Crypto Market Report Q3 2023

Q3 was another busy quarter for the crypto market. New sectors emerged strong trends from Q2 came back into vogue, and others experienced drastic capitulation. The cryptocurrency industry can seem chaotic at times because so much is happening. Not only do prices change, but popular protocols come and go. This crypto market report will bring you a summary of what happened in the third quarter of 2023.

Article Summary

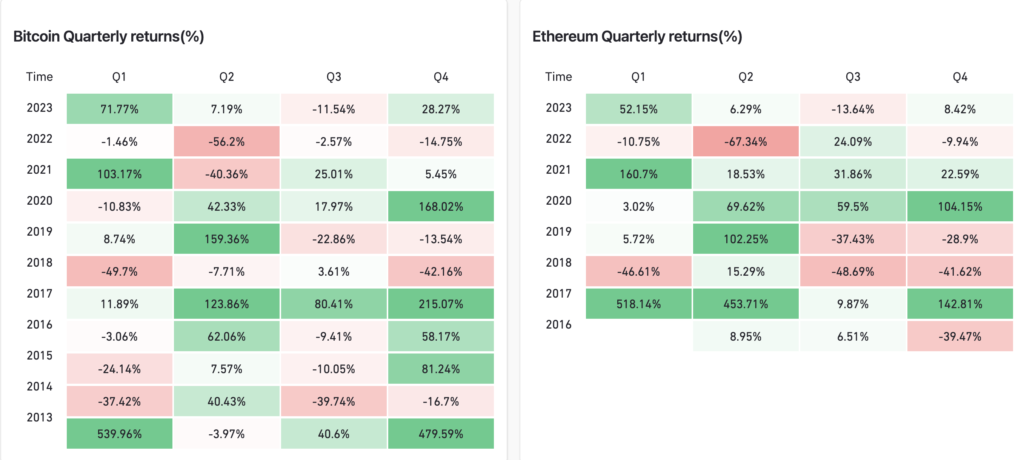

- ⚖️ Bitcoin experienced an -11% correction, dropping to a low of $25,000 but still recording a 68% gain from the start of the year. Post the drop, the market went sideways with low volatility, stuck in the $25,000-$28,000 price range from August to late September.

- The third quarter of 2023 became the worst period for the NFT market, with a decline in the base price of blue chip collectibles and a 55.6% drop in NFT transaction volume. However, blockchain game-based NFTs showed growth, with Axie Infinity leading the sector.

