Market Analysis 3-9 April: BTC, ETH Prices Drop & Terra Buys $200 million in AVAX

What happened in the market over the past week?

In the first week of April, Bitcoin fell back below the support line of the 21-week EMA with a price range of 42,000 US dollars, after being above it for the last two weeks.

What actually happened? Last week was supposed to be a week with a lot of exciting crypto announcements, as the 2022 Bitcoin Conference in Miami is taking place. What shadowed these exciting announcements were the minutes of meeting from the Fed with the following two important points:

- 📉 Fed officials reached a consensus at their March meeting that they will start reducing their balance sheet by $95 billion/month, most likely starting in May.

- 🚩 There are strong indicators that a 50 basis point rate hike will be implemented soon.

The minutes of the Fed’s meeting strongly indicated that this time, they were very serious about fighting inflation and this immediately sent stock prices plummeting. The decision was made because, for the first time since 2019, the 2-year Treasury yield tops the 10-year Treasury yield, as can be seen in the chart below.

💡 When the 2-year Treasury yield is higher than the 10-year Treasury yield, this is an indicator of a recession or a decline in economic activity. This indicator has a fairly strong track record in predicting recessions. If you look at historical data, this is evident from the last eight recessions in the US, namely since 1969.

BTC Price Movement 3-9 April 2022

As seen in the chart below, at the beginning of the week, Bitcoin was fighting to reclaim the US$47,000 spot, almost breaking the 0.5 Fibonacci retracement resistance, but to no avail for the 3rd consecutive week.

From the 2nd to 5th of April, for 4 consecutive days, BTC try to break above that but was rejected and it went down to US$45,000 before further slipping to US$42,000.

Also, another historically important indicator that supports and justifies our place in the bull market, is for the 20 weeks MA staying above the 50 weeks MA. Looking at the chart below, it has not been the case since 2 weeks ago.

We have seen that in mid-March, the 20 weeks MA indeed crossed below the 50 weeks MA. A discouraging sign if we zoom out. Note that after its crossing, the crypto market has tanked from north of US$47,000 to the current price of US$42,000.

ETH Price Movement 3-9 April 2022

On the ETH/BTC chart, we can see that they both have been performing as par as they could be over the past week.

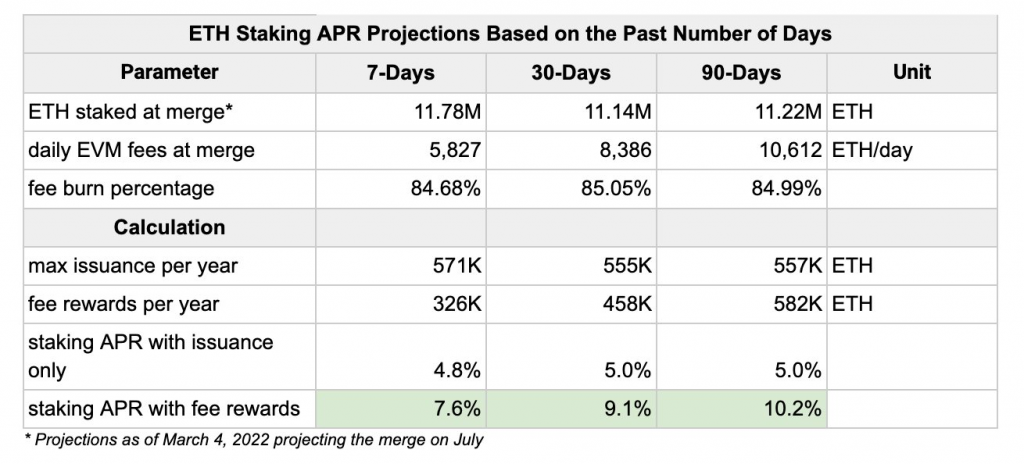

ETH is on track to be slashed by 90% in less than 3 months. Once the merge of the current mainnet with the beacon chain PoS system happens, the ETH emissions will drop from 5.5 Million/ year to 0.55 Million/year. This will mark the end of PoW (proof-of-work) and the full transition to PoS (proof-of-stake).

What else is there to observe from the market in the past week?

- 📉 The crypto total market cap was down 250 billion in less than a week, that’s a wipeout of almost 9% of the crypto market.

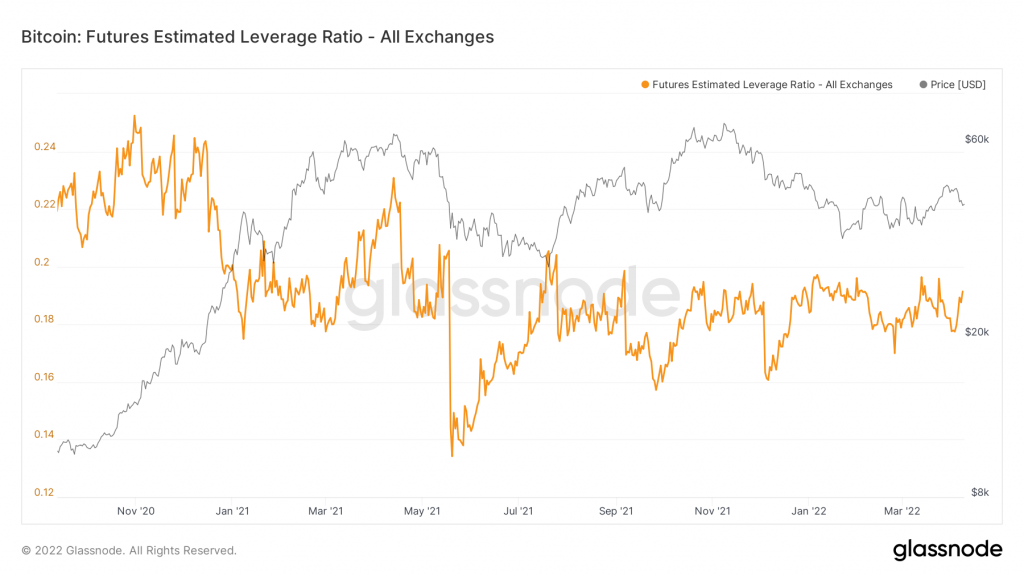

- 🤔 Surprisingly, the number of liquidations is not that high (as compared to the end of January). As you can see in the next chart, the Futures Estimated Leverage Ratio is still high. During such a high ratio, expect BTC price volatility to rise, the market may be considered over-leveraged and a liquidation squeeze could follow to wipe out the excess leverage.

