What is Crypto Trading Journal?

Whether you’re just starting or have been trading for a while, a crypto trading journal is an essential tool to have. Keeping track of all your transactions allows you to monitor your performance and evaluate your decisions. In this article, we’ll explore why having a crypto trading journal is crucial and provide tips on creating one.

Article Summary

- 📖 A crypto trading journal is a detailed record that documents all your crypto trading transactions.

- It helps us to think and make decisions logically and systematically. It also serves the purpose of tracking the performance of each transaction and analyzing each decision made.

- 🔧 You can create a crypto trading journal manually using spreadsheets or utilize online apps specifically designed for this purpose.

- 🚨 Maintaining a crypto trading journal requires dedication, consistency, and analytical skills. Furthermore, additional costs are involved in having a more effective and practical crypto trading journal.

What is Crypto Trading Journal?

A crypto trading journal is a detailed record of every transaction we have made. It can contain details such as the date & time of the transaction, the token traded, the buy & sell price, the transaction amount, and the result (profit or loss).

Beyond quantitative data, qualitative information can also be included in the journal. This includes factors such as market conditions during trade execution, employed strategies, and the rationale behind each transaction.

In essence, a crypto trading journal is a trader’s diary. As a diary, a crypto trading journal can help us track the performance of each transaction to analyze every decision made.

By analyzing the notes in the crypto trading journal, traders can gain insight into why the transaction succeeded or failed. Then, the analysis results can be used as provisions and considerations in the future.

Making a crypto trading journal doesn’t mean you must keep and record a ledger manually. You can create one using spreadsheets, or you can use a paid crypto journal trading platform.

The following article will help you to understand more about crypto trading

Why Should You Use a Crypto Trading Journal

Setting up and keeping a crypto trading journal is time-consuming and requires discipline. However, an undisciplined trader will never make a profit. Therefore, preparing a crypto trading journal is one way to practice your discipline. After all, the more regularly a trader fills out his journal, the more his skills will be honed.

Given the volatile and dynamic nature of the crypto market, impulsive and unstructured decision-making carries a high risk. A crypto trading journal can help us to think and make decisions logically and systematically. This can be learned from every transaction that has been made.

Therefore, the primary use of a crypto trading journal is to keep track of the trades you make, starting from what the performance has been like so far and what the market conditions are at that time. You can also note why your transactions are performing as they are.

By tracking and taking notes of each transaction, you can use it to evaluate. From the various transactions you make, insights such as why you made certain decisions, whether they were right or wrong, and multiple patterns can be identified. These insights can also be used to develop trading strategies in the future.

A crypto trading journal also helps traders manage risk by preventing over-trading. Having too many open positions makes monitoring more difficult, which can lead to losses. Knowing how many positions are currently open and their performance can prevent over-trading.

Pros and Cons of Using a Crypto Trading Journal

The Pros

- 🔍 Evaluate trading performance. A trading journal displays a record and history of all transactions to show whether you have made the right or wrong decision. It makes you more accountable for every decision you make.

- ♟️ Helps with strategy creation. With the evaluation results, traders can identify patterns and determine the most suitable strategy. It also helps traders find various mistakes that have been made so that they can avoid them in the future.

- 👀 Improving discipline and emotional control. The routine and consistency of filling out a journal make traders more disciplined. At the same time, it minimizes impulsive decision-making.

The Cons

- ⌛ Requires dedication and consistency. Creating and using a trading journal can be time-consuming, making it impractical for some.

- 💸 Requires additional costs. If you don’t want to go through the hassle, getting the most effective and practical trading journal can cost extra.

- 🔬 Analytical skills are required. A trading journal will be meaningless if traders cannot analyze and draw conclusions from them.

Besides the trading journal, the whale tracker is another tool you can use when trading. Find out more information here.