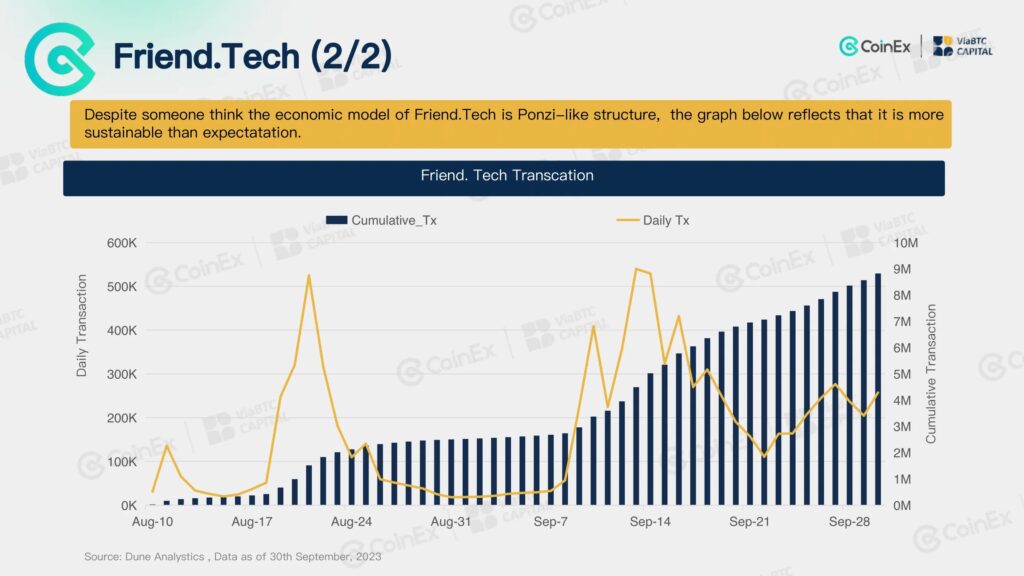

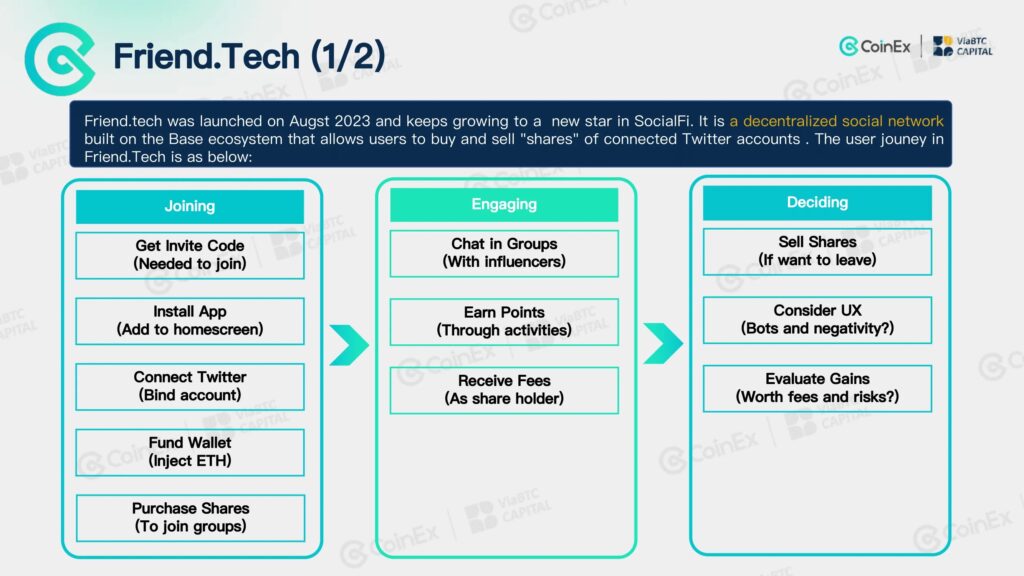

- 🧠 Three sectors were the main theme in the third quarter, namely the SocialFi sector, DeFi with RWA, and Telegram bot trading. SocialFi is the latest sector started by the Friend.tech protocol that successfully started the trend of crypto-based social media applications. DeFi with RWAs such as MakerDAO managed to show strength in the third quarter. Lastly, trading bot protocols are still very popular and talked about in the community.

- ⚠️ The fourth quarter is usually an exciting quarter for the crypto industry as it is the most positive quarter for Bitcoin. By the end of October, Bitcoin successfully broke out of the $30,000 dollar price range. The fourth quarter also has various catalysts that have the potential to boost the price of various crypto assets.

Crypto Market Conditions in Q3 2023

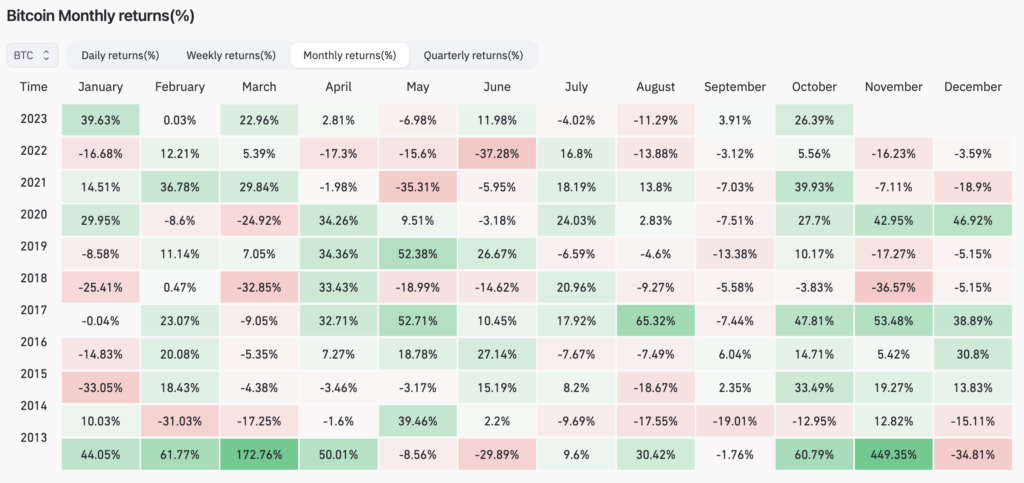

After closing the first and second quarters with positive numbers, Bitcoin finally experienced a correction. Bitcoin experienced an -11% correction in the third quarter of 2023 and fell to a low of around $25,000 dollars. However, BTC is still up about 68% from the starting price of 2023.

