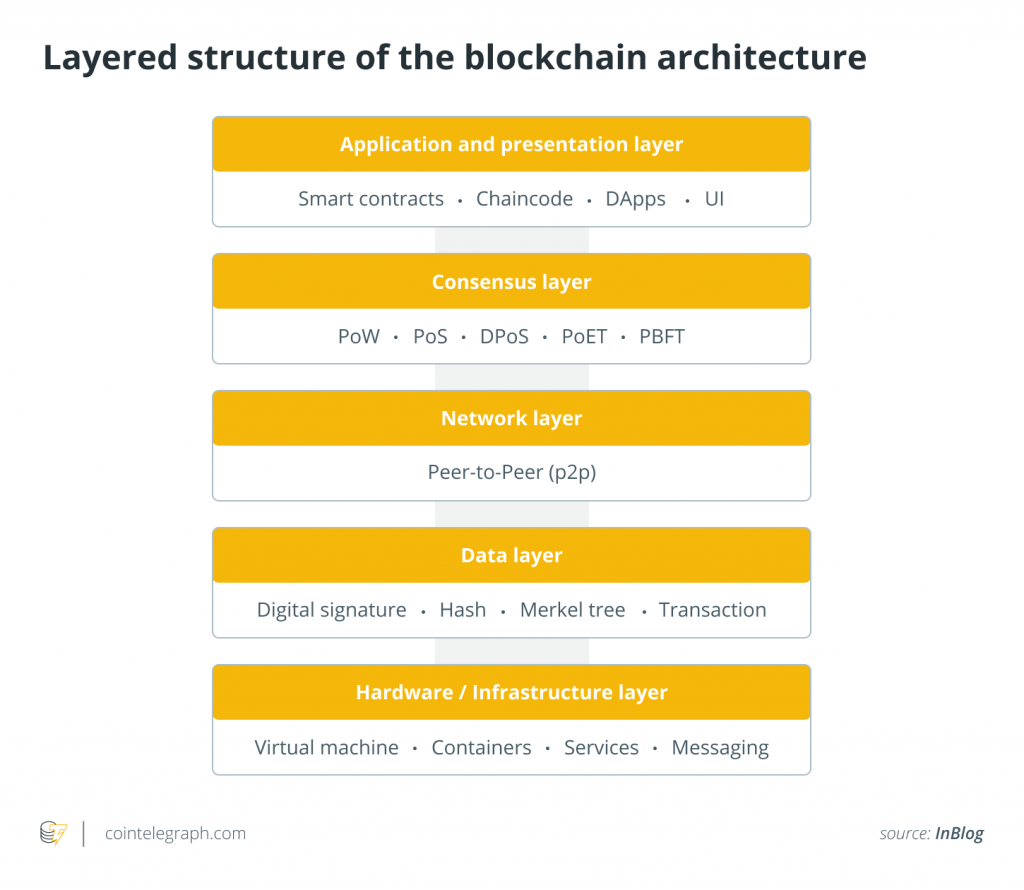

In general, there are five blockchain layers that ensure a decentralized network functions optimally. These five layers are stacked with the infrastructure layer as the foundation and the application layer in the top.

1. Hardware and Infrastructure Layer

The blockchain infrastructure layer is the various hardware that helps run the network. This layer consists of all the node computers that store blockchain network data. Hundreds of these nodes connects to each other in a decentralized peer-to-peer (P2P) network. So, all these nodes form a decentralized network that operates 24 hours.

The infrastructure layer of each blockchain has different specifications depending on the needs of the network. Bitcoin nodes will be more complex and powerful than other blockchains because they require more computing power.

Moreover, unlike a centralized network, the nodes running the blockchain are all over the world. Even though they are spread out, all nodes are connected live and exchange information simultaneously to process all transactions on the network.

