Complete Guide to XRP Ledger for Beginners: Functions, Validators, and How to Use It

XRP Ledger (XRPL) is one of the oldest public blockchains still actively used since its launch in June 2012. According to official documentation on XRPL.org, the network can process around 1,500 transactions per second with an average transaction fee of only 0.00001 XRP (around Rp0.00016 at the XRP exchange rate of Rp16,000).

Want to know how the XRP Ledger (XRPL) works and why this technology is considered one of the most important innovations in the world of crypto and cryptocurrency? Check out the complete guide in this article!

Article Summary

- 🌐 XRP Ledger (XRPL): XRP Ledger is an open-source blockchain network first developed in 2012 by David Schwartz, Jed McCaleb, and Arthur Britto. The network is known for its high transaction speed, low cost, and focus on cross-border payment solutions.

- 🔒 Key Features of XRPL: Uses a unique consensus mechanism (Ripple Protocol Consensus Algorithm/RPCA) that does not rely on proof-of-work or proof-of-stake. XRPL has more than 100 active validators worldwide, ensuring decentralization and network security.

- 💱 The Role of XRPL in Crypto: XRP Ledger provides infrastructure for various financial applications, including cross-border payments, a built-in decentralized exchange (DEX), and asset tokenization. XRP as a digital asset is used for liquidity on the network but is different from XRPL itself.

- 🤝 New Partnerships & Integrations: XRPL collaborates with DBS, Franklin Templeton, and Linklogis for asset tokenization and supply chain finance. Chainalysis also adds compliance support for XRPL tokens.

- 🚀 Technological Developments & New Products: Users can now earn up to 8% yield through liquid staking. Ripple has released a new roadmap targeting institutions, while on-chain data records new activity highs on XRPL.

1. What is XRP Ledger?

XRP Ledger (XRPL) is an open-source blockchain that functions as a global payment network. According to Ripple, XRPL supports fast transactions with an average confirmation of only 3–5 seconds, making it one of the fastest blockchain payment systems in the world.

In addition to being a payment system, XRPL also has other features such as a built-in decentralized exchange (DEX), the ability to issue new tokens, and support for simple smart contracts. This makes XRPL not only relevant for cross-border transfers but also as a platform for digital financial innovation.

XRPL is also known to be energy-efficient compared to proof-of-work-based blockchains like Bitcoin . With more than 150 active validators spread globally, XRPL has become one of the most efficient and decentralized blockchain infrastructures while supporting the decentralized finance ecosystem.

2. When Was XRP Ledger First Created?

XRP Ledger was first launched in June 2012 by three developers: David Schwartz, Jed McCaleb, and Arthur Britto (Ripple Insights). In the same year, Ripple Labs (originally named OpenCoin) was founded to help develop the XRPL ecosystem.

Since its launch, XRPL has become one of the oldest blockchains still operating consistently to this day. The original goal was to create a more efficient global payment system compared to legacy systems like SWIFT, with a focus on speed, low cost, and interoperability between currencies.

3. How Many Validators Does XRP Ledger Have?

Validators in XRPL are responsible for verifying transactions and maintaining network consensus. According to data from the XRPL.org Validator Registry, there are currently more than 150 independent validators operating globally.

These validators are not only run by Ripple Labs but also by various companies, universities, and independent communities. This distribution ensures that XRPL remains decentralized and not dependent on a single party.