If we take a macro view, BTC’s decline in Q3 also coincided with other asset classes such as gold, S&P 500, and NASDAQ. In mid-August through September, this decline turned into a sideways movement with low volatility. Bitcoin was stuck in the $25,000-$28,000 dollar price range from August to the end of September.

Bitcoin’s sideways movement indicates low liquidity and interest in crypto assets. This period also coincides with the US interest rates which are still very high (5.25%-5.5%). As a result, investors prefer to benefit from interest on bonds and the like rather than investing in risky assets such as cryptocurrencies. This can be seen from the supply of stablecoins which decreased from $129 billion dollars to $123 billion dollars.

However, as has happened before, a sideways market does not mean there are no trends. In dull or declining markets, there are always sectors and assets that show their strength. Usually, trends spread faster in sideways market conditions.

Several Crypto Market Trends in Q3 2023

1. NFT Market Capitulation

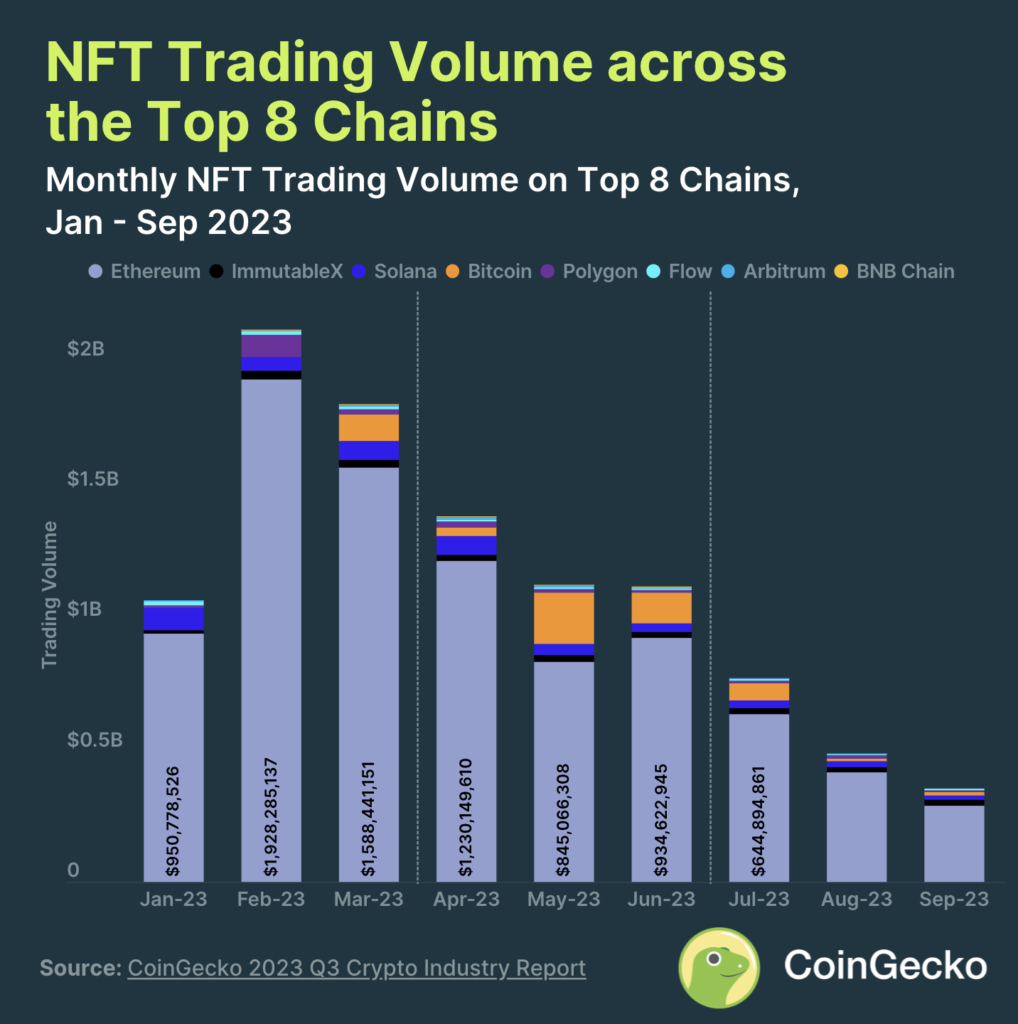

Q3 2023 was the worst period for the NFT market. Binance Research shows that September was the worst month in NFT sales since January 2021. The floor price of blue-chip collectibles like BAYC, Azuki, and MAYC fell 25% from last quarter. NFT transaction volume was even worse, with a 55.6% drop from $3.67 billion in Q2 2023 to $1.63 billion dollars. September seems to be a month of capitulation for the NFT market. Will this be the bottom for NFTs?

On the other hand, blockchain game-based NFTs are gaining popularity. Axie Infinity is still the sector leader with $90 million dollars of NFT transaction volume. Gods Unchained, which just released a new season, is Axie’s competitor. Gods Unchained also contributed to Immutable X’s increase in transaction volume to the 20 million mark. Finally, TreasureDAO’s existence is also noteworthy as it managed to compete with the much more popular DeFi Kingdoms and Alien Worlds.

The sluggish state of the NFT sector is influenced by various factors, including low liquidity market conditions and the Azuki Elementals incident which greatly affected the Azuki base price.

However, there is some good news as the Blur digital NFT market has just announced the 2nd airdrop season that will start November 20. As we know, Blur’s airdrop season at the beginning of the year took center stage for NFT players. Blur’s 2nd airdrop season could be the catalyst that will pull the NFT sector out of the bear market.

Read more: the new generation of GameFi projects.

