Introduction to DeFi in the Fantom Ecosystem

Decentralized finance is one of the most promising industrial sectors in the crypto world. Many developers utilize blockchain technology to create various financial services applications. The DeFi industry creates decentralized services for loans, savings, and even decentralized cryptocurrencies exchanges. Fantom is one of many platforms for DeFi ecosystem that are gaining popularity from the crypto community.

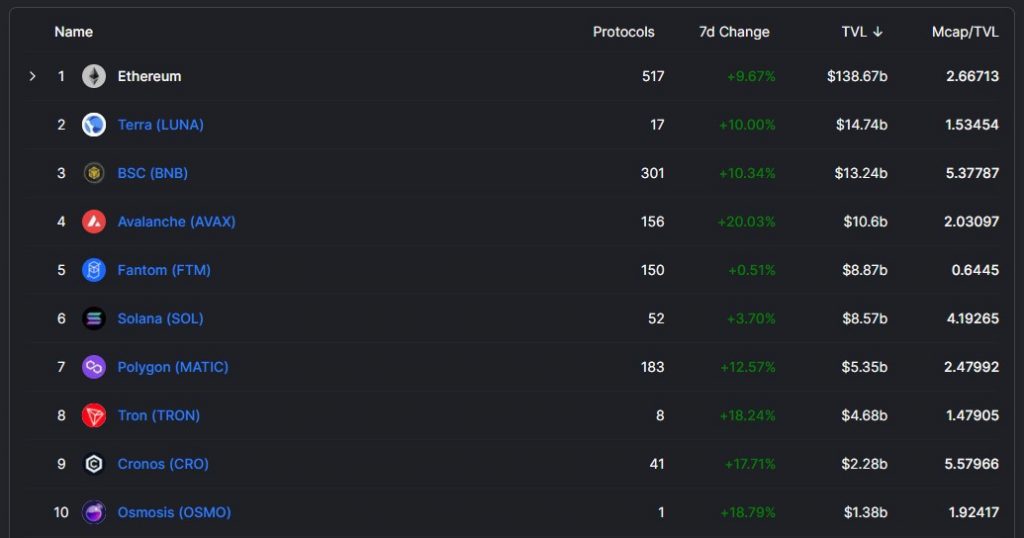

Fantom has a rapidly growing DeFi ecosystem, surpassing many other big competitors like Solana. Apart from its user-friendly technology, Fantom has a very lively community, especially on social media platforms like Twitter. So, why is Fantom’s DeFi ecosystem growing so fast? What are the DeFi applications on Fantom that you can use? This article will explain it in detail.

Article Summary

- 💻 Fantom is a Layer 1 cryptocurrency with smart-contract capability that can support the creation of a DeFi ecosystem containing various decentralized financial services.

- 🌐 Fantom’s DeFi ecosystem includes hundreds of decentralized financial applications that are rapidly growing and have a strong community presence on various social media platforms.

- 🧑🎨 A wide variety of DeFi apps on Fantom are visually appealing and easy to use. Apps like SpookySwap have a simple UI so you can understand how to use them.

- 💸 Fantom applications can provide various services options according to your risk appetite. If you just want to earn passive income with low risk, apps like SpookySwap or Beethoven can give you quite a lot of interest ranging from 10% to 100%. If you are willing to take risks, you can use take a loan, become an LP, and do staking to actively seek additional financial benefits from several apps.

Fantom DeFi ecosystem growth

Fantom is a Layer 1 cryptocurrency with smart-contract capabilities that can support the creation of a DeFi ecosystem containing various decentralized financial services. It uses a proof-of-stake consensus algorithm called Lachesis which allows transaction confirmation to occur in seconds at a low cost. This prompted many developers to build decentralized applications on top of the Fantom network.

Also read: What is Fantom and how does it work?

Currently, Fantom has a total value locked (TVL) of $8.87 billion. In early 2022, this TVL figure even briefly touched $10 billion and placed Fantom as the 3rd largest crypto asset based on TVL, beating Binance. Fantom’s TVL figures are driven by many factors taking place in 2021.

One of them is the Fantom incentive program for DeFi developers in its ecosystem. In late August 2021, the Fantom Foundation announced that Fantom app developers can enrol in this incentive program for direct funding from the foundation. Fantom allocated 370 million FTM for this incentive program.