4. How to Use XRP Ledger

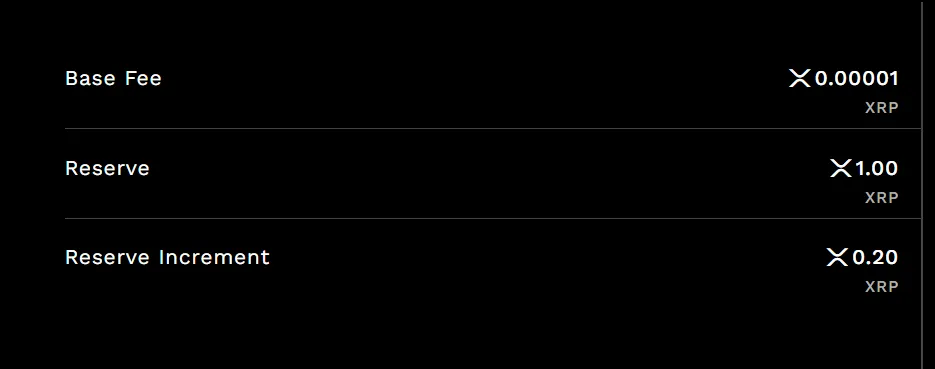

To start using the XRP Ledger (XRPL), users need to create an XRP Wallet. Previously, each wallet in XRPL required a minimum balance of 10 XRP as a reserve requirement. However, since December 2, 2025, this rule has changed: now users only need to prepare 1 XRP as the basic minimum balance.

📌 This means anyone can open an XRPL wallet with a smaller amount, making network access more inclusive. Once the wallet is active, users can do various things on XRPL, such as:

- Cross-border transfers in seconds with very low fees, only about 0.00001 XRP (±Rp0.16 per transaction).

- Create new tokens directly on the XRPL network.

- Use the built-in decentralized exchange (DEX) to trade digital assets without intermediaries.

- Store or use other digital assets, including NFTs, trust lines, or stablecoins built on XRPL.

- Participate in DeFi applications or other projects in the XRPL ecosystem.

According to XRPL documentation, each additional object (such as trust lines, signer lists, NFTs, and oracles) also requires a small reserve, namely 0.2 XRP per item. This serves as an anti-spam mechanism to keep the network secure and efficient.

📌 With this reserve requirement reduction, the entry cost to XRPL is much cheaper, enabling more people to participate in using this blockchain technology.