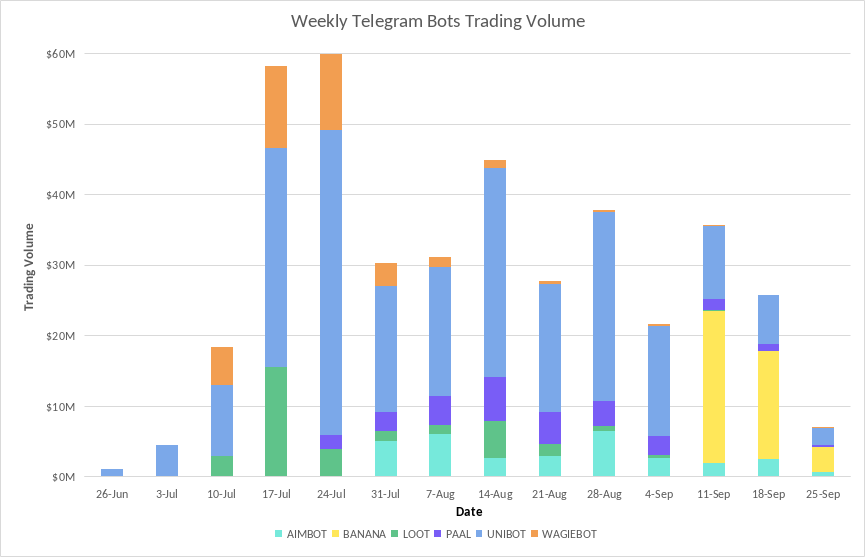

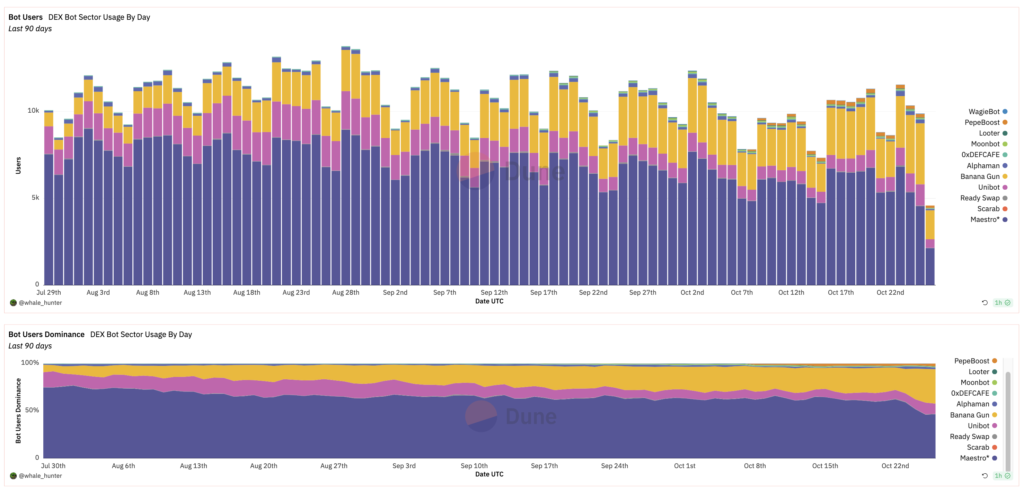

3. Telegram Trading Bot: Sustainable Trend?

One sector that did not decline in popularity since last quarter was Telegram trading bots, initially popular in May and June. UNIBOT as the token trading bot leader of this sector started to get competition from many new trading bots. As shown in the image above, Unibot’s market share dominance is starting to be taken by various new trading bots such as Wagiebot and Loot. The data above also does not show Maestro Bot, the largest trading bot by volume but has no token.

The trading bot user dominance data also tells the same story. Maestro bot has market share dominance and Banana Bot is eroding Unibot’s user base. With the new BANANA token in October, more and more people are moving to Banana. So, Unibot has now slipped to 3rd place in the telegram trading bot race.

