What is Fantom (FTM)?

Currently, many new generation cryptocurrencies have smart-contract capabilities because they want to create an ecosystem of decentralized applications (DApps). This trend follows the success of Ethereum which has opened a new crypto industry that focuses on various financial applications. Solana, Avalanche, and Terra are examples of crypto projects that have built their own ecosystem. Beyond that, Fantom’s DeFi ecosystem is gaining traction among the crypto community. So, what is Fantom? Why does it have such a huge DeFi ecosystem? This article will discuss Fantom (FTM) in detail.

Article Summary

- 🧰 Fantom is a smart contract platform based on Directed Acrylic Graph (DAG) that facilitates a decentralized financial ecosystem.

- 🌐 Innovative technologies such as aBFT, DAG, and Lachesis allow Fantom to process transactions quickly and inexpensively. All of these technologies help form a secure and decentralized crypto asset network.

- 💸 Fantom’s DeFi ecosystem provides an opportunity for its users to earn interest up to hundreds of percent through applications that utilize liquidity providers (liquidity pool).

Definition of Fantom

Fantom is a smart-contract platform based on Directed Acrylic Graph (DAG) that facilitates a decentralized financial ecosystem. Fantom’s open-source platform, Fantom OPERA, is compatible with Ethereum’s EVM (Ethereum Virtual Machine). So, it is relatively easy for Ethereum developers to port or migrates their network to Fantom.

Also read: What is Ethereum and how does it work?

Fantom uses Directed Acyclic Graph (DAG) technology which allows transactions to be completed in 1-2 seconds. This transaction speed is especially useful for the dozens of DeFi applications that interact every second in the OPERA mainnet.

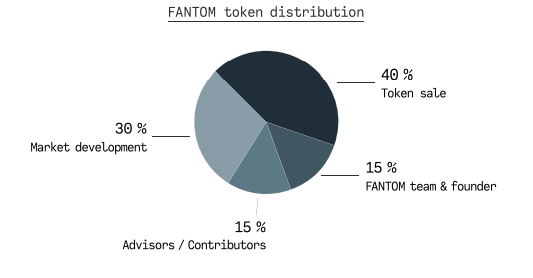

Fantom’s native cryptocurrency is FTM which acts as a transaction fee and staking. Currently, Fantom has a market cap of $9 billion dollars at a price of $3 dollars per 1 FTM (January 2022). This figure places FTM as the 27th largest crypto asset in the world. In addition, FTM tokens have a maximum supply of 3.1 billion FTM.

Fantom History

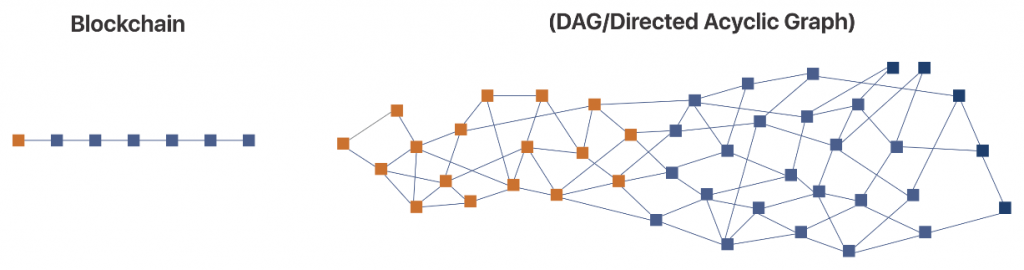

Fantom started as an idea in 2018 among Dr Ahn Byung Ik (a computer scientist from South Korea), Matthew Hur, and several other friends at Digital Currency Holdings, Australia. Dr Ahn Byung Ik and several colleagues believe blockchain has many limitations, especially in scalability, expensive transaction fees, and slow transaction confirmation. From the start, Fantom did not use blockchain technology like Bitcoin. Instead, Fantom utilizes a Direct Acyclic Graph (DAG) which has a different data structure from blockchain but functions with the same operational principle. DAG technology does not suffer from the same problems experienced by blockchains.