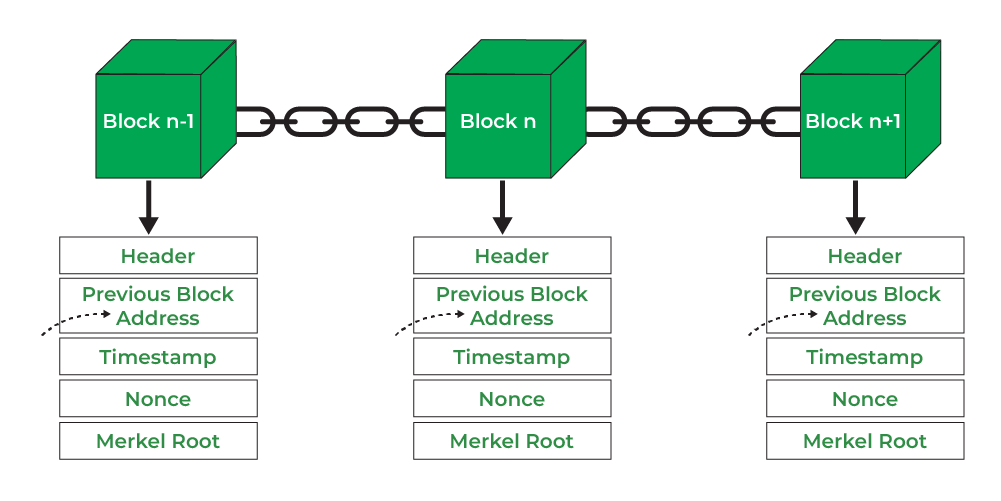

2. Data Layer

The data layer is the blockchain layer in charge of storing transaction data since the first block (genesis block). All information about blocks, transactions, and block sequences is stored in this layer. Apart from that, sensitive information such as previous block hashes, time stamps, and Merkle roots store transaction data.

This layer is also in charge of verifying incoming transactions by requesting a digital signature on each transaction. This is part of the encryption process that keeps all crypto transactions safe. Only users with access to a private key in a crypto digital wallet can sign the signature. So, you will be familiar with this process if you have ever used a digital wallet like MetaMask.

3. Network Layer

The network layer in the blockchain performs a peer-to-peer (P2P) function. The network layer in the blockchain facilitates communication between all nodes. In addition, the network layer manages the creation and addition of blocks. This makes the network layer often referred to as the propagation layer. The network layer also ensures nodes can communicate with each other to process transactions and add blocks.

MEV or Maximal Extractable Value is one of the strategies of nodes to gain profits when producing blocks on the blockchain. So, MEV occurs at the network layer because nodes can reorder transactions and blocks to get the maximum benefit from user transaction fees. MEV often has a negative impact on users.

4. Consensus Layer

The consensus layer is an important layer in the operation of the blockchain. This layer is an important foundation in creating a decentralized network. So, without a consensus layer the blockchain network cannot verify transactions and no blocks can be validated. The main task of the consensus layer is to validate and sequence blocks and ensure all nodes reach an agreement on which blocks should be added. If several blocks are created simultaneously due to network congestion, the consensus layer ensures that only one block is added to the network.

Blockchain protocols set the criteria for reaching a consensus. Every blockchain has different requirements for this. Additionally, this layer is also often called the consensus mechanism.

In addition, many new blockchain generations are adding technologies to speed up the block validation process such as Fantom’s implementation of aBFT, Cardano’s DPoS, and NEAR’s Sharding.

5. Application Layer

The application layer in the blockchain contains various protocols and technologies that users directly interact with. However, this layer can be further divided into execution layer and application layer. User Interfaces (UI), APIs (application programming interfaces), and scripts are the application layers. Meanwhile, smart contracts, protocol regulations, and the code behind the application are the execution layer that executes commands from the application layer.

Furthermore, application layer will usually have a UI like the sites we usually find. This is specifically useful for users who have never use crypto applications.

Blockchain Categories Based on Layers

You must have heard the term blockchain layer 1, 2, and even 0. The naming of a blockchain based on this layer is different from the explanation of the 5 layers of blockchain architecture described above. The categorization of layers below is related to the capabilities and functions of a blockchain.

Layer 0

Layer 0 is a category of blockchains that gives the development team the tools to build other blockchain networks on top of layer 0. In other words, a layer 0 blockchain can become a platform for any number of other blockchains built on top of it. It is usually the technology and software (which is open source) that other development teams can use.

Examples of blockchain networks at layer 0 are Avalanche, Cosmos, and Polkadot. Additionally, Cosmos and Polkadot have a special system that regulates the blockchain ecosystem on it (Parachain for Polkadot and Zones for Cosmos).

Layer 0 blockchain has an important role as a network layer that connects blockchain within its ecosystem to other blockchain ecosystems. It is an interoperability technology that will always be needed as more blockchains are built.

