The Differences Between CeFi and DeFi in Crypto

Discussions about the potential of crypto in the financial sector can never be separated from decentralized finance , a blockchain-based decentralized financial application. DeFi offers the future of the banking world that is open to use by anyone with a transparent system. However, the widespread adoption of crypto in the community cannot be separated from the role of centralized finance (CeFi), which offers convenience for users who are just starting their journey in the crypto world. So, what are the differences between CeFi and DeFi? We will discuss this further in this article.

Article Summary

- 🔗 Decentralized finance or DeFi is a blockchain-based financial application ecosystem that can operate without a central authority such as banks or other financial institutions.

- 🏛 Meanwhile, centralized finance, or CeFi is a financial service provider platform with a centralized structure that relies on one authority to make decisions and run operations.

- 🔎 DeFi is expected to transform the way that financial services are provided globally. CeFi’s existence, however, is significant as it serves as the primary gateway for those just entering the cryptocurrency market.

What is DeFi?

Decentralized Finance or abbreviated as DeFi is a financial application ecosystem based on blockchain that operates without a centralized authority. This means users of DeFi services can lend and borrow money, and exchange assets, just like in traditional financial services, but without the presence of intermediaries such as banks.

If previously financial services depended on institutions such as banks acting as intermediaries, with DeFi, all transaction processes were carried out by codes written in smart contracts. DeFi application code is generally transparent and open-source, where all users can verify the application code themselves. Thus, users can have complete control over their funds.

💡 As of July 2020, the amount of funds in the DeFi ecosystem (total value locked) has reached 3 billion US dollars. As of December 2021, the amount of funds in DeFi smart contracts had touched the figure of more than 180 billion US dollars, as seen in the data above. However, in line with the bear market, TVL on DeFi is currently declining to 59.5 billion US dollars.

The development of various DeFi applications was basically initiated by the invention of blockchain Ethereum with its smart contract technology. Smart contract is a term for computer programs written on blockchain Ethereum.

Also read: What is Ethereum?

Most DeFi protocols run with decentralized autonomous organizations, or DAOs (Decentralized Autonomous Organizations), where governance token holders (eg UNI tokens on Uniswap) jointly make decisions, such as treasury allocations or changes to tokenomics.

Decision making is also transparent and can be tracked via public blockchain explorers, such as Etherscan for blockchain Ethereum. The existence of DeFi basically provides alternative financial services that have been dominated by the traditional financial system.

What is CeFi?

Unlike DeFi, CeFi is basically short for centralized finance, which means financial services with a centralized structure, like banks and traditional financial institutions that we know so far.

However, in the crypto world, CeFi refers to financial services with various features such as those offered by DeFi, but with centralized operations like traditional financial services.

With CeFi, users can purchase and exchange crypto assets, earn interest on asset deposits, loan interest and so on, just like in DeFi. However, CeFi companies run company operations like companies in general. Not using smart contracts that are open-source like DeFi.

Users who use CeFi services are basically customers who pay for the services provided. CeFi’s business includes lending platforms such as BlockFi and exchanges such as FTX and also Pintu.

💡 CeFi provides simple access and services for customers who are just starting their cryptocurrency adventure, despite not being administered in a decentralized fashion. This is because CeFi offers flexible fiat currency and cryptocurrency exchange options while maintaining access to all of DeFi’s services.

Difference between CeFi and DeFi

DeFi and CeFi are financial services with their respective advantages and functions. Therefore, these two financial service systems can still exist side by side and complement each other with the aim of providing more value to their users.

Sometimes CeFi is often confused with TradFi, which stands for traditional finance. TradFi is a financial service that we know so far, consisting of retail, commercial and investment banks. For more details, here are the differences between the three.

| Functions | DeFi | CeFi | TradFi |

| Spot Trading | Uniswap, Curve | Coinbase, Pintu | New York Stock Exchange, NASDAQ |

| Derivatives | dYdX, GMX | Bybit, FTX | Chicago Mercantile Exchange |

| Asset Management | The Index Co-op, Yearn | Galaxy, Grayscale | Blackrock |

| Lend & Borrow | Aave, Compound | Celcius, Nexo | Bank of America |

CeFi and DeFi risks

Although both CeFi and DeFi have their respective advantages, they cannot be separated from various risks. What happened to Terra Luna in May 2022 shows how the entire DeFi ecosystem can collapsed.