How to Make Crypto Trading Journal

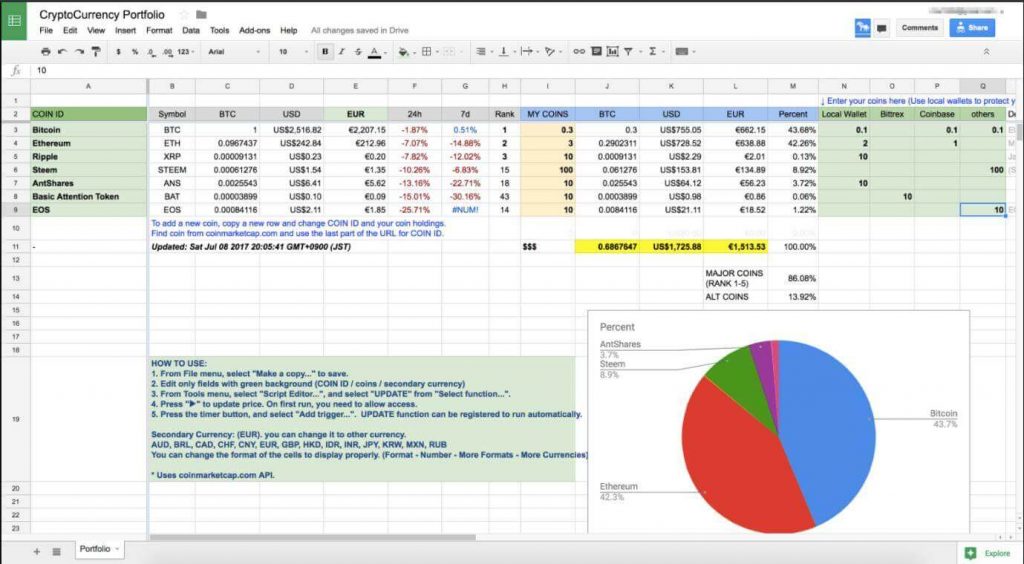

Nowadays, several platforms provide paid crypto trading journals with various features. However, making a trading journal is quite simple for those who don’t want to spend extra money.

You only need to prepare a spreadsheet like Microsoft Excel or Google Sheets. You only need to create columns containing various components and indicators. You can also use Microsoft Word or Google Docs to take extended notes.

The following is an example of a crypto trading journal, along with commonly used indicators and their explanations:

| Time and Date of Transaction | Transaction Type | Asset | Transaction Values | Entry Price | Exit Price | Stop Loss | Result | Result in Percentage | Notes |

|---|---|---|---|---|---|---|---|---|---|

| Date and time you made the transaction | Whether you are going long or short | The crypto asset you are trading | The total value of transactions made | Price at the time of purchase | Price at the time of selling | Target price if the trade does not go as intended | Trading results whether you profit or lose | What percentage of profit or loss | Extended notes on market conditions, reasons for cut loss or sell, strategy, etc. |

| 5-June-2023 15.00 WIB | Long | ETH/USD | US$ 3.500 | US$ 1.650 | US$ 1.900 | US$ 1.500 | Profit | 15,15% | Blackrock’s Bitcoin ETF Positive Catalysts |

| 4-June-2023 12.00 WIB | Long | ARB/USD | US$ 1.000 | US$ 1,20 | US 1,00 | US$ 1,00 | Loss | 16,67% | SEC vs CoinBase Drama |

Keep in mind this journal is customizable and is only an example. The journal can be created differently according to your needs or trading style.

Apart from the components mentioned above, some technical indicators are often added to the crypto trading journal. These indicators can help traders identify patterns and trends in the market through the trading journal. Here are some of the components that you can add:

- Trading volume. The number of crypto assets traded during your trade.

- Volatility. The rate at which the price of a crypto asset fluctuates during your trade.

- Moving Averages. The average price movement of a crypto asset during your trading.

- Support and resistance levels. The historically strongest support and resistance points for the crypto asset you are trading.