The Telegram bot trading sector is a very new sector in the crypto world. While Maestro is currently leading in many metrics, it is not impossible for Unibot or Banana to overtake Maestro. These three protocols are competing with each other to be the fastest and vying to offer many benefits to users.

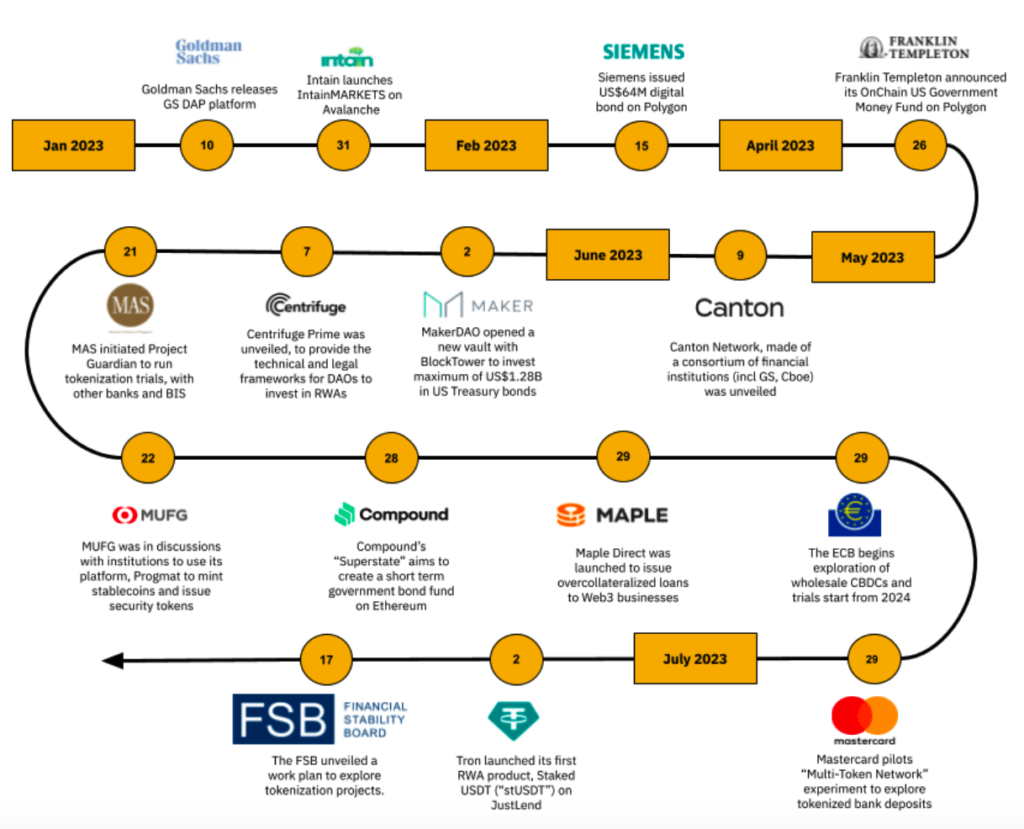

4. The Rise of RWA in DeFi

The DeFi sector utilizing RWAs is gaining popularity this year. Conversely, traditional financial companies that use blockchain for RWA tokenization are also growing. RWA assets such as bonds, property, and commodities are assets that can be tokenized. The RWA sector is predicted to be a sector that many financial companies will utilize to enter the crypto world. In some cases, this is already happening.