Dr. Ahn Byung Ik and the others then set up the non-profit organization Fantom Foundation which handles the development of the network. Then, Fantom held an ICO in June 2018 that manages to attract many investors. In December 2019, Fantom successfully launched its main platform, OPERA network, with smart-contract capability. Currently, the organization is led by CEO Michael Kong with Andre Cronje as the architect of DeFi, which focuses on developing Fantom’s DeFi ecosystem.

Also read: Whitepaper Fantom Foundation

How Fantom works

Also read: What is blockchain and how does it work?

DAG does not batch a series of transaction data into a block. Instead, transaction data within the same time frame directly connect to each other and are verified without waiting for confirmation from many nodes (validator computers) on the network. DAG allows confirmations and verifications of transactions within 1-2 seconds without having to wait for the creation of blocks that need to be batched and connected like in the Bitcoin network.

Although different, these two systems have the same principle, namely that the network only moves in one direction. All data within these two systems cannot be changed, replaced, or deleted.

Apart from using the DAG system, Fantom uses its own consensus algorithm called Lachesis.

block-heading joli-heading" id="lachesis">Lachesis

Lachesis is a special consensus algorithm for DAG networks modified from a proof-of-stake (PoS) mechanism. Fantom creates this algorithm specifically for their network. The network uses Lachesis as a verification method to ensure its network is secure, decentralized, and process transactions quickly with cheap transaction fees.

💡 What is Consensus Algorithm?

A consensus algorithm ensures all transactions are successfully confirmed and verified. It basically checks that the network reaches an agreement (consensus) about which transactions are legitimate and which are not.

In Lachesis, each validator has its own DAG that contains transaction structure and chronology. So, validators only need to follow their own DAG structure. This allows each validator to reach a consensus independently. All validators can verify transactions without having to match data with each other because the algorithm ensures that each validator is given a different set of transactions. This method of verification is also called a leaderless proof-of-stake.

Asynchronous Byzantine Fault Tolerance (aBFT)

One of the important technical details about Lachesis is that it utilizes asynchronous Byzantine Fault Tolerance (aBFT) technology. The aBFT mechanism ensures the network can still reach consensus even if some validators (nodes) on the network have malicious intent or behave strangely such as delaying transaction verification. As long as the network can reach consensus through several validators that perform proper verification, the transaction will always go through.

Fantom’s aBFT differs from traditional BFT because it assumes all validators have the potential to act maliciously and the algorithm will automatically isolate bad validators so they cannot affect the network as a whole. In this way, the Fantom network is more resilient against DDoS (Distributed Denial-of-service) attacks.

💡 What is BFT?

Byzantine Fault Tolerance (BFT) is a solution to reach consensus in a decentralized network even if 1/3 of the nodes or validators act badly. Most decentralized networks such as blockchain use BFT technology or modifications of BFT.

A combination of the DAG network and the Lachesis consensus algorithm allows Fantom to process and verify transactions very quickly. Fantom mentions that the entire transaction process only takes 1-2 seconds, in contrast to Bitcoin which takes a few minutes.

What can you do with FTM?