In addition, Fantom also experienced a drastic price increase in 2021 and managed to attract many new retail investors who later became users of various DeFi applications in its ecosystem. These new users are most likely attracted by the various DApps that can provide high-interest income with an easy-to-use UI.

Fantom’s DeFi Ecosystem of DApps

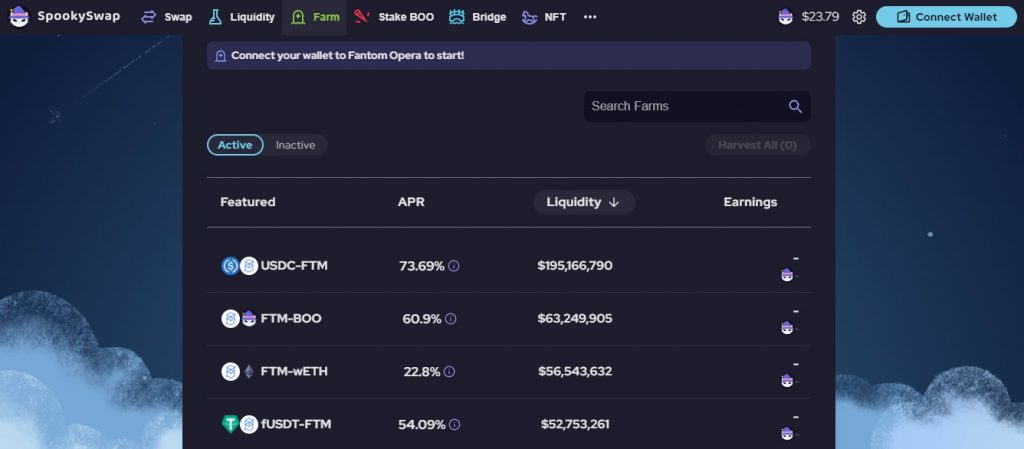

SpookySwap

SpookySwap is the largest decentralized exchange (DEX) in the Fantom network. According to DeFiLlama, SpookySwap is the largest application in Fantom with a TVL of $1.33 billion dollars (9 February 2022). The native cryptocurrency of SpookySwap is BOO, which you can buy immediately or earn as a reward after becoming a liquidity provider (LP).

In addition, Spooky Swap has a clear and easy to understand UI. You can easily access all activities on SpookySwap directly from the main page. In addition to the standard DEX activities, SpookySwap can also function as a bridge from other blockchain networks to Fantom and vice versa. SpookySwap also has its own collection of NFTs called MagiCat. Furthermore, SpookySwap said that in the future, MagiCat will be integrated into the DEX and BOO token ecosystem.

Some of the activities that you can do in SpookySwap are as follows:

- Liquidity provider (liquidity provider/LP): You can earn BOO rewards by becoming a liquidity provider (depositing a pair of crypto assets of the same value). You can see a list of the pools alongside their cryptocurrency pairs and the profit percentages on the farm page.

- Exchange/Swap Tokens: This feature allows you to exchange various tokens with low transaction fees.

- Staking BOO: After you become LP and get BOO, you can stake them with an APR of 32%. Then, you will get xBOO as a receipt of ownership of your stake which you can then sell or use in stage 2 staking. So, you can get double profits through staking BOO and then xBOO.

- Transfer tokens/bridge: The bridge feature allows you to move tokens from another blockchain network to Fantom or vice versa. The bridge function in SpookySwap processes a transaction within a minimum of 10 minutes to several hours.