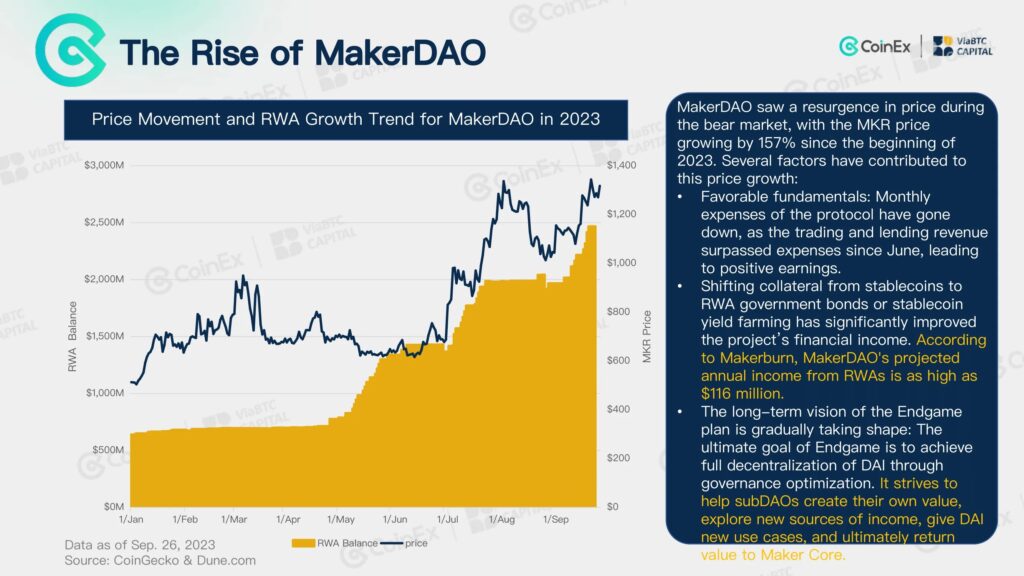

One of the clearest examples of RWA implementation is MakerDAO. MakerDAO recently authorized using BlockTower’s bond assets as collateral to mint DAI, MakerDAO’s stablecoin. Furthermore, MakerDAO’s RWA portfolio was close to $2.5 billion dollars at the end of the third quarter of 2023 and is currently at $3.3 billion dollars. As shown in the image above, this figure continues to increase and is a stable income that Maker is getting in a highly volatile market.

Read more: The Future and Potential of MakerDAO.

The use of RWAs is still very limited due to various risks and technical barriers that have yet to be resolved. One example of a failed RWA experiment is the USDR stablecoin secured by property assets. USDR was created by Tangible and had a market capitalization of $59.4 million dollars before its freefall. Currently, the largest and most successful implementation of RWA is MakerDAO which utilizes stable yield-bearing assets such as US Treasury bills (T-Bills).

What About Q4 2023?

In the last four years, October is usually the most positive month for Bitcoin. As of October 27, 2023, Bitcoin managed to rise 26.39%, crossing the strong resistance mark of $32,000 dollars. Bitcoin finally managed to break out of the $25,000-$32,000 price range that it has always failed to break since April 2023.

In contrast, Bitcoin’s price strength makes ETH very weak. This is shown by Bitcoin’s dominance rate of 54%, the highest in the last two years. As a result, the ETH/BTC price has also reached its lowest point since June 2022.

The current dynamics of Bitcoin and Ethereum follow a typical pattern of the beginning of a bull market. In the early stages of a bull market, Bitcoin dominance usually soars and BTC price performance outperforms ETH. So, are we really at the beginning of a bull market? BTC’s movement in Q4 2023 will be the key.

Don’t forget to read Pintu Academy’s articles on how to prepare for a bull market and signs of a bull market starting.

