Long-Term Investment vs Trading: Which is Better?

People can make huge profits from trading crypto assets. But is turning a profit an absolute necessity in trading? Definitely not. While the opportunity for significant gains exists, traders must also confront the reality of possible losses, which might even surpass their profits. On a parallel note, investors aren’t exempt from these risks either, although they might have a relatively better grasp on managing them in certain cases. This brings up a fundamental query: Does long-term investment better than trading? In this article, we’ll explore the dynamics between trading and investing in crypto space and five things you can do for long-term investment.

Article Summary

- 📈 Trading involves buying and selling crypto assets in the short term for quick profits, while long-term investing refers to buying assets with the hope that their value will increase over time.

- 🤑 Success stories of trading on meme tokens show the potential for huge profits but are often not balanced with the risk disclosure of possible losses.

- 💰 The experiences of professional traders who have suffered huge losses remind us of the need for long-term investments to reduce risk.

- 🙌 Important steps in investing involve portfolio diversification, price monitoring, precise goal setting, exit strategies, good risk management, and vigilance against external influences.

Understanding Trading and Investing

What are trading and investing in the crypto space? Trading involves buying and selling crypto assets in the short term to profit from rapid price movements.

On the other hand, long-term investing refers to buying and holding crypto assets with the expectation that their value will increase over time. While quick profits often drive trading, long-term investing is characterized by stability and less dependence on daily price fluctuations.

There are several types of trading strategies that traders implement, such as arbitrage, day trading, scalping, swing trading, and position trading. You will find out more in this article as you read along.

HODL and DCA (Dollar Cost Averaging) are some crypto investment strategies we often hear about. HODL is the decision to hold on to crypto assets rather than sell them. While, DCA is a strategy of buying crypto assets regularly regardless of the price. Theoretically, DCA helps to average out prices over time and reduce the impact of volatility on an investment portfolio.

Are Losses a Common Companion in Your Trading Journey?

Trading is like a battle game between individual or retail traders and trading firms. These firms have access to extensive information, use sophisticated trading bots created by the best analysts, and even utilize artificial intelligence algorithms.

Meanwhile, retail traders look for signals to trade crypto assets from various sources. It includes personal knowledge, such as technical analysis, market analysis, and information from social media, such as Twitter. In this case, analytical skills and deep understanding are essential in making trading decisions.

There have been cases of people earning life-changing money by trading on PEPE or UNIBOT tokens. Even in the case of the BALD token, someone made 1,000 times that in a single trade. But he wasn’t a random guy. He searched for a contract deployed by whales on the new network (Base) that could increase his liquidity. As such, this success illustrates the commitment and deep analysis required to achieve great results in crypto trading.

Aside from the news of huge profits, not much is actually revealed about how much other traders have lost.

The world of trading is an environment full of challenges and opportunities. There is both profit potential and risk involved. Success in trading requires a knowledge-based approach, analysis, risk management, and discipline. Without extensive knowledge, trading crypto assets can be considered gambling.

Also read Coin Meme Season: How to Avoid the Meme Coin Trap.

Trading: Does Profit Always Follow?

When you make big profits from trading crypto assets, it’s natural to feel confident in your ability to generate substantial profits. Given the evidence of your successful trading history, you may even think of yourself as a professional. However, the more confident you are, the bigger the risk of losing money. As a result, losses are inevitable.

A crypto trader, Stacy Muur, shared her trading experience on her Twitter account. In 2018 and 2019, she actively traded on BitMex. She even hired a trader analyst to help her. In 2018, she made a profit of 16,000 US dollars. However, in 2019, he lost more than 30,000 US dollars.

From that experience, we can learn that instead of trading large amounts aggressively (all in), it’s wiser to try a long-term investment strategy. This strategy has the potential to be profitable in the long run but requires a lot of patience.

5 Tips for Long-Term Crypto Investments

Here are five things you can do to make long-term crypto investments:

1. Portfolio Diversification.

One of the basic principles in investing is portfolio diversification. In this case, you can allocate some of your funds to various crypto assets with long-term growth potential. It will help reduce risk as you are not stuck with one type of asset.

Stacy Muur shares her portfolio breakdown as follows:

- 50% of the fund is allocated to stablecoins.

- 40% for long-term positions with different risk or profit profiles. It includes coins with strong fundamentals that have great potential in the future.

- 5% for short-term trading with Stop Loss (SL) and Take Profit (TP) options.

- 5% for degening.

Degening is derived from the word "degenerate." In the crypto context, degening is used to describe highly speculative and high-risk behavior. People who are degening may be involved in newly launched tokens or highly volatile assets.