- 🚨 The Fear & Greed Index tumbled to 30 from last week of 52. That’s a major shift in the outlook for the crypto market. At the current fear sentiment, usually, it is a good time to buy if you’re keeping long term, but do keep in mind that price could still continue to trend downward to the unforeseeable future.

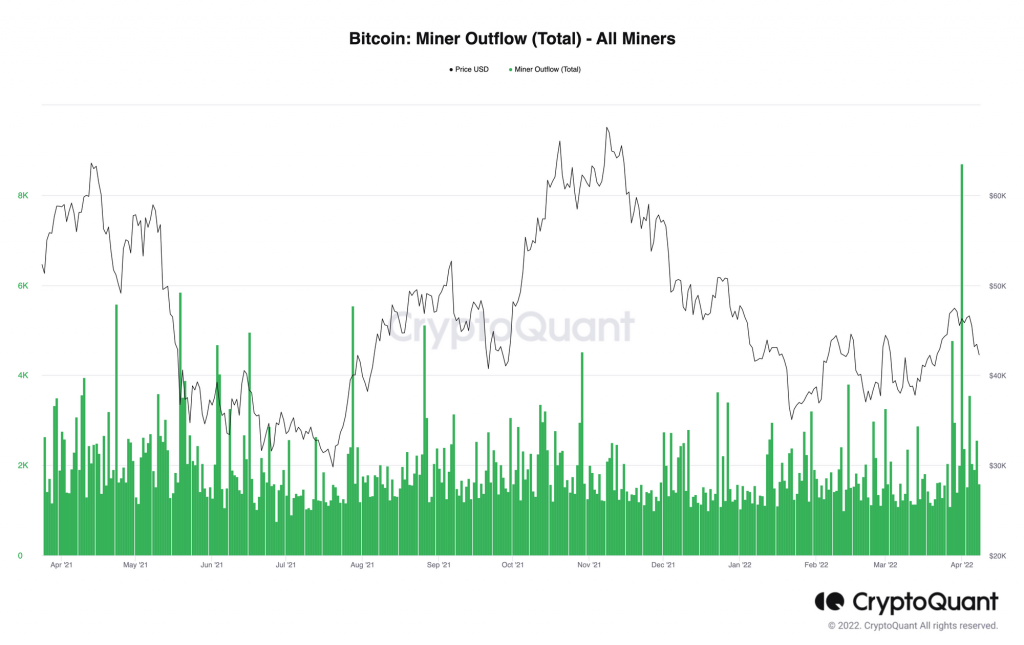

- 💵 Miners started selling their BTCs, Notice the spike on the 2nd of April 2022.

- ⚠ Most altcoins are also in the red, with most losses coming from SOL, AVAX, ADA, and LUNA.

News from the altcoin world

- 🌖 Terra buys US$200 million worth of AVAX: Having previously planned to buy US$10 billion worth of Bitcoin in reserve for its UST stablecoin, Terra decided to diversify that strategy. Citing Cointelegraph, Luna Foundation Guard, a non-profit organization built to support Terra, has purchased Avalanche tokens worth US$200 million from the Avalanche Foundation to increase its stablecoin reserves.

- 🚀 Near Protocol Jumps 23% Following New Funding: The NEAR token increased nearly 23% on April 8th, before dipping to around $15 on Monday April 11th. The increase came after the announcement of a new $350 million investment in Near, including funding from FTX Ventures, Dragonfly Capital, and others. The funds will be used to expand Near ecosystem.

Other important news from the crypto world in the last week

- ⚡ Bitcoin Conference 2022: Strike, a digital payments platform built on the Lightning Network Bitcoin, announced its integration with Shopify. Shopify is one of the giant e-commerce companies spread across various countries. This opens up opportunities for Bitcoin to be used as a currency in various daily transaction activities.

- 😇 Twitter Crypto Community Raises Funds for Cancer Patients: A touching story emerged when a member of the crypto community on Twitter, [@kuiyopi] announced that his cancer was back. Yopi explained that he could not afford to pay the medical bills which amounted to US$50,000. As a sign of solidarity, several people from the crypto community started fundraising and managed to raise US$75,000, exceeding the amount Yopi needed.

Reference

- Dinar Fitra Maghiszha, Kurva Yield Terbalik, Ancaman Resesi Amerika di Depan Mata?, IDX Channel, accessed on 10 April 2022

- Tom Mitchelhill, Terra buys $200M in AVAX for reserves as rival stablecoins emerge, Cointelegraph, accessed on 10 April 2022Liam J. Kelly, Near Protocol Jumps 23% Amid Fresh $350M Funding, Decrypt, accessed on 10 April 2022

- Danny Nelson, Jack Mallers’ Strike Announces Shopify Integration for Bitcoin Lightning Payments, CoinDesk, accessed on 10 April 2022

- Tom Farren, Crypto Twitter unites to raise funds for community member’s cancer treatment, Cointelegraph, accessed on 10 April 2022

Share

Related Article

See Assets in This Article

AVAX Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-