Market Analysis August 8-14: ETH Price Jump Ahead of The Merge and US Inflation Falls to 8.5%

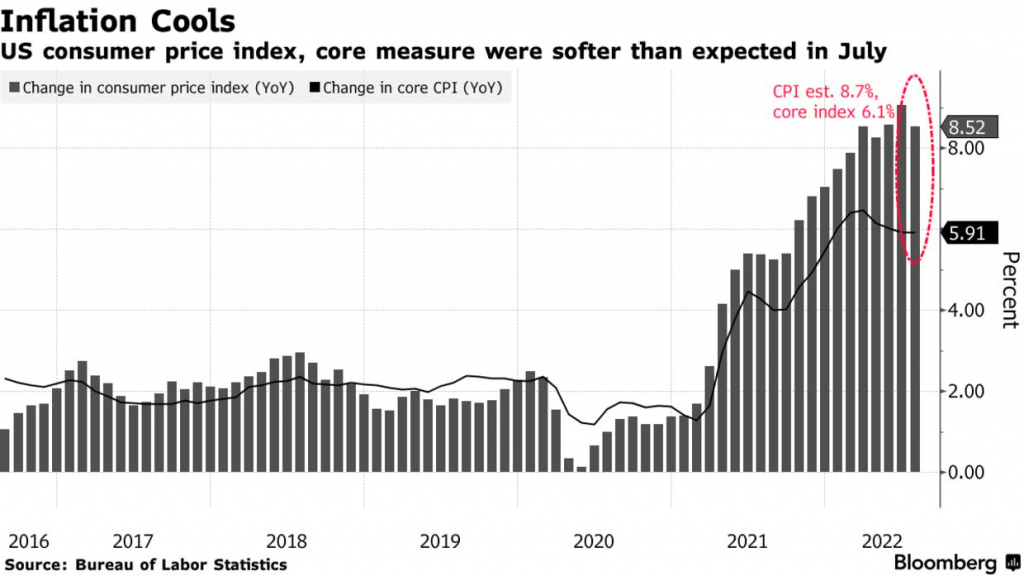

The latest data from the Consumer Price Index (CPI) shows that consumer price inflation in the United States (US) slowed to 8.5% in July 2022. Meanwhile, ETH prices continued to increase as the implementation of the Merge drew closer.

Pintu’s trader team has collected various important data about the price movements of the crypto asset market over the past week which is summarized below. However, kindly note that all information from this Market Analysis is for educational and informational purposes only, and not financial advice.

Market Analysis Summary

- 📉 The latest data from the Consumer Price Index (CPI) showed that consumer price inflation in the United States (US) eased to an annualized 8.5% in July.

- 📊 On the weekly chart, BTC is still at the support line of the 200-week MA and is still in the bearish flag channel.

- 🚀 ETH continues its positive momentum as the Merge implementation approaches. The dominance of ETH has shown a strong momentum (20.6%), which is caused by the price of ETH soaring high.

- 💡 Crypto Fear and Greed Index is currently at 42, a significant increase for 1 month, from where it previously reached 15.

US Inflation Falls to 8.5%

New CPI data released this week suggests inflation has peaked. The CPI finally pulled back from a 40-year peak in July, as the consumer price index came in cooler than expected. The CPI inflation rate eased to 8.5%, retreating from June’s 9.1% inflation rate.

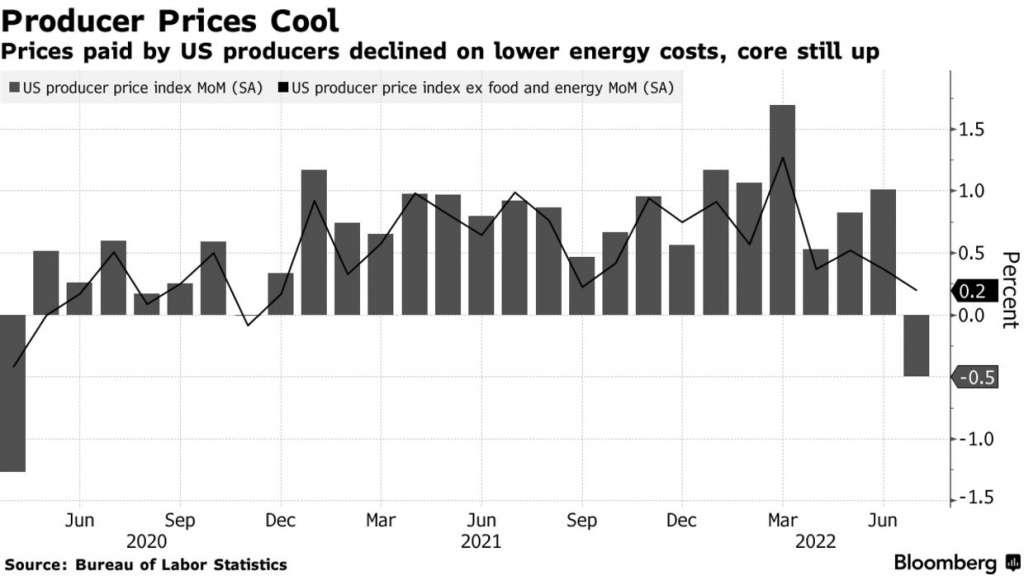

The producer price index, a gauge of final-demand wholesale prices, decreased 0.5% in July due to a slide in energy prices. The year-over-year gain was 9.8%. The annual increase was the lowest since October 2021, and the monthly move was the first decline since April 2020. This is a another sign that price increases are slowing.

BTC Price Movement 8-14 August 2022

BTC has not moved much over the week. The fact that BTC added another support point to the 200-week MA line is encouraging. This is encouraging as the more often we made the support, the more certain we are on the reversal towards the upside.

BTC is currently still within the bearish flag channel. Like mentioned previously, in case of a bullish breakout, the 100-day moving average, which currently resides near the $25.5K level, would be the first obstacle before the significant $30K supply zone. In the case of a bearish pattern, an eventual breakdown from the pattern would likely happen.

BTC Dominance has entered the

Share