Staking FTM

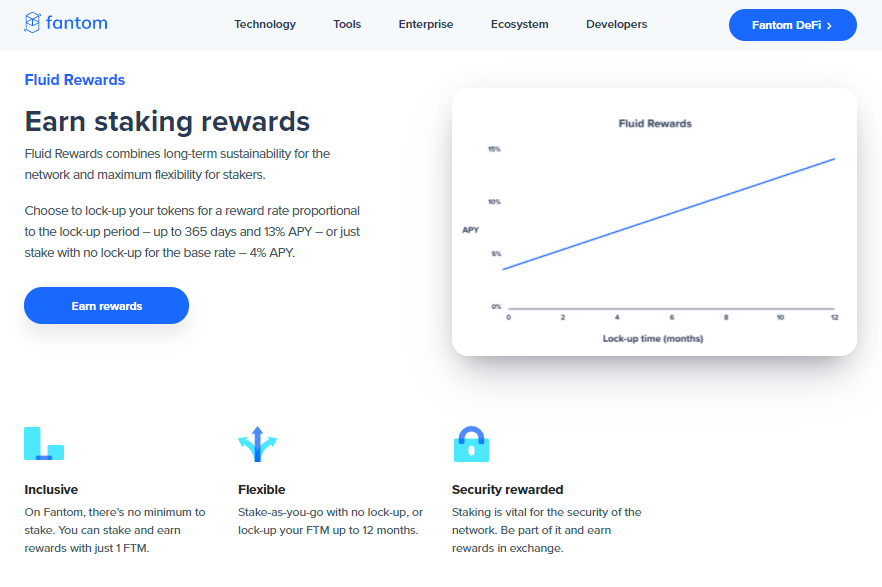

Fantom’s staking scheme is one of the most unique among other platforms. Basically, there are several types of staking which are flexible staking, locked staking, and liquid staking.

Fantom’s most conventional staking method gives you the option to stake FTM without locking it so you can stake and collect it anytime. Flexible staking has an interest rate of 4%. Second, you can use locked staking for a specified period of time from 1 week to 1 year. The longer you lock your FTM assets, the more interest you earn, up to 12%.

Finally, liquid staking locks your FTM assets and lets you convert them into sFTM which you can use on all Fantom DApps applications. So, at the same time, you get a staking reward and sFTM to use on other Fantom apps. If you choose to use sFTM on DeFi application, you can get a double benefit.

Using Fantom’s DeFi ecosystem

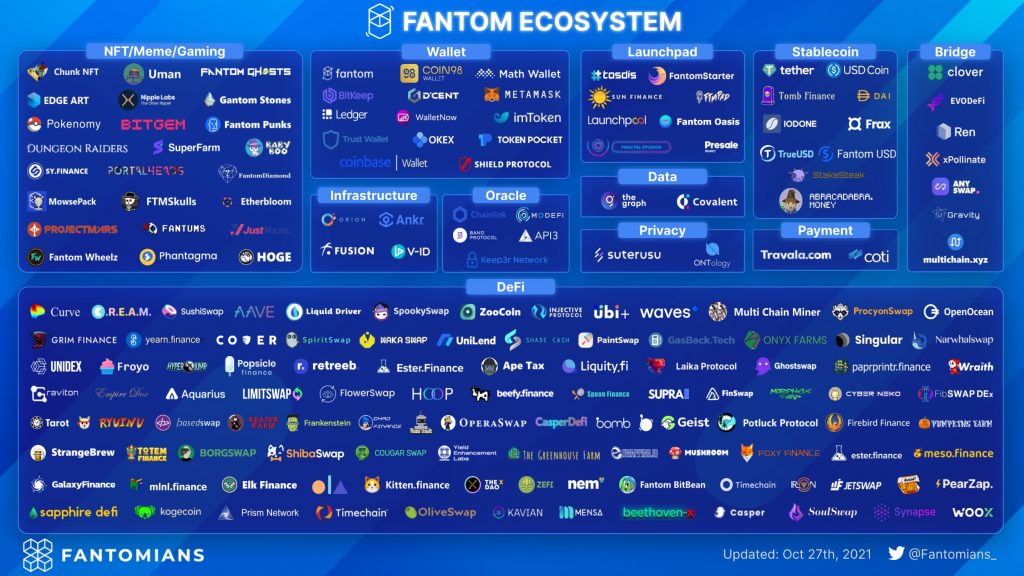

Fantom is one of the cryptocurrencies with the fastest-growing DeFi sector. This can be seen from Fantom’s total value locked (TVL) figure which reached $12.23 billion dollars, placing it as the 3rd ranked crypto asset in the world based on TVL per 24 January 2022. Apart from that, Fantom’s compatibility with EVM Ethereum also helps app developers. Major DeFi apps like Curve and YFI already have Fantom compatibility which helps to flow funds from Ethereum to Fantom.

DeFi apps built on Fantom have unique names because they use ghost and supernatural themes such as Tomb Finance, Grim Finance, and Spirit Swap. Most DeFi applications on the network can give you big profits if you become a liquidity provider.