Geist Finance

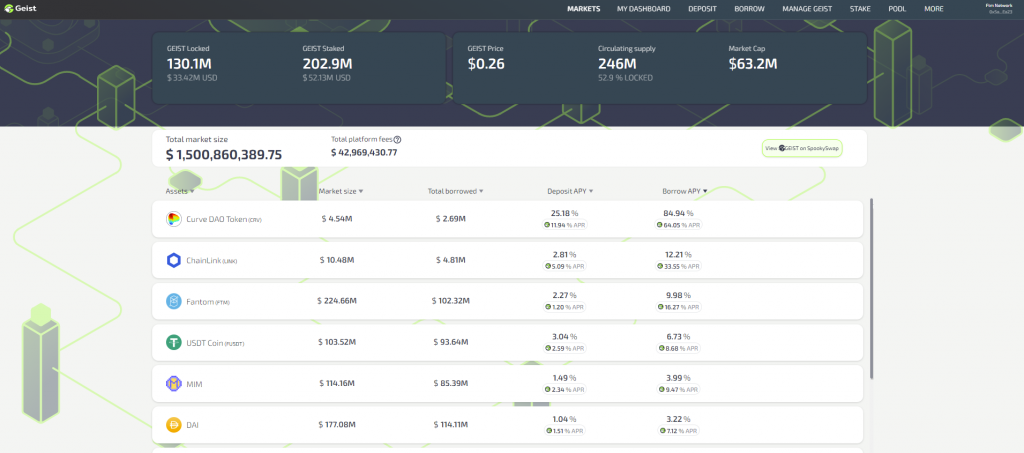

Geist Finance is a decentralized lending-focused DeFi protocol similar to AAVE. The Geist Protocol currently has a TVL of $822 million dollars. Scream and Geist are the two largest loan apps on the Fantom network and both compete for liquidity from users. Geist Finance has the advantage that both the borrower and the lender earn interest in return. In fact, if you borrow assets from Geist Finance, you will earn more interest than just providing liquidity.

As shown in the picture above, the interest for providing liquidity is only at 2-3% while if you borrow crypto assets, the percentage reaches 9%, 12%, and even 84% . The interest rates give you a reward in the form of the GEIST token, Geist Finance’s native token. You can then use this GEIST token for staking.

Here are some activities you can do in Geist Finance:

- Lending crypto: Geist Finance provides incentives for users to borrow cryptocurrencies in the platform with high-interest rates.

- Become a liquidity provider: Liquidity providers (LP) at Geist Finance earn relatively low-interest rates as the Geist platform encourages users to borrow more.

- Staking Geist tokens: The GEIST that you get from borrowing or becoming an LP can be staked within the platform for a 289% interest rate. However, all GEISTs you stake will be locked for 3 months before they can be withdrawn. This is done to maintain the price of the token.

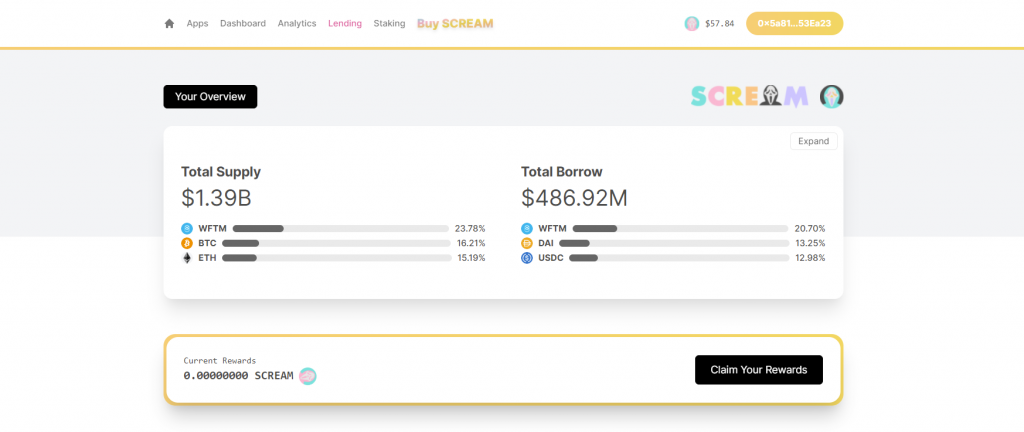

Scream

Scream is a decentralized lending DeFi protocol modified from Compound Finance. It is the first lending protocol on the Fantom network. Currently, Scream has a TVL of $916 million, slightly more than its competitor, Geist Finance. Although its name is taken from the popular horror films of the 90s, Scream has a very colorful and bright UI.

Conceptually, Scream has much in common with Geist Finance in that it provides greater incentives to borrowers than providers of liquidity pools. However, some assets such as MIM and SPELL on Scream pay higher interest rates than Geist Finance. You can compare interest rates between these two platforms before trying to borrow crypto assets. In addition, Scream also has its NFT collection, Screamo which you can buy or get through several giveaway events held by Scream on their social media.

Some of the activities you can do in Scream:

- Lending crypto assets: You can borrow cryptocurrencies for trading or l yield farming on other apps. The loan interest that you will get on Scream varies from 6% to 18%. You will get SCREAM tokens in exchange for borrowing.