Q4 also has some catalysts for some cryptocurrencies and sectors. These catalysts can be good opportunities for traders. Here are some upcoming events and updates for the fourth quarter of 2023.

Crypto Events and Conferences in Q4 2023

- Solana Breakpoint October 30-November 4: Solana Breakpoint is the largest Solana event in Amsterdam and the venue for many important announcements. With the SOL token gaining attention from the crypto community, this year’s Breakpoint could be a big catalyst for Solana.

- ApeFest November 3-5: ApeFest is the biggest annual event for the APEcoin ecosystem. This year’s ApeFest is rumored to be the venue for one major announcement.

- OpenAI Conference November 6: The team behind ChatGPT, OpenAI, will be holding their first-ever DevDay. Just like what happened earlier in the year, this AI event has the potential to boost the prices of AI-related tokens such as FET, WLD, RNDR, and OCEAN.

- Cardano Summit November 2-4: Cardano Summit is the largest Cardano community event held in Dubai. An event of this magnitude will surely be the venue for the announcement of various important updates in the Cardano ecosystem. The Cardano ecosystem tokens on the door are ADA and COTI.

- NEARCON November 7-10: NEAR Protocol is the NEAR community’s most significant event in Lisbon, Portugal. With the focus changing to Blockchain OS, NEARCON will bring important news about the NEAR ecosystem and its future plans.

Crypto Protocol Upgrades in Q4 2023

- Fantom: Fantom has just conducted testing for the Sonic update which will increase Fantom’s speed to 2,000 transactions per second.

- dYdX: dYdX has just launched its own appchain on the Cosmos network. Trading for users will open in the next few weeks.

- Arbitrum STIP: STIP is an incentive program for the recently completed Arbitrum ecosystem. Dozens of projects that successfully entered will be distributed ARB tokens in the next few weeks, pending an announcement from Arbitrum. At the beginning of the year, the OP token and several tokens in its ecosystem experienced massive pumping after the ecosystem incentives. Will the same thing happen in Arbitrum?

- EIP-4848 and Dencun Ethereum: Hundreds of Ethereum developers are currently testing another massive update for Ethereum, Dencun, which includes EIP-4848. The EIP-4848 update will make L2 rollup transaction fees like Optimism and Arbitrum much cheaper. Dencun has the potential to be a huge catalyst for the L2 sector.

Conclusion

The third quarter of 2023 was a period with many surprises. Some new trends emerged, strong trends from the second quarter made a comeback, while other sectors experienced drastic declines. Bitcoin experienced a correction of -11% but still recorded a 68% increase from the beginning of the year. The NFT market had its worst period, while the SocialFi and Telegram Trading Bot sectors managed to steal the show. Q3 was also a predominantly sideways quarter as the crypto market moved in similar price ranges. However, the fourth quarter is likely to be a period of opportunity as there are many potential catalysts that could push the crypto market up.

How to Buy Cryptocurrencies on the Pintu App

You can start investing in cryptocurrencies by buying them on the Pintu app. Here is how to buy crypto on Pintu:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for your favorite asset.

- Click buy and fill in the amount you want.

- Now you are a crypto investor!

You can trade various cryptocurrencies on Pintu such as BTC, ETH, and SOL. In addition, the Pintu application is compatible with various popular digital wallets such as Metamask to facilitate your transactions.

Go and download the Pintu cryptocurrency app on the Play Store and App Store! Pintu is regulated and supervised by Bappebti and Kominfo.

You can also learn crypto through the various Pintu Academy articles which are updated every week! All Pintu Academy articles are for educational purposes, not financial advice.

References

- CoinEx &ViaBTC Capital, “CoinEx &ViaBTC Capital | 2023 Crypto Q3 Quarterly Report Established in 2017“, Medium, accessed on 24 October 2023.

- Sara Gherghelas, “State of Blockchain Gaming in Q3 2023“, DappRadar, accessed on 25 October 2023.

- “Crypto Market Recap Q3, 2023″, Cryptorank.io, accessed on 25 October 2023.

- CMC Research, “According to CMC: Crypto Market Analysis Q3 2023“, CoinMarketCap, accessed on 26 October 2023.

- Edgy, “The DeFi Quarter 3 Rewind“, The DeFi Edge, accessed on 26 October 2023.

- “2023 Q3 Crypto Industry Report“, CoinGecko, accessed on 27 October 2023.

Share