5. The Difference Between XRP and XRP Ledger

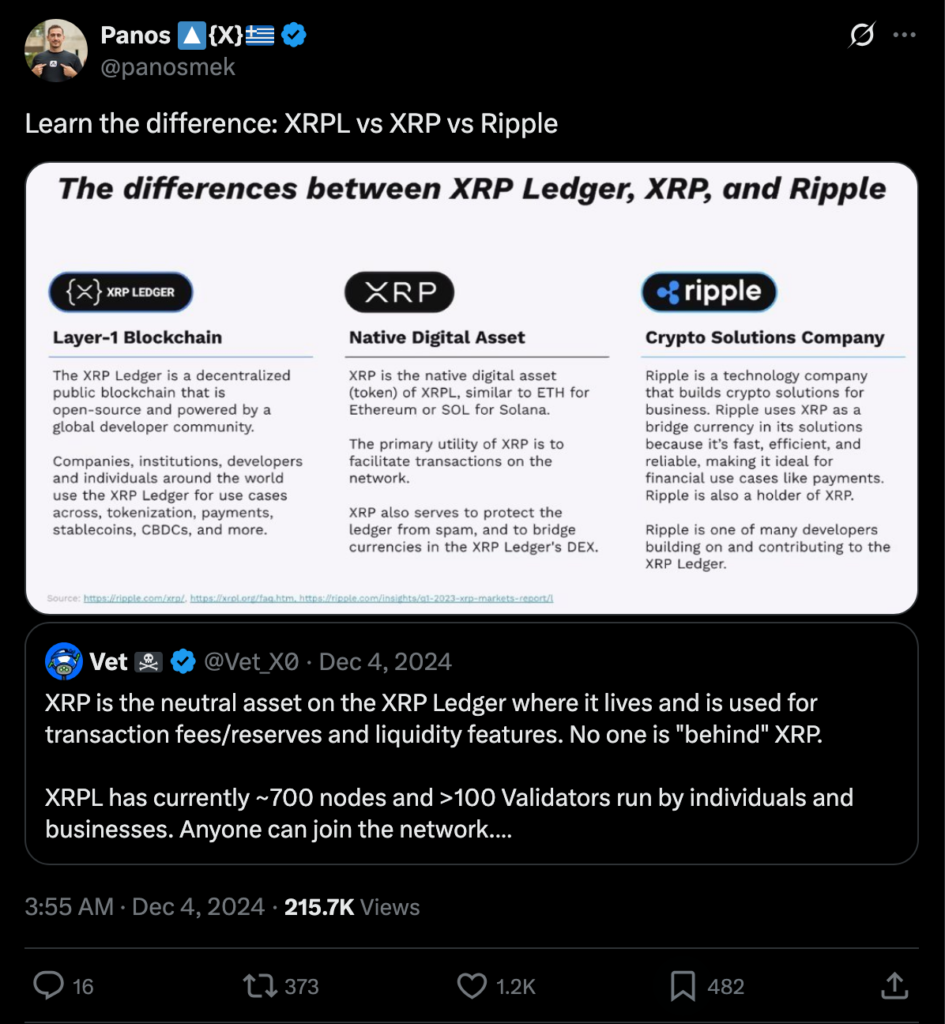

The terms XRP and XRP Ledger (XRPL) are often used interchangeably, but they actually serve different purposes.

- XRP Ledger (XRPL) is a public Layer-1 blockchain that is open-source and run by a global developer community. XRPL supports various use cases such as tokenization, cross-border payments, stablecoins, and CBDCs.

- XRP is the native digital asset of XRPL, similar to ETH in Ethereum or SOL in Solana. XRP is used to facilitate transactions on the network, protect XRPL from spam, and act as a liquidity bridge in XRPL’s built-in decentralized exchange (DEX).

In other words, XRP is the token, while XRPL is the blockchain technology that serves as the infrastructure where the token operates.

6. New Partnerships & Integrations

Here are some of XRPL’s new partnerships and integrations with global institutions:

- DBS + Franklin Templeton + Ripple

On September 18, 2025, DBS (Singapore’s bank), Franklin Templeton, and Ripple announced a collaboration to allow institutional investors to trade and lend tokenized money market funds using the RLUSD stablecoin and sgBENJI tokens issued on XRPL. Franklin Templeton will issue the sgBENJI token on XRPL, and DBS will list these tokens on the DBS Digital Exchange. - Linklogis (China) & XRPL

Chinese fintech Linklogis partnered with XRPL to digitize global supply chain finance. Its trade finance application will run on XRPL mainnet, including the use of real-world assets (RWAs), cross-border settlement, and exploration of smart contracts & AI. - Chainalysis supports XRPL

Chainalysis expanded its support for XRPL with automatic token support in its compliance and monitoring products (KYT, Reactor) to make it easier to track transactions and fund flows on XRPL.

7. Technological Developments & New Products 📈

Here are some technological developments and new products from XRPL:

- Liquid Staking mXRP

Midas & Interop Labs introduced a liquid staking product called mXRP on XRPL EVM. This product allows XRP holders who were previously “idle” to earn yield (estimated at 6–8%) and integrate into DeFi through bridges to XRPL. - XRPL Roadmap for Institutions