- Become a liquidity provider: The safest activity you can do is to become an LP in the Scream loan pool. Some assets such as USDT, SPELL, and CRV still provide substantial interest.

- Staking SCREAM tokens: You can stake your earned SCREAM token or buy SCREAM directly on SpookySwap to get a staking interest rate of 37%.

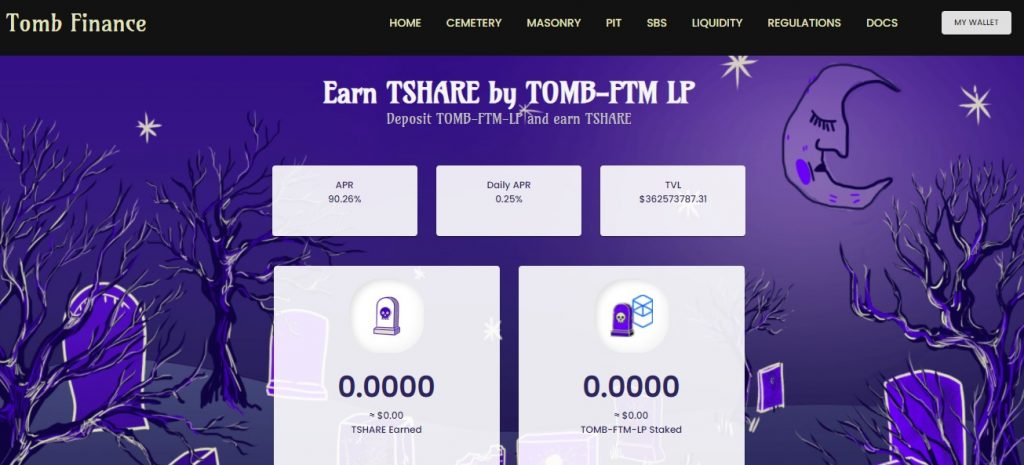

Tomb Finance

Tomb Finance is a unique DeFi protocol with a native TOMB token, an algorithmic stablecoin that is pegged to the price of FTM (1 TOMB=1 FTM). The main goal of Tomb Finance is to provide liquidity to the Fantom ecosystem using TOMB. In the application, you can participate in a liquidity pool to get profits in the form of TOMB, TSHARE, and TBOND. Tomb Finance is also fully integrated with Fantom’s DEX application, SpookySwap. You can only buy TOMB and TSHARE tokens in the SpookySwap application and Tomb Finance itself.

Tomb Finance has a fairly complex incentive and reward scheme involving TOMB and TSHARE. However, as a user, all you have to do is have an FTM and TOMB or TSHARE and then deposit it into the liquidity pool that matches your tokens. Tomb Finance has a Special FAQ section on using Tomb if you’re still confused.

Some of the activities you can do on Tomb Finance:

- Become a TOMB-FTM liquidity provider (LP): Tomb Finance’s most basic feature allows you to deposit FTM-TOMB and become an LP. This liquidity pool has an APR of 90% and rewards you in the form of a TOMB token.

- Become a TSHARE-FTM LP: You can buy TSHARE on SpookySwap and deposit it in the TSHARE-FTM liquidity pool and get TSHARE rewards for an APR of 210%

- Staking TSHARE: The staking section of Tomb Finance is on the masonry page which allows you to deposit TSHARE with 395% APR which rewards you in the form of TOMB.