Crypto Trading Journal Platform

If you find it difficult to keep a journal in Excel or Google Sheets, here are some online crypto trading journal platforms that you can use:

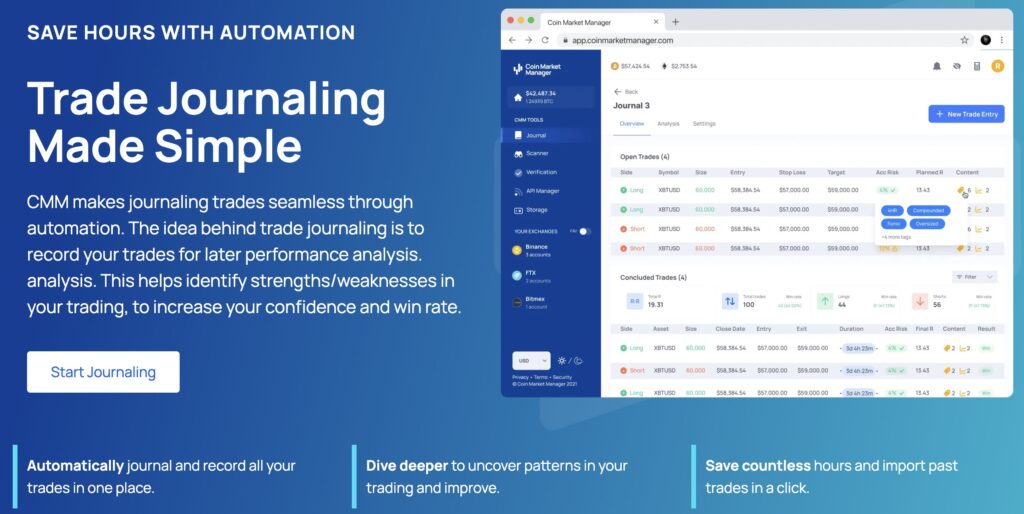

Coin Market Manager provides a range of helpful features to assist traders in managing their transactions. These include importing trading data from exchanges, charting, taking detailed notes, and downloading reports. Additionally, users can manually create trading journals using the various tools and analytics available on the platform.

Another excellent feature is the real-time display of crypto price features and performance. Even data on which crypto is being actively traded can also be seen. Coin Market Manager can be used for free, but users must pay a monthly subscription fee of US$ 69.99 to get more exclusive features.

2. TraderSync.

TraderSync is specifically designed to help investors record and track their transactions. Users can enter data manually or import CSV data. However, Trader Sync is not specialized for crypto, and it can also be used for stocks, forex, and options.

Some features offered by TraderSync are tracking price targets or stop losses of trades, evaluating trading performance, a dashboard that displays ongoing and completed trades, and detailed reports. To gain access to TraderSync’s features, users have to pay US$ 29.95 (Basic), US$ 49.95 (Premium), and US$ 79.95 (elite) per month.

3. Tradervue

If you’re looking for a free online platform to keep track of your crypto trades, Tradervue is worth considering. You’ll have free access to useful features like a dashboard, auto import, diary, and running profit and loss data.

However, if you want more advanced features like detailed reports, comparison reports, the ability to use tags, and risk analysis, you’ll need to pay for them. Two paid plans are available: silver for US$29 per month and gold for US$49 per month.

Don’t forget to use the crypto analysis web as an additional tool when trading crypto.

Conclusion

Using a crypto trading journal can help traders execute systematic and measured trading. Although filling out the journal requires dedication and consistency can be difficult for some people. However, it can help to develop discipline and provide valuable insights for future trading strategies. Therefore, traders must record every transaction in their respective crypto trading journals.

Buy Crypto Assets in Pintu

Looking to invest in crypto assets? No worries, you can safely and conveniently purchase a wide range of cryptocurrencies such as BTC, ETH, SOL, and others safely and easily at Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.

References

Lakshman Prabhu, What Is a Trading Journal and How to Use it? Coin Market Cap, accessed on 5 July 2023.

Sebastian Sinclair, 3 Things Every Crypto Trading Journal Needs, CoinDesk, accessed on 5 July 2023.

Onkar Singh, What is a trading journal? And how to use one, Coin Telegraph, accessed on 5 July 2023.

Phillip Konchar, What to Include in Your Journal Trading Spreadsheet, My Trading Skills, accessed on 5 July 2023.

Temitope Olatunji, What Is a Crypto Trading Journal and Why Do You Need It? Make Us Of, accessed on 5 July 2023.

Share