Terra Protocol is a blockchain protocol that produces algorithmic stablecoins with TerraUSD (UST) as the main stablecoin. Algorithmic stablecoin is a stablecoin designed with an algorithm to keep its value equal to the asset it is pegged to.

One of the most used DeFi applications on Terra blockchain is Anchor Protocol, a decentralized savings account, which promises up to 19.5% APY. Anchor is widely used by Terra users as a place to store assets due to the high “interest” offered.

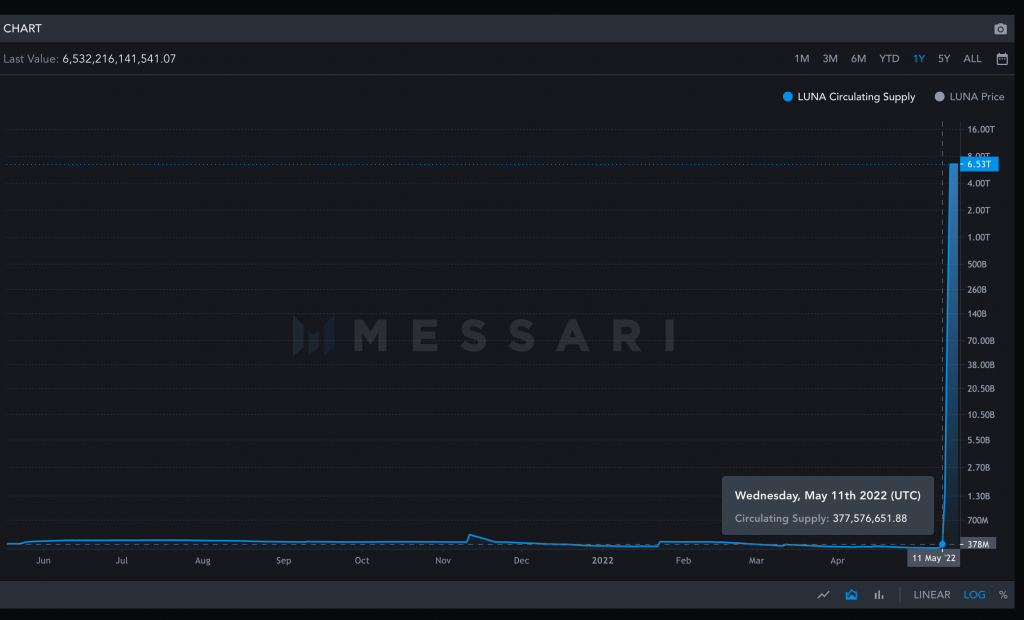

On May 13, 2022, the price of LUNA (Terra’s coin) fell 100% to the level of US$0.0002 This is due to the algorithmic stablecoin system that forces Terra to continuously create new LUNA to keep the value of the UST (Terra stablecoin) constant. at 1 US dollar.

What happened to LUNA turned out to have a domino effect on CeFi through the crypto hedge fund Three Arrows Capital (3AC), which invested in Terra and borrowed crypto worth billions of dollars from various CeFi companies to carry out its high-risk strategy. CeFi companies trust 3AC and provide loans without adequate collateral. When the crypto market crashed, 3AC was unable to repay the loan and this affected the CeFi companies.

Investing in Crypto

You can start investing and check the prices of various crypto assets on Pintu. Through Pintu, you can buy various cryptocurrencies such as BTC, ETH, SOL, ADA, and others in a safe and easy way.

In addition, the Pintu application is compatible with various popular digital wallets such as Metamask to facilitate your transactions. Download Pintu on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

You can also learn more about crypto from Pintu Academy. All Pintu Academy articles are made for educational purposes only, not as financial advice.

Share

Related Article

See Assets in This Article

DEFI Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-