The function of layer 0 is to provide the software and technology infrastructure so that all the blockchains on it can work simultaneously and interact with each other. In this context, layer 0 provides the network layer technology and infrastructure for blockchains within its ecosystem.

Layer 1

Layer 1 blockchain is a decentralized platform that has the 5 blockchain layers described above. Additionally, the function of layer 1 is to facilitate various types of transactions and ensure that the network is secure. The majority of layer 1 now has smart contracts that allow other applications and protocols to exist on top of them. Therefore, one of the characteristics of a layer 1 blockchain is having a DApps ecosystem (decentralized application). Examples of blockchain networks at layer 1 are Bitcoin, Ethereum, Cosmos, and Solana.

One blockchain that does not have a smart contract feature is Bitcoin because it is still faithful to Satoshi Nakamoto's original design as a P2P payment platform.

As explained earlier, every blockchain faces problems in the blockchain trilemma (decentralization, scalability, and security). One of the most frequently encountered problems is scalability. Currently, blockchain has limited transactions that can be processed at one time (TPS).

Various solutions are developed to overcome this problem such as sharding technology, innovation in consensus layer, and using blockchain layer 2.

Layer 2

Layer 2 blockchain is a blockchain that solve the problems that arise at layer 1. This technology is exist on top of the layer 1 network to address scalability issues. So, layer 2 blockchains offer fast transaction processing and much cheaper transaction fees than layer 1. However, some layer 2s are now bringing a variety of new technological innovations and have unique value offerings regardless of the underlying blockchain network.

One of the advantages of a layer 2 blockchain is that it still gets the security of layer 1 above it. So, it combines faster transaction processing and lower transaction fees but inherits the security of layer 1. Some examples of blockchain networks at layer 2 are Polygon, Arbitrum, Optimism, Loopring, and Aurora.

Layer 3

Layer 3 is a special layer in the blockchain infrastructure that deals with decentralized applications. The term layer 3 is actually still on debate. Basically, layer 3 is the layer where crypto applications operate, whether it’s on top of layer 1 or 2 blockchains (or even on its own blockchain). The function of layer 3 is to carry out all transaction activities that occur in the application. Some examples of layer 3 are UniSwap, AAVE, Curve, and STEPN.

The layer 3 application industry is dominated by the DeFi (Decentralized Finance) industry containing Decentralized Exchange (DEX) applications. In addition, many new types of applications have emerged such as Chiliz with a fan token ecosystem, STEPN as a pioneer of the move-to-earn (M2E) scheme, and the GameFi ecosystem that continues to grow.

In addition, there is a layer 3 trend whereby crypto applications are considering creating their own blockchain platforms. This type of blockchain is commonly called appchains (application-specific blockchains) because the network is made specifically to fulfill an application function. Some examples of appchains are DeFi Kingdoms, dYdX, Osmosis, Acala, and Thorchain.

Appchains themselves cannot be fully called a layer 3 blockchain because some of them fulfill the capabilities and perform the functions of a layer 1 blockchain.

Buying Cryptocurrencies in Pintu

You can start investing in cryptocurrencies by buying them in the Pintu app. Here’s how to buy crypto on the Pintu application:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for your favorite crypto assets.

- Click buy and fill in the amount you want.

- Now you have crypto as an asset!

In addition, the Pintu application is compatible with various popular digital wallets such as Metamask to facilitate your transactions. You can download the Pintu cryptocurrency app on Play Store and App Store! Pintu is regulated and supervised by CoFTRA and Kominfo.

You can also learn more crypto through the various Door Academy articles which are updated every week! All Pintu Academy articles are for educational purposes, not financial advice.

References

- A beginner’s guide to understanding the layers of blockchain technology, Coin Telegraph, accessed on 13 December 2022.

- A Beginner’s Guide to Understanding the Layers of Blockchain Technology, Blockchain Council, accessed on 13 December 2022.

- Layer 1 v. Layer 2. Hedera, accessed on 14 December 2022.

- Harshana Serasinghe, What are Layer 0, 1 & 2 Blockchains?, Medium, accessed on 14 December 2022.

- What’s the difference between blockchain layers L0 and L1?, Coin Telegraph, accessed on 15 December 2022.

- Dmitriy Berenzon, Application-Specific Blockchains: The Past, Present, and Future, 1kxnetwork Medium, accessed on 16 December 2022.

Share