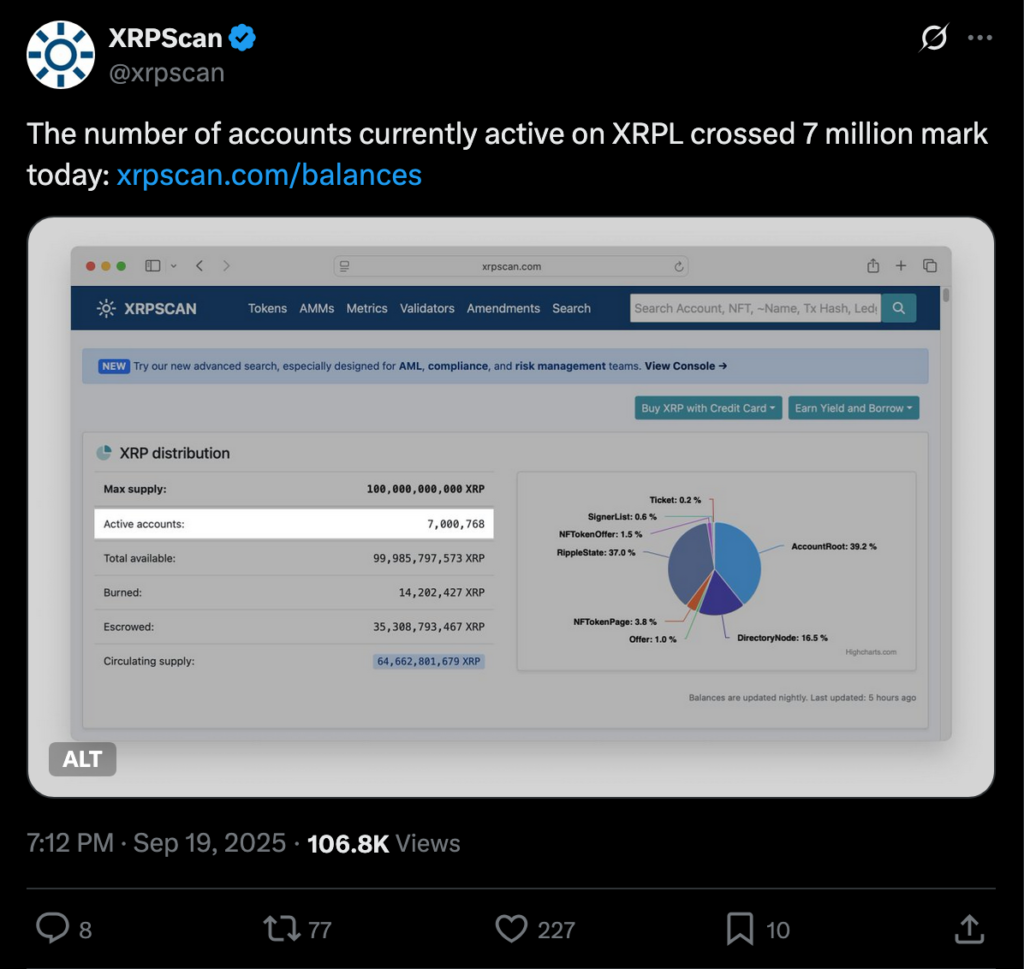

Ripple released a new roadmap focused on institutions: developing lending features, enhancing its ability to support financial stability, and upgrading infrastructure to make XRPL more “institution-friendly.” - Record Number of Active Accounts

Even though XRP’s price weakened, an important XRPL metric recorded a record of active accounts reaching 7 million.

Conclusion

XRP Ledger (XRPL) is an open-source blockchain designed to support fast, low-cost, and energy-efficient transactions. Since its first launch in 2012, XRPL has grown into one of the leading blockchain infrastructures with thousands of transactions per second and hundreds of independent validators. Understanding the difference between XRP as a digital asset and XRPL as a network is essential for both investors and new users to avoid confusion about their functions.

Disclaimer: All articles from Pintu Academy are intended for educational purposes and do not constitute financial advice.References

- Bitcoinist. Major Metric on XRP Ledger Hits New Record. Accessed 24 September 2025.

- Chainalysis. XRP Ledger Automatic Token Support in Chainalysis KYT and Reactor. Accessed 24 September 2025.

- Coindesk. XRP Holders Can Now Earn up to 8% Through New Liquid Staking Token. Accessed 24 September 2025.

- Cryptoslate. China-based Linklogis partners with XRP Ledger to transform global supply chain finance. Accesed 24 September 2025.

- Mitrade. XRP Ledger cuts its reserve requirement from 10 to 1 XRP, favoring small new wallets. Accessed 24 September 2025.

- Ripple. Overview of the XRP Ledger. Accessed 24 September 2025.

- Ripple. The History of Ripple. Accessed 24 September 2025.

- XRPL.org. Validators List. Accessed 24 September 2025.

- XRPL.org. Reserves. Accessed 24 September 2025.

- Reuters. DBS, Franklin Templeton, and Ripple team up for tokenised money market fund trading. Accessed 24 September 2025.

- Yahoo Finance. Ripple’s XRPL Roadmap Targets Institutions. Accessed 24 September 2025.

Share

Table of contents

Related Article

See Assets in This Article

BTC Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-