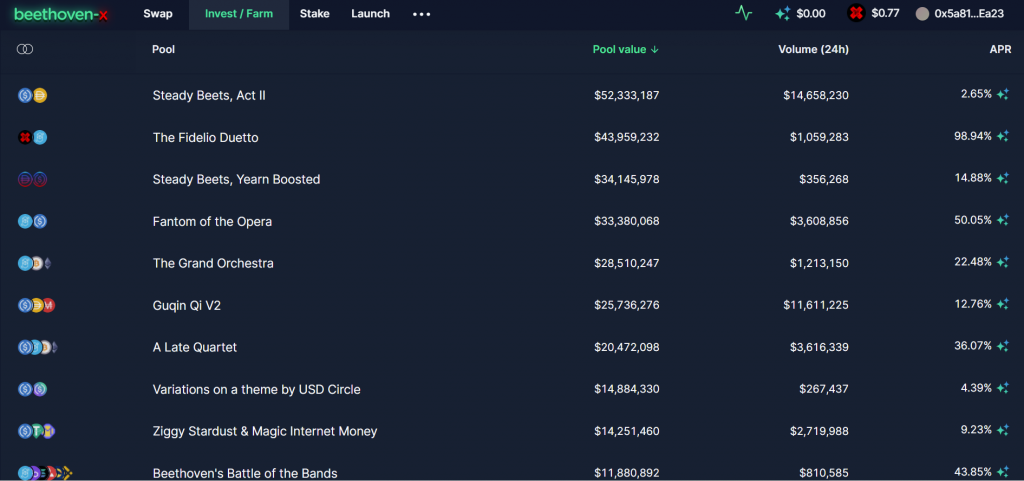

Beethoven X

Beethoven X is a DeFi protocol that gives you many investment options including a decentralized index fund. The Beethoven X application was launched in October 2021. Using Beethoven is fairly simple, you only need to make a deposit similar to being a liquidity provider in general. Currently, Beethoven X has a TVL of $350 million dollars. Beethoven X has a unique theme centred around Beethoven and his music. The names of Beethoven X’s liquidity pools are all based on the music melody and the title of Beethoven’s music.

Beethoven X provides various liquidity pools such as stablecoin pairs similar to Curve and also decentralized mutual funds where one liquidity pool contains up to 4 to 7 crypto assets. These liquidity pools provide various interest rates of up to 300%. Beethoven has a fairly complex incentive system in the form of BEETS, fBEETS, and BPT. Each fund pool will give you a different token between BEETS and BPT. Then, you can stake and swap these tokens.

Some of the activities you can do on Beethoven X:

- Token Exchange: You can exchange various tokens on Beethoven X to maximize your income strategy. For example, converting your BPT interest tokens into BEETS and depositing them into the BEETS-FTM fund pool to earn more interest.

- Invest in various liquidity pools: You can choose to invest in various liquidity pools with a fairly large APR. Remember to invest in liquidity pools with large volumes to reduce risk.

- Staking BEETS and fBEETS: The reward tokens that you get can be exchanged into BEETS and fBEETS which you can then use for staking. Beethoven X gives an interest percentage of 100%.

Why are people attracted to Fantom’s DeFi applications?

- 👻 Horror themes: Almost all DeFi apps on Fantom have the same theme which is the supernatural world like ghosts, skulls, graves etc. This theme can also be seen from the appearance, symbols, and language used by each application.

- 🎨 Attractive UI: The UI of applications such as SpookySwap and Tomb Finance is designed to be easy for every user to use. Most of the DeFi application interfaces on Fantom are simple, lightweight, and easy to understand.

- 💵 Huge interest rates: One of the reasons Fantom has the 5th largest TVL is that a lot of people log into the Fantom network just to use its DeFi app. Apps like Beethoven X, SpookySwap, and Tomb Finance can provide interest up to hundreds of percent.

- ️🏎️ Fast transactions and low fees: Fantom leverages the Lachesis consensus algorithm and DAG technology to run its network. These two technologies help create fast transaction verification (1-3 seconds) as well as very low transaction fees.

Disclaimer: Using DeFi carries considerable risk due to the potential for hacking and fraud that can occur. Always be more careful in choosing the application you want to use. All Pintu Academy articles are made for educational purposes only, not financial advice.

Buying FTM coin

You can start using various DeFi apps in Fantom by buying FTM in the Pintu app. Through Pintu, you can buy ATOM and other cryptocurrencies in an all-in-one convenient application.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

You can learn more about cryptocurrencies through the various Pintu Academy articles that we update every week!

References

- Timothy Craig, A Beginner’s Guide to Fantom’s DeFi Ecosystem, Crypto Briefing, accessed on 8 February 2022.

- Quang Phan, Explore Fantom Ecosystem: An Ideal Destination For DeFi Users, Coin98 Insights, accessed on 8 February 2022.

- What is Tomb Finance?. As of now, the general crypto market is… | by Tomb.finance, Medium, accessed on 9 February 2022.

- A deep dive into the Fantom ecosystem: how it works + the 7 biggest projects, Fontem, accessed on 9 February 2022.

- Fantom Ecosystem Spotlight – Tomb Finance, Fantom Blog, accessed on 10 February 2022.

- Andre Cronje, Medium, accessed on 10 February 2022.

Share

Related Article

See Assets in This Article

CRV Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-