2. Monitor Entry and Exit Prices Thoroughly

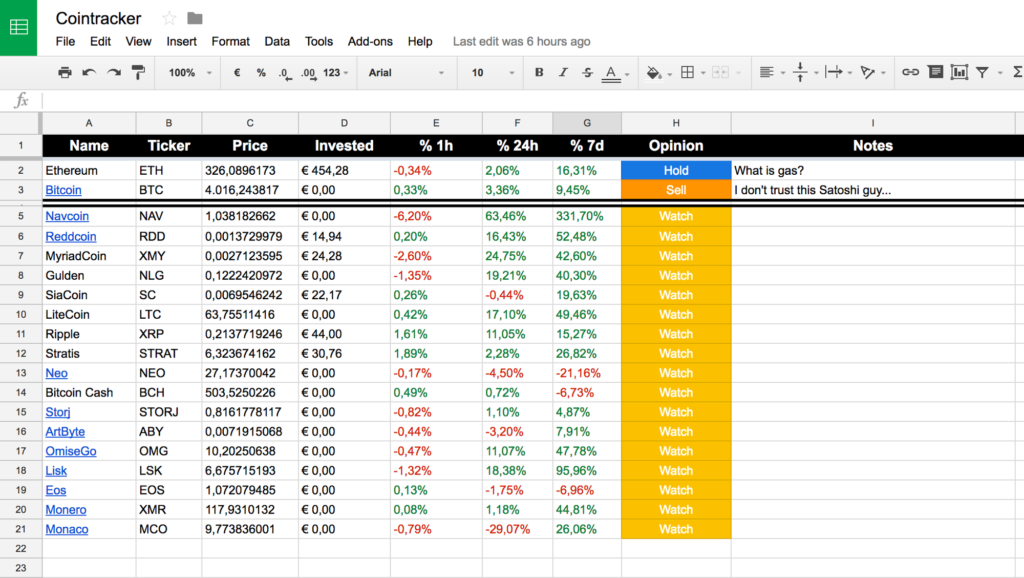

Recording the entry and exit prices of each investment is a key step in monitoring the performance of your portfolio. By having detailed records, you can easily track the profits and losses of each asset, as well as analyze the reasons behind the results.

You can use portfolio tracking apps, such as CoinTracker, CoinStats, CoinMarketCap, and others. In addition, you can also use a spreadsheet to record all entry prices, fees (gas fees), and average entry prices (if you buy crypto assets multiple times).

Read more in the Crypto Trading Journal article: A Trader’s Essential Journal.

3. Set Goals and Exit Strategy

Before you invest, set your goals. Are you aiming for growth up to several times the initial investment, or are you more interested in passive income? Also, make sure you have a well-defined exit strategy. It helps you to secure your assets once you reach your target.

For example, you can define your exit price from the beginning on short-term trades. When your asset makes three times the profit, you can exit. It doesn't matter if the asset continues to grow.

4. Protect Investments with Risk Management

Risk management is an essential factor in long-term investing. Allocate a small portion of your portfolio to actively trading or making riskier investments. While the majority of assets remain directed towards more stable, long-term investments. It helps you protect your capital from potential significant losses.

5. Avoid Excessive External Influences

Finally, keep yourself away from excessive external influences. Don’t get too hung up on social media trends or influencers’ recommendations. Making investment decisions based on rational research and analysis is important, not emotions or FOMO (Fear of Missing Out).

When crypto influencers promote a token, they have most likely bought it at a price lower than your entry point. When you start buying tokens that are rising in price, you may become their exit liquidity.

Conclusion

Trading involves the quick buying and selling of crypto assets for instant profits, while long-term investments focus on the growth of assets over time. While successful trading implies the potential for large profits, it also carries a high risk of loss.

Portfolio diversification, price monitoring, a clear exit strategy, risk management, and avoiding external influences are wise steps in potentially achieving stable investment success in the dynamic crypto asset environment.

To make long-term investments, Pintu has staking and earning features that allow you to earn passive income. You can invest in coins with strong fundamentals, such as ETH, SOL, and other coins, while benefiting from the interest earned and the potential increase in coin value.

Buying Crypto Assets on Pintu App

You can invest in crypto assets such as BTC, ETH, SOL and others without worrying about fraud on Pintu. In addition, all crypto assets on Pintu have passed a rigorous assessment process and prioritize the principle of prudence.

The Pintu application is compatible with various popular digital wallets, such as Metamask, to facilitate transactions. Download the Pintu app on Play Store and App Store! Your safety is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

In addition to making transactions on the Pintu app, you can also learn more about crypto through various Pintu Academy articles that are updated weekly! All Pintu Academy articles are created for educational and knowledge purposes, not as financial advice.

Referensi

- Marcel Deer, Crypto trading vs. crypto investing: Key differences explained, Cointelegraph, diakses 24 Agustus 2023.

- Stacy Muur, If you trade, you lose. If you invest, you win, Twitter, diakses 24 Agustus 2023.

- Kristin McKenna, Trading Vs. Investing: Which Is Better For Long-Term Goals? Forbes, diakses 24 Agustus 2023.

- CNBCTV18, Crypto investing vs trading: What suits you better, CNBC, diakses 14 Agustus 2023.

Share

Related Article

See Assets in This Article

0.0%

AI Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-