Here’s a list of Fantom DeFi applications that you can try:

- 💀 Tomb Finance: $TOMB is a stablecoin that is pegged to the FTM price so 1 TOMB = 1 FTM. Tomb Finance aims to be a liquidity provider for the Fantom ecosystem to incentivize users not to sell their FTMs. You can use Tomb to become a $FTM-$TOMB liquidity provider with 120% APY interest without any impermanent loss.

- 👻 Spirit Swap: Spirit Swap is a decentralized exchange for tokens within the Fantom ecosystem. Spiritswap has $SPIRIT tokens that you can stake in DeFi apps like Liquid Driver to earn interest starting from 50%.

- 💸 Liquid Driver: Liquid Driver ($LQDR) is a liquidity mining that works similar to apps like Yearn Finance but operates exclusively within the Fantom ecosystem. You can become a liquidity provider in Liquid Driver and earn interest ranging from 80% to150%.

- 😱 Spooky Swap: Spooky Swap operates much like Spirit Swap in that it offers a decentralized exchange and let you be a liquidity provider. The interest percentage offered by Spook Swap ranges from 30% to 80%.

FTM as an investment

FTM is one of the best performing crypto assets in 2021 with a price increase of 10,000%. The launch of various DeFi apps on the Fantom network such as CRV and YFI was one of the primary drivers for FTM price hike. In addition, FTM listing on major cryptocurrencies exchanges such as Binance US opens up access to Fantom for new retail investors.

As already explained, Fantom has a large DeFi ecosystem. Many people from the crypto community are starting to realize the potential of Fantom’s DApps that can give a very large percentage of interest. These yield and interest hunters are also known as degen in the crypto community. They specifically take advantage of applications such as Tomb Finance and Liquid Driver which can provide interest ranging from 100% to 1000% APY.

However, if you are going to buy and HODL FTM, Fantom is also a promising crypto project. With strong fundamentals and community, the project still has a long way to go.

The MCap/TVL calculation is an indicator to measure the potential of Fantom in the context of its DeFi ecosystem. An MCap/TVL ratio below 2 is considered quite good. The network has a ratio of 0,46591 which prompts many people to call Fantom an undervalued asset. However, you must remember that there are many other factors that can determine the fluctuations in the price of an asset. Always do a combination of technical and fundamental analysis before investing in a crypto project.

Fantom Roadmap for 2022

Fantom has not released a roadmap for 2022. However, based on some other information that has been provided, there are several milestones that could be a catalyst for the price of FTM in 2022.

- 🖥️ Fantom Virtual Machine (FVM): Software tools created for developers who want to build applications on the network. However, Fantom will still retain its compatibility with EVM machines.

- 🐾 Felix Exchange: Fantom plans to create a CEX named Felix which is specifically used to exchange Fantom ecosystem tokens such as $TOMB and $SPIRIT.

- ⛏️ DeFi by Daniele Sesta and Andre Cronje: Andre Cronje and Daniele Sesta plan to create a new DeFi application called Ve(3,3) which utilizes NFTs in the context of DeFi. The two of them are some of the most popular DeFi developers in the crypto community.

- 🗒️ Listing on some of the major CEXs: Fantom is still not listed on some major cryptocurrencies exchanges Coinbase. If more CEXs list Fantom, new retail investors will have access to purchase FTM.

Buying FTM

You can start investing in Fantom by buying FTM in the Pintu app. Through Pintu, you can buy FTM and other cryptocurrencies in an all-in-one convenient application.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download the Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

References:

- Fantom Foundation Whitepaper, accessed on 14 January 2022.

- What is Fantom Opera? | Fantom, accessed on 14 January 2022.

- FTM staking: Stake & earn crypto rewards | Guide & FAQ | Fantom, accessed on 15 January 2022.

- Consensus algorithm ‘Lachesis’ | aBFT consensus-as-a-service | Fantom, accessed on 17 January 2022.

- What is Fantom (FTM) | History, Roadmap, Economics, Messari, accessed on 17 January 2022.

- Fantom Crypto Network: Fantom Staking w/ FTM Token, Gemini, accessed on 17 January 2022.

- Why Fantom (FTM) Is A Good Cryptocurrency Investment, Hacker Noon, accessed on 18